Alright folks. So you want the secret sauce? The je ne sais quoi? I will share with you a brand new system, which to my knowledge has never been published on the internets. The system is triggering an entry tomorrow. Feel free to erode the edge.

The Setup

The rules for this system require you to set your Chaikin Money Flow indicator to a 2 period setting.Â

With a two period setting, CMF(2) needs to have crossed below -0.5 from above.

The [[SPY]] Â must have closed above its 50 Day Moving Average.

If these 2 conditions are met, a buy of the SPY is triggered for the next open.

The Exit

Sell the position when RSI(2) closes above 80, or a stop is hit.

The Results

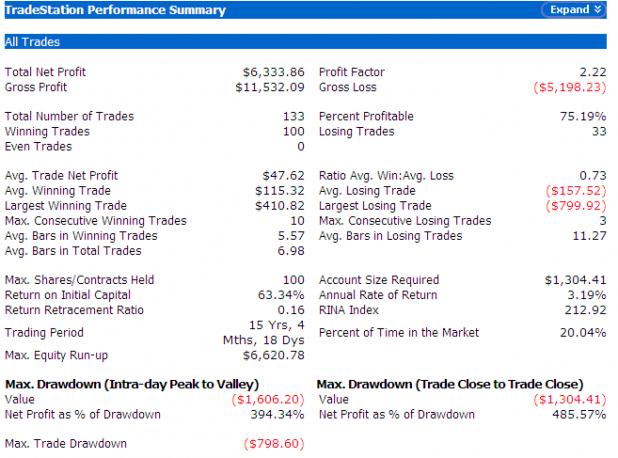

These results are with $10,000 per trade and an 8% stop. The stop was hit 3 times.

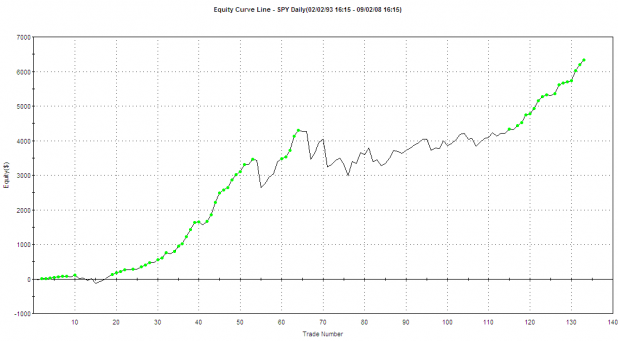

The green dots mean a new equity peak was hit.

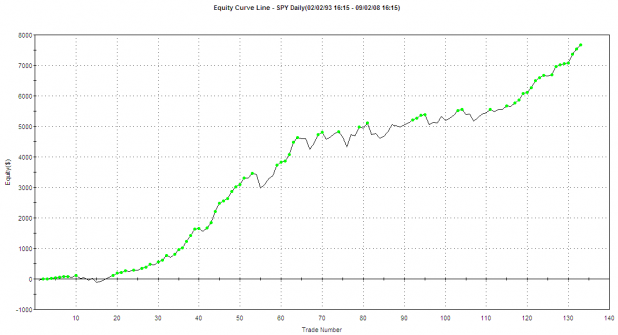

Below is the equity curve for the strategy, without the 8% stop. Without the stop, the max trade drawdown hits -$1,175. However, the max drawdown is significantly less without a stop, at -$506.72 compared to     -$1304.41 with a stop.

And finally, here is what the setup looks like on the current SPY chart:

Â

don’t get it…annual rate of return 3.19%, how about put your money in t bills?

Good question Martin.

While it was tested over a 15 year period (all the data for the SPY), you were invested only 3 of those 15 years.

The idea is to take high probability setups when they occur, while avoiding being invested when you have no edge. To achieve a higher rate of return, one might be trading many different strategies, all with a defined edge.

Does it work with anything other than SPY?

My system of indicators (published soon) show little reason to be downside exposed going into tomorrow.

I like when different indicators agree, thanks for sharing and explaining the system blood.

