Really, this is all about making money trading. Therefore, Part 1 will detail my trading profits.

In Part 2 I will discuss what worked and what could have worked better. I will also discuss the changes I will make in 2009.

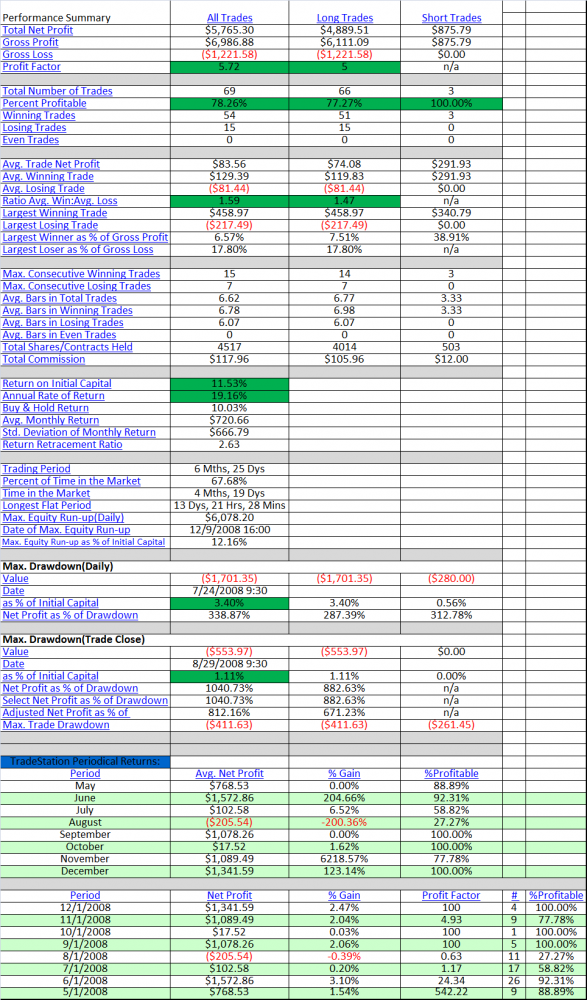

Here is a quick summary. My strategy account was up 11.53% (19.16% annualized), while my discretionary account finished flat. Combining the two accounts brings my overall gains in 2008 to 6.03%. I’m not happy with my lackluster performance in my discretionary account, but that is more a conversation for Part 2.

I want to focus on the metrics of the strategy trades. The performance statistics are below. I find them nothing less than stellar. The metrics that I found especially appealing are highlighted in green.

Note the montly performance report. I had only one down month equaling a percentage loss of -0.39%. To be clear, the account made its first trade on May 19th, so I was down 1 out of 8 possible months, during the worst market since the Great Depression.

Feel free to leave any questions about my performance or the report in the comments section.

I want to wish a Happy and Prosperous New Year to the iBC community. I also want to issue a sincere thank you to all of the readers who have supported me over the years. 2008 has been a pivotal year for me, and it absolutely could not have happened without the blog and the readers.

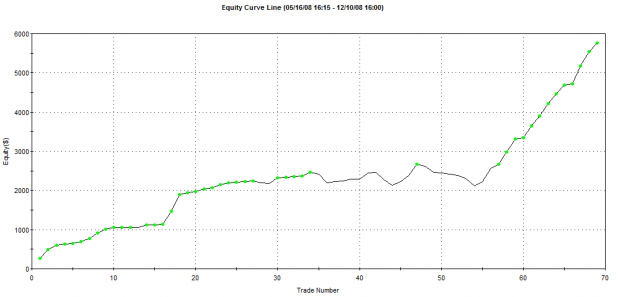

Wow, whatever you were doing really started working about the fifty-fifth trade.

hey wood…

thanks for all the info you share with us… i look forward to following you in the new year…

your brother in the battle…

just simply great. to you and your family Happy New Year.

Nice job, Woodster. Happy New Year to the Richmond Crewe.

Good job in a tough market, congrats!

Happy New Year!

Outstanding, Woody.

Looks like you’ve got it dialed in for the year ahead.

Here’s to an even more prosperous ’09.

Well done Wood, keep it up.

Congrats on the performance. Keep up the good work.May your best trading in 2008 be your worst trading of 2009!

I can see you are really racking your brains and I hope you won’t take my comments the wrong way. because they are intended to be constructive. Why don’t you just trade price action? Throw away all those formulas and indicators. The idea is to only trade the highest probability set ups. Look up the Holy Grail Trade by Raschke. It’s simple to learn and execute and has a very good performance record. I only trade pullbacks that occur during steep trending angles and that form as volume declines. It’s very high probability. There is no indicator or formula to alert me to this. I just flip through charts and find the steep angles. Try it. You will see. Indicators should only be used to confirm what your eyes already see.

Jim

I just checked the holy Grail System. How do you find the stocks?

Do you check the 52 week highs and follow up to see if they retrace?

Thank you for your help

Andy