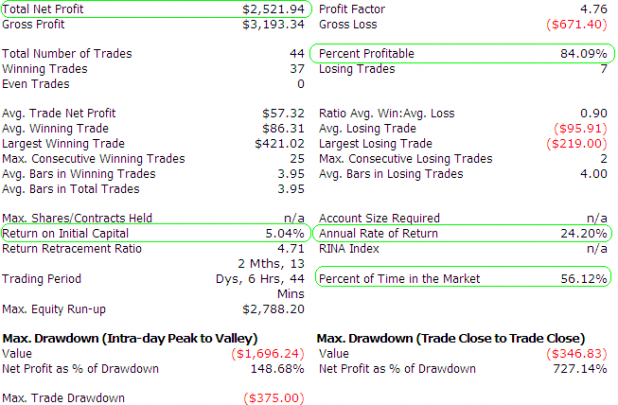

Above are the results since inception of May 19, 2008, from the mean reversion strategy (RSI2).

The strategy is holding one position, which is marked to market, in the above results.

I have still not had the entire equity allotted to this strategy in the market. The cash is available for positions at least 2x larger than what these results reflect. I am getting more and more comfortable with the system with every new trade, and it is getting to be more automatic. Before 2008 ends, I want to go a little bigger with my positions. Common sense tells me that my returns will be twice what is reflected above, but that will remain to be seen, as changes in position size affect psychology. The hardest part of system trading is managing my psychology.

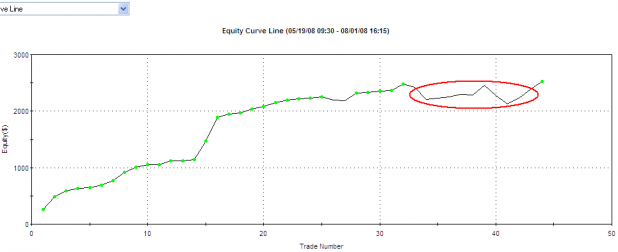

The circled area on the equity curve reflects the last days of June and the first half of July, when the indexes were moving downward, with very few spikes up or down.

This system likes trending conditions, if they have regular counter-trend moves. As long as there are swings, it is happy.

The green dot means that the account closed today at a new high. I’m hoping this means the near-term market conditions are changing to be more favorable for this type of strategy. Months like January and June will result in drawdowns or flat results.

Well done.

FYI, I plan to start paper trading RSI(2) using e-mini futures contracts on the next buy or sell signal for either the Dow, S&P or Naz 100.

I reviewed this week’s DDM trade and the total two-day move in the Dow was 450 points, times $5 per point, equals a gross profit of $2,250 per contract. Subtract about $4.50 for commissions to get the net.

I’ll be paper trading for a bit because I need to answer two questions, what are the drawdowns going to be, and how do I establish a stop loss for futures?

The leverage inherent in futures makes those two areas kind of scary, but the potential rewards are too enticing not to explore. At the end of the day, I may not have a large enough account, or cojones, to trade the system using futures, but I’m going to at least poke around a bit.

I’ll share my results if I get something worth writing about.

Please do share. I look forward to hearing more about it. That is one area that I have not at all explored.

I am not at all familiar with futures, but could you backtest each index and then extrapolate those results to the futures?

I might be able to backtest the futures through Tradestation. What are the symbols you want to trade?

If you can backtest in Tradestation, that would be great. The symbols are: NQ (Naz 100); YM (Dow) and ES (S&P).

One issue that makes backtesting futures difficult is, of course, they expire several times a year, so you don’t have a continuos history to work with.

Backtesting the index is probably the best way to go, I’ll give it some thought over the weekend while I’m working out in the yard.

Just off the top of my head, it seems the indexes tend to bounce from an oversold condition very quickly, usually the next day, but they tend to go a little higher before rolling over when overbought. At least that has been my observation this year.

Thanks again for your help and make sure to email those results to Mexican!