Danny,

“little reason to be downside exposed” = what? no longs, no shorts?

Please clarify for this foreigner.

Kat, yes, it works with results similar to those above on both DIA and QQQQ. It works the best with SPY.

I have not tested it across anything else. Tradestation can’t test at the portfolio level, so it is a pain to test many different securities.

One of my assumptions or biases is that the indexes are the best vehicle for trading mean reversion systems (like this one) as they are less prone to intensive tanking or moving for extended periods in one direction without surges or pullbacks.

I am talking about a 2 day time frame. I cannot predict the future, but the customized indicators I use are at a level which in the past month has met with a bounce every time.

Also, as an observation, most 2-3 day patterns reverse. This has been alarming consistent trend since the market low on July 15th.

Accordingly, there less reward here for the risk of being short, until my indicators show a better spot to put money to work short. Closer to 1300.

Was that what you were looking for?

Hey Shed: I am beginning to notice a pattern here – using short term oscillators against larger trends.

What I find most interesting is that this looks and feels like the Turtle system – and they were best played without any stops whatsoever.

Good show. 5*

The cats outta the bag. I will black box your system, effectively rendering it useless, before you’ve coined your first billion.

I always thought that the je ne sais quoi was that critter livin’ in the bayou behind Mere Mere’s trailer …

Cuervo, I think it differs substantially from a Turtle system. I’m going from memory, but I think the Turtles favored going long after a breakout above n day highs. And then, they followed the trend.

This system is much more short term, and buys weakness instead of strength.

Juice, I wish you much success. Just don’t forget my 2%!

The Turtles used 20-day and/or 55-day breakout (their choice). The stop loss was ATR x 2. The exit signal was a new 20-day low (or high if short).

And, they would pyramid into a trade as it moved in their favor, adjusting their stop loss each time they added to the position until they had their full position in place.

Could this be done using double strength options such as SSO?

Romeo, the initial and very brief testing I did with double long ETFs did not show much promise, but I believe that due to the increased volatility. I plan on doing more testing with the ETFs.

That’s nice, but all too complicated.

Just buy the banks! (or, we’ll waterboard you)

It has what the French call a certain, “I don’t know what”.

MFE, finally broke to the downside. made 2 points on the short sell.

RTH, my short on that is going good in fits and starts. It’s behaving just like MFE. I have to keep getting in and out.

So, anyway, I’m just waiting for you to post another trade, so I can compare notes with you again.

OIH sidenote, OIH got awfully close to the fib 61 = 165 today. I’m looking for OIH to hold around $165 or so. That could be the signal to start going long XLE.

I didn’t say it WAS a Turtle system – I said it looked and felt like one.

Meaning – to my confused synapses there is an odd symmetry to your trading system that’s all. No grief intended.

Besides – buying into weakness as opposed to strength is just being a day or two earlier. If I get this system right – you’re trying to capitalise on the short term bounce up on a downward trend.

holy shit are you canadian?

spy still good for tomorrow?

Cuervo- that’s right…Short term, trying to catch a bounce.

Aymon, the entry order signal was good for this morning. However, since the SPY closed down only .11cents, the setup is likely still valid, even though CMF(2) is not beneath -.5

Cuervo,

This is a mean reversion strategy, while the Turtles were trend followers. These are completely different approaches.

Think of it this way. The market spends a lot of time acting like a rubber band. Stretch it too far up and it snaps down. Stretch it too far down and it snaps up.

The goal of a mean reversion strategy is to profit from those short-term snap moves. The trades usually are very short-term in nature lasting no more than a week or two, oftentimes less.

On the other hand, trend following trades last weeks to months or even years, depending on the system and markets traded.

As far symmetry goes, all systems should have symmetry in the sense they have well-defined entry and exit signals, with the latter including a stop loss and a signal for exiting profitable trades.

Wood, did you create a stochfetcher routine to test this? If so, I would love to see the code.

Renn, I have the SF code and the tradestation code. Let me know if you want one, or both, and I’ll get them to you. Just make sure you plug in the correct email address in the next comment.