Will not reward failure. Terrible terrible day for Turd Portfolio even though NFLX was down 3-4% from open and AAPL was up nearly 2% today. Damn Spytard Calls got that exuberance.

Comments »Bearish Divergence on your face

Looking to tomorrow

Barring some 3PM reversal, I’m steadfast in shorting this homo rally. Your personal god Fly is going to post one of those PPT charts that posts a fucking FOUR, well beyond the twos and threes you normally see. Upon the world seeing The PPT, we will enter Financial WW3.

Hey fucker, that rhymed. I probably got enough to do that young people music you guys love so much…

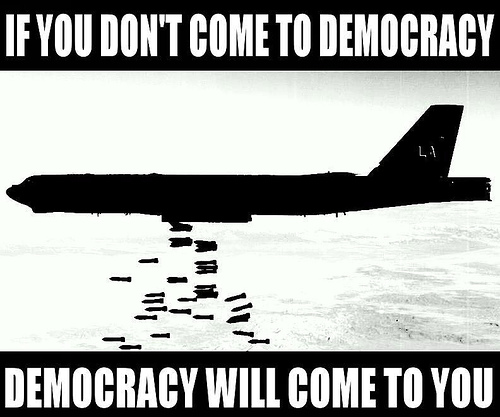

Comments »Democracy is shit

Look what your democratic process got you: Me. Democracy is shit. Turd is shit. But it’s ok. Buy some TZA here at 30.18. Show your leaders your vote of no confidence.

A warning, true. But it’s still shit. I don’t buy shit and neither should you.

Comments »Bank Earnin’s

Back in the day, banks were in the business of providing loans and other forms of financing to the “small people” and businesses alike. Not no more. No, today these banks are nothing more than huge hedge funds with unreal jack at their disposal. Is it any coincidence that bank earnings were going through the roof once we hit the March 2009 low until now?

For the short attention span crowd, go back and see what this here market went and done in 2Q. Hint, it ain’t purty. But to spell this shit out, the $SPX dropped 12% in that time period. So why the fuck would you expect the “bank” earnings to continue their moonshot trajectory? Sure they probably banked some coin on the downside but I doubt they timed this shit perfectly. They earnins ain’t too bad, but also not good nuff to propel this shit ass market higher so far.

Don’t forget that Po Pimp told you to be careful out there a couple of days ago. You wuz warned.

Keep it real, son.

Comments »Let’s be Careful out There

Disclaimer 1: Yes, I remember Hill Street Blues but I am indeud below the 47.5 age limit for IBC.

Disclaimer 2: I normally don’t believe in conspiracy theory bullshit; but sometimes you got to pay attention.

Back around the first of the year China reported some ridiculous GDP figure like 14% growth. Like you can believe those fuck faces any further than you can throw them. Around the same time we began 4Q 2009 earnings reports. AA crapped the bed like normal, but others were reporting some good shit. Then OPEX came around about the same day JPM reported earnings. Within a couple of days Obama decided to start all that crazy talk about the Volcker rule thus sending the market into a mini-tailspin remembered as “The Great Crash of 2010” (Jan – Feb correction).

Fast forward one more quarter. I don’t remember what the Chinese reported for GDP growth then and I don’t care. It’s not relevant to a good conspiracy theory. However once again we were getting some good earnings reports. Market was in the midst of “The Great Bull Run of 2010” (Feb to April rally). Lo and behold here comes OPEX again and Obama decides to throw the fine gentlemen of Goldman Sachs under the bus. Few days later BP decides to fuck up everything that the GS bullshit didn’t kill. Hence “The Greater Crash of 2010” complete with the Flash Crash and all other sorts of fuckery.

Now here we are again. The Chinese have another ungodly GDP number and earnings reports are pretty fucking good so far. Even AA “beat” the sand-bagged lower revised estimates. Hell, for them a beat is a beat is a beat. Pity must be imparted on those poor fools.

But tomorrow could be interesting as we see if OPEX leads to another negative surprise giving us “The Even Greater Crash of 2010”. Should we take a pool on what the cause will be this time? Obama has already fucked the banks and energy. What’s next?

Comments »