Tradestation has continuous contracts that you can use for backtesting. Just add the @ symbol in front of the contract symbol….@YM, @NQ, @ES etc

Thanks Greg.

I just sent Dog the results for ES.

Thanks for sharing Woodshedder. Truely exceptional results, particularly in this market. Congratulations.

Wood,

Excellent results. Developed transparently in a public forum, always a difficult proposition.

As a mechanical [quantitative] strategy, it seems [based on your backtesting] robust.

jog on

duc

Thanks Duc.

I have been a lot less confident about discussing the specifics of the strategy any more in public, although many here understand the basic system. However, I have archived all the posts pertaining to it, so one could certainly find most of what he needs to trade it.

There has been a lot more testing done by another trader, and what he has uncovered has taken the system to another level, in terms of expectancy of entries and exits, how to obtain the highest average win amount, etc. This additional research has not been published, and I do not intend to share it. But you’re right…what we’ve found is that it does seem robust.

Despite part of me believing that it would take a long time period, and many traders trading the strategy EXACTLY the same way for the edge to be diminished, in terms of slippage, losing the edge can happen very quickly.

For example, if there are 20 traders trading the system, all taking the same signals, even if they are not trading any size more than 100-200 shares, their orders, on the open, are likely to cause a gap up, unless there are some other sellers out there.

In fact, slippage has been one of the biggest negatives of this system, but testing has shown that there is not really a good way to overcome that.

Woodrow – great results caught my attention and so I looked at Covestor – so I have a question: is the Fly really Timothy Sykes?

Buylo, I’m not sure what on Covestor led you to postulate such blasphemy.

Finding out the Fly is really Timmay! would be like waking up and finding out that Michelle Obama’s body was taken over and inhabited by Billary, and that once every evening at 12:00 midnight, s/he poke their heads out of her stomach, and have sex with Barack.

Yeah, it might even be worse than that.

Wood, glad to see you concur, I’m gonna work on finding da evidence to expose one or the other or both!

Nice results Woodshedder! Can you restate your strategy one more time for us? I believe it was go long when RSI(2) falls below 10. But when do you sell?

BD

Wood,

Interesting with regards to slippage.

Could you not utilise a buy prior to the close, rather than on the open? This would necessitate a live RSI<2 feed, but not a problem surely?

Assuming for a moment that it is a problem, as you are at work, then one way to overcome slippage is “time” viz a longer hold.

Of course in the current market, I appreciate that this could fail ugly.

In a bull market however, results may well be different, which you have alluded to already.

jog on

duc

Buylo, wait a minute!!! I do not concur…lol…

Blue, sell > 80.

There are actually many ways to use RSI2. One thing I’m working on right now is a strategy for equities that actually BUYS when RSI2 > 80. That might be a fun strategy to develop on the blog, as there should be enough signals generated that it would be difficult to create an issue with slippage.

Duc, tests have been run, with buys prior to the close, and also with limit orders at a specific RSI2 level, rather than market orders.

These entries and exits offer some benefits over a standard market order on the open, but there are also drawbacks.

One drawback that you might not expect, but did in fact occur, was that the drawdowns were significantly larger.

For my personality, risk profile, and availability to trade, market orders on the open have more benefits and less drawbacks.

Wood,

Ok, interesting. Did you ever hypothesise why this may be the case? [regarding increased drawdowns]

Drawdowns would be a major concern to myself also. The psychological ramifications are difficult to quantify, but I suspect they are myriad and dangerous.

jog on

duc

Hi wood, see I drooped by. COF, COF, sorry, I have a bad COF. BWAHAHA!! Have a good one!

Wood:

Have you read “Evidence Based Technical Analysis”, by David Aronson ( http://www.amazon.com/Evidence-Based-Technical-Analysis-Scientific-Statistical/dp/0470008741 )? He makes a compelling argument that “subjective” technical analysis needs to be discarded in favor of “objective”, i.e., if the thesis can be condensed into a repeatable computer formula, then it is valid.

