I have attempted to establish that traders who take the same position sizes in leveraged vehicles as they would in common stock or non-leveraged ETFs are actually just doubling their risk, unless they manage that risk by adjusting their position size to fit with the leveraged product. Part 1 and Part 2 have established that it is possible to keep similar levels of risk across leveraged and non-leveraged vehicles.

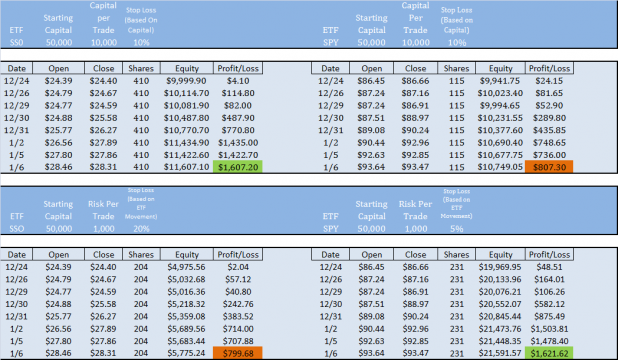

The spreadsheet below shows a series of winning trades.

Note that I have changed the sheet slightly from the format of the sheet posted in Part 2.

The top row again shows a 10K trade, risking 10% of capital, in SSO and SPY. As expected, the leveraged SSO returns double the SPY. Keep in mind that if these trades were losing, SSO would also lose money twice (or even faster) as fast as SPY, while still requiring the same amount of capital.

The second row shows the same trade in SSO, but this time the SSO stop is based on the volatility of the diETF. This allows one to keep risk the same as in the SPY trade ($1,000) but requires only half the capital.

The lower right quadrant shows how to leverage with the SPY, while keeping risk the same as with SSO ($1,000 risked). This is accomplished by reducing the stop on the SPY to 5% (maybe too small, but it is half of what is used for the upper left quadrant SSO trade), and using that figure to build the position.

My goal when I started writing this was to show how to use the leverage of the diETFs while keeping risk similar to levels expected with non-leveraged instruments. When these leveraged products are entered with a known edge, traded over a short time period, and position-sized to capture the leverage while not simultaneously doubling risk, they can be a valuable addition to any trader’s quiver.

I appreciate the comments left in previous posts. They have been very helpful, and I’ve enjoyed the discussion.

I’m a little lost here Wood: on the top row for, left quadrant, second trade: the trade opened at 24.79 and closed at 24.67, yet in the profit/loss column there is a value of $114.80 and with no plus or minor notation, it appears to my caffeine deprived brain that it’s a profit?

Cuervo, the trade is opened on 12/24 @ $24.39. The trade is left open; it is not closed out at end of day. That profit/loss figure is rolling.

Wood,

Thanks for linking to the article on diETF. I’ve been trying to understand them ever since they started disconnecting late last year.

This has been a very helpful series, Woodrow. Thanks.

Anton, glad you found it helpful.

Japoe, that is one of the most helpful articles on the diETFs I have found.

Wood

Thanks for this post. It is outstanding. This is just the kind of information I need. As I read your post and Fly’s…I would be interested in learning more about major trading themes/styles. Do you know of any books/resources? Perhaps this would make a good blog post. Wyckoff vs TurtleTrader vs etc