Every evening I check my strategies for signals to be placed at the next open. There haven’t been very many signals lately as almost all of the strategies have as one component some form or another of a moving average.

If there are no strategies, then I run some more scans. The following are some charts I like from a variety of scans. Most of these came from a momo scan. Thus, they should be bought after a pullback.

BWS had a nice move above the 50 day average on huge volume. Could be a long candidate, or possibly a short candidate, depending on the reason for the surge in volume.

CSKI Nice breakout move. I would like to see volume begin to average over 300K. I have no idea what is driving this one forward.

DLX- This one I’m placing into the short candidates. The surge in volume is encouraging, but 200 day resistance is just overhead. Also, it has doubled in less than a month.

Should Deluxe Corp. (cool name) begin to flag here, on declining volume, it may actually make a good long candidate.

DRI- I have this one as a short candidate. I have no idea why the volume surged. Looks like a lot of resistance overhead.

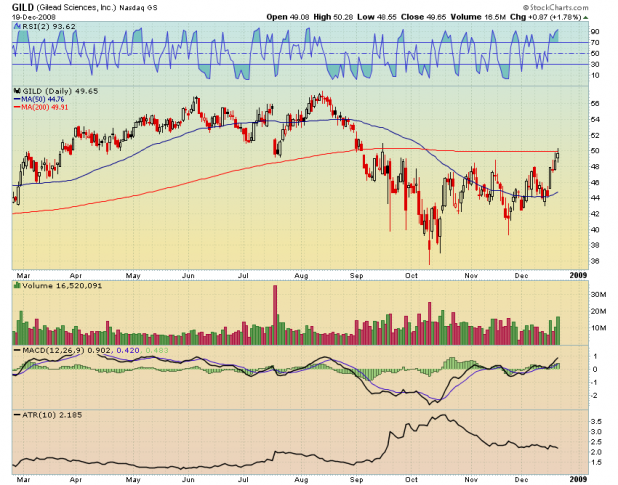

GILD Could be a nice cup forming, or the 200 day may halt the advance, until it tries again.

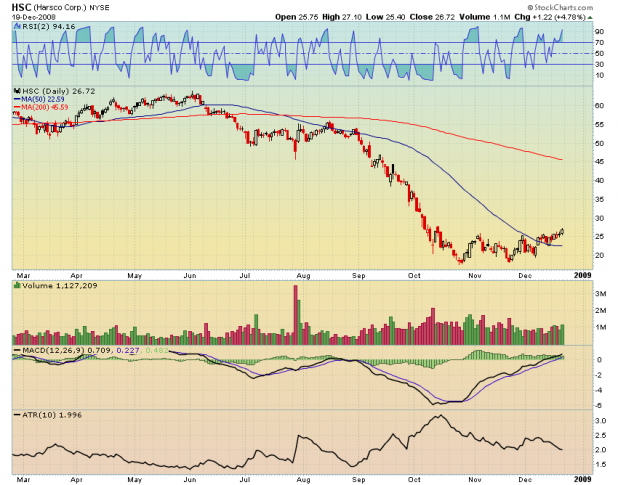

I have no idea what HSC is or does. However, the chart has a beautiful rounded bottom forming, with volume increasing in all the right places.

I had to go and check out a little about this company. Here is the yahoo blurb: Harsco Corporation provides industrial services and engineered products primarily to steel, construction, railways, and energy industries worldwide.

Maybe HSC is a play on the Obama infrastructure plan.

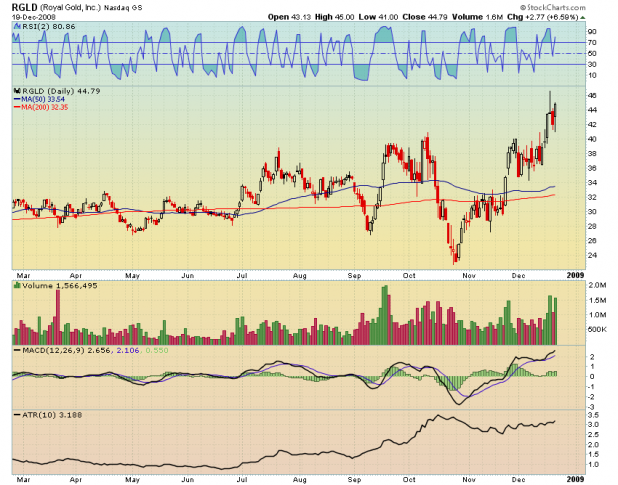

RGLD: Who doesn’t love a gold stock making new 52 week highs?

Nice pattern forming in RNT. I would like to get a small position here after a pullback. The position would be in anticipation of a breakout.

SBH has another beautiful bottom forming, with volume in all the right places. A run to $6.50 would make a 15% move from Friday’s close.

CAVEAT: Do yourself a favor and investigate the surges in volume before buying/selling any of these companies. It would not be fun to get short a company in front of buyout rumors.

Excellent. I like your charts everytime you post. Keep it up and thank you.

Yep, same here.