How much testing do you think is needed to objectively confirm the Woody RSI² Principle? Also, why do you believe in a computer-program controlled market as is today’s, that a number as low as 20 simultaneous users trading 100-200 shares would effect prices? Wouldn’t the determining factor be the average shares per day traded for the equity? 3,000 shares at the open when 3 million/day are traded would be less significant than for a 300,000/day stock.

Zen, I haven’t read the book, but I agree with his argument, if it is as you have stated it to be.

The breakouts I use are not subjective, but are based on quantative criteria, so although the charts may all be a tad different, they all fit within a quantative framework. Basically, think William O’Neil’s criteria for a base, programmed into a screener. It is a lot more complicated than that, but those are the basics.

What that allows is that I know if I buy a breakout that is screened, that it has a 25% chance of failure, which means it declines 8% from the close of the day it broke-out. I also know what percent go on to make between 5-20%. It makes things a lot easier in terms of position sizing, stops, etc, knowing these things.

As for the RSI2, I can tell you that there has been a lot more testing on it than has been published here. I think that if one is going to trade a system, he is going to need to understand the system, inside and out, including any variables he can think of.

Finally, if there is only one signal for the morning, 3,000 shares on the open will cause a gap, regardless if it trades 1 million shares. I have witnessed it enough times to know it does have an effect. Also, some of the symbols are trading less than 1 million a day, and so, as you have said, it can have an even greater effect.

A little math…

If the market gaps .25 cents, on a 200 share order, that slippage has cost you 50 dollars on that trade. If you get 200 more signals that year, and the same thing happens, you have just spent $10,000 on slippage. On a 50K account, you have lost 20%. And believe me, I would be thrilled if these were ONLY gapping .25

You have to remember that when these signals hit, the market may be imbalanced due to the fact that this signal catches extremes. There may be no, or very few sellers or buyers of the particular symbol, and when the MM sees buy on open orders coming in, he is going to raise the ask.

Good discussion Zen…what else are you reading?

Zen,

I haven’t read that book so I don’t know if the author discusses this at all. I too agree that TA should be objective but once you start actually programming things into the computer, you begin to notice some issues.

There is a lot of research being done on fuzzy logic in computing but as of now, most backtesting uses boolean logic meaning yes/no whereas fuzzy logic can make more subtle evaluations such as good/better/best – closer to how the human brain works.

An example of this might be a trader looking to test entry into a stock after a successful test of its 50dMA. Most humans would recognize that if the stock closed 3cents below the 50d before bouncing, that would constitute a successful test (as good enough) where as the computer would consider it a failed test. There are ways of programming a type of scoring system that can begin to do this, like say within 1% is good(1 point), within 1/2% is better(2points), within 0% is best(3 points), but it a challenging to say the least. Especially as the number of rules and criteria add up.

Fuzzy logic can also be the downfall of TA as well and it is really where the “art” and science meet (IMHO). With that said, I have tested a lot of indicators and found most (not all of them) to be useless, atleast within the non-fuzzy parameters of my tests. I suspect Woodshedder has done the same because the ones he uses tend to be the same ones I have tested to be statistically significant.

Woody and bhh:

You both make excellent points.

My most recent readings are:

“Bet with the Best” ( http://www.amazon.com/Bet-Best-Strategies-Handicappers-Handicapping/dp/0970014708 ) and

“Beat the Dealer” ( http://www.amazon.com/Beat-Dealer-Winning-Strategy-Twenty-One/dp/0394703103/ref=pd_bbs_sr_1?ie=UTF8&s=books&qid=1217792826&sr=1-1 ).

As I refine my own trading models, I am seeking to train myself to approach investing from the viewpoint of “what will the Big Boys do?” since 80% of all trades are done by the Big Boys. For example, I want to be able to “know” that the Big Boys will buy XYZ when it hits its 50ma and the RSI(2) has a 2 reading.

Bet size is certainly a key variable in strategy development.