When the market is range-bound and whipsawing I find it more productive to read and do research about trading rather than practice trading in a difficult environment. While searching around the web, I recently discovered some research about position-sizing, as well as another blogger’s informative post on the subject.

The following research is a must-read. It measures how position-sizing effects trader performance when trading a system with positive expectancy. In other words, when trading a winning system, bet-size will determine whether one survives, thrives, or goes bankrupt.

Position-sizing Effects on Trader Performance: An Experimental Analysis

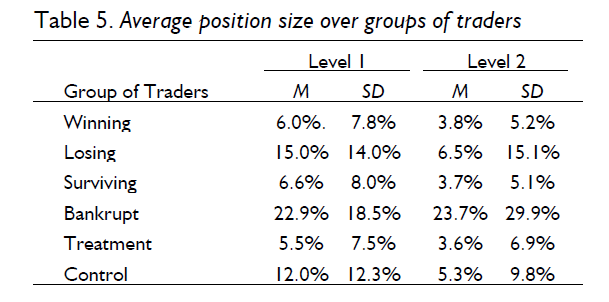

“One purpose of this study was to find evidence for the importance of position sizing. The results showed that in order to survive trading in a simulated stock market, using a trading system with expected value of < 1.0, one should take positions in sizes of approximately 3.7% – 6.6% as the surviving traders, rather than 22.9% – 23.7% as the bankrupt traders. Further, to be able to increase one’s account over the long run and actually make money by trading the simulated market, one should not risk much more than 6% as the winning traders did on an average (2000, Ginyard, pg. 20).”

I encourage taking the time to read the research in order to understand the experimental design.

The second piece I discovered is on Max Dama’s blog: Position Sizing Monte Carlo Analysis.

Max takes a positive expectancy system as described by Van Tharp in the November, 2005, Active Trader magazine article Meeting Your Trading Objectives with Position Sizing and models it in Excel. His results may challenge some assumptions about bet size.

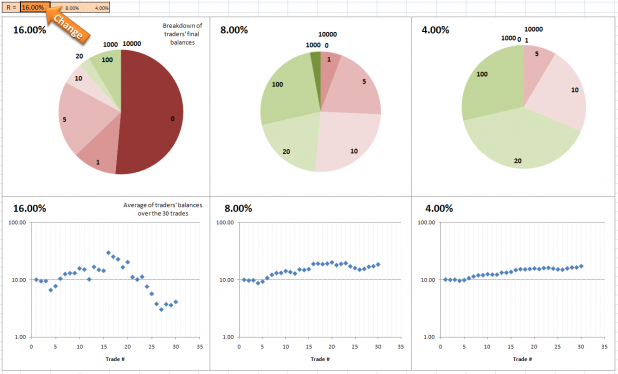

Max writes, “Since it’s a Monte Carlo model the results are random, but here’s a typical set of results:”

“The charts on the left model a group that risks 16% of capital on each trade, the middle is 8%, and the right models the results of a group of individuals who risk only 4% per trade. The top row of charts are the ending money of each individual in the group, and the bottom charts are the average capital of all group members after each marble comes up.”

“It is not surprising that the number of people in the red (below the starting money) is the most for the group that risked the most and the least for the most conservative group on the right. What is surprising is that the group of people who risked 8% had among them more big winners (dark green) than the 16% group, which had none (no dark green on the pie chart). So you can actually win more by betting less, and therefore lasting longer.”

Please visit his blog for the rest of the article as well as a link to the excel spreadsheet he created to model the system.

good advice. bookmarked.

its tough for system trading on this tape, no? still waiting for more “cards” to flip before making positions. i agree w/ Max, in that you to preserve one trade for a better one. I see it as letting a few small waves go by so I can catch a cleaner set. position-sizing can be likened to “energy.” You want to exert less energy (conservation of energy = conservative stance) when there’s no trend/wave, and you want to slowly (position-size) paddle out as the wave goes your way. it’s basically a Canslim approach. i still think there shouldn’t be a fixed magical % for a stop. Depending on the velocity/volatility/volume of the market, I will adjust that stop. I’m so used to it already, I usually use one big buffer computerized stop on the outer range + a mental stop on the inner range that controls 95% of trades.

btw, i like the monte-carlo approach!

Gio, the systems do well in volatile markets, but do not trade often during whipsaw.

I just need direction, one way or another, and then it’ll be off to the races!

With position-sizing, keep in mind the blackjack expert. He may have an edge of 2%. Out of 100 hands, he will win 2. Think about that. Think how much more of an edge you have if you average even 60% winners. You will win 60 of 100 hands. Yet the blackjack player still makes money. He bets small or not at all until he sees the edge, and then he bets a full position.

I am beginning to believe that most traders are about like tourists showing up to Las Vegas, plunking their money down on the table and thinking they are experts. They have no idea of their edge. None. They do not even have records with enough detail to calculate their edge. To top it off, not knowing their edge, they bet too large. If they survive, or even profit, it is mostly out of luck. Perhaps, they, like me, will make a concious effort to learn and grow and discover their edge, before they lose all their money.

I think once the market finds direction system traders adjust enough to eventually edge out day traders.

“I am beginning to believe that most traders are about like tourists showing up to Las Vegas, plunking their money down on the table and thinking they are experts. They have no idea of their edge. ”

… exactly! let’s keep it that way, k?

btw, I like the BJack analogy. just one thing… every extra card increases your chance for losing. right?

-gio-

Quality.

There’s a typo in your reply. Blackjack expert will win 52 hands out of 100, not two hands.

Great post.

Here’s the first three levels of Van Tharp’s simulated game over at his website: http://www.iitm.com/products/Trading-game.htm

I found that 10% was a good size for his simulated trading with an average drawdown of about 30%.

I still agree with Matt Damon’s opening monologue in rounders with regards to the market.

The market is no lottery.

Consistent small wins over times beats everything.