I have lightened my load this morning of death vehicles such as TZA and other instruments of pain, in exchange for cash and select purchases of stock (I’ll probably buy AAPL at the open). I am looking for a small bounce today from where we are now (perhaps 1062). 1050 on ES is support to me, and I think we may bounce. I am still very bearish but like I’ve said in a few comments, I do not think the crash comes today. I am still very bearish and my shorts easily outnumber my longs. If we fail to bounce, I will sell out all of my longs below 1049.50 on ES unless they are acting exceptionally well. If this happens I will fall on the sword and apologize. When we hit 1062, I will start looking to add back shorts.

Comments »Another Death Cross?

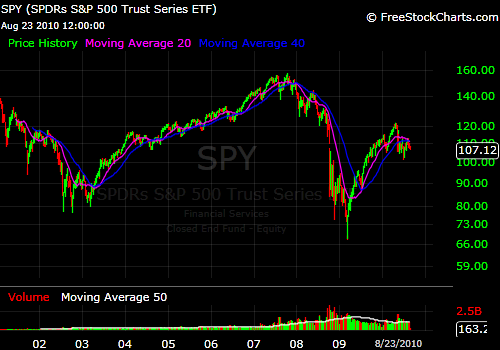

here are the 100 day and 200 day moving averages. this cross is different from those back in 2004-2007 because the direction of averages at the time of the cross is down, not up. the 50/200 cross i warned earlier was shit as the averages were pointing up. here, however, the 200 is flat/ rolling over. while moving averages aren’t my favorite, this does have more validity than any before. throw in massive looming head and shoulders, bearish elliot wave counts, and every technical trader is in cash or short. good luck, longs.

Comments »Bullshit

Inevitably, much if not near all of what you know is bullshit. From your morality to the reasons you choose investments (bullshit term), it is all bullshit. You need to reject every bullshit notion you have in order to see clearly. I simply call to you to remove the bullshit crust from your eyes! Now, the scientific method shows us that rejecting falsehoods is the best method of discovery while constructing a coherent theory is extremely tough and in some cases, futile. In the practice of markets, it must be concluded that is less than a science, so we must not try to construct any theories at all but merely reject bullshit.

I’ll get us started (please feel free to add):

1 – The “bond bubble” thesis is bullshit. Bubbles are disconnected from any or all objective measures of value. Flight to a relatively secure stream payments in uncertain times is not a bubble. Bond prices are historically high, but it is not a bubble as the rise is based on reason. Argue that the level of uncertainty is bubblish and you sir, are a fucktard.

2 – The “smart money” thesis is bullshit. Pay no attention to 13-Gs. Empirical data suggests most don’t have a fucking clue. The notable names do well because idiots blindly follow but the majority aren’t beating the SPY.

3 – The “European Debt Crisis is over” is bullshit. Does anyone realize that Ireland CDS are higher now than last month and Spain is nearly as high. Chartists would go ape shit over Spains CDS.

Not much to say

Today’s action was extremely bearish. I have to tell you that you need to be paying attention to the slide occurring in financials, for the shit storm is a brewin’. However, the people that matter are on vacation. So, let’s not make too much of this. Downside bias is obvious and I’m winning. I told you that I would win this month, how I was going to win, but yet I feel as if you still don’t understand that I have won. What else do I need to do? Should I start telling you everything I’m doing hour by hour? The market is goddamned boring, so I go do something with my life. You should do the same. Instead, you sit here and look at ticks that hand over your money to me because you think you can fade the Turd. Fuck you.

Oh yeah, here are some “predictions”:

Tomorrow-

Existing Home Sales will suck. But I don’t know how the market is going to trade off them. Sorry. If the headline number is below 4M, then the market will plummet. I think there is a reasonably good chance of that occurring unless we are already down a nillion handles because this market is begging for capitulation.

Wednesday-

New Home Sales will probably better than the Existing Home Sales but too dependent on Tuesday’s trade to try to predict now. Don’t really give a shit, honestly. Real Estate market is dead. Don’t buy a house, moron.

Thursday-

Now we get 500+ Jobless. If it’s 540+, get the fuck out of the way ’cause the shit storm be here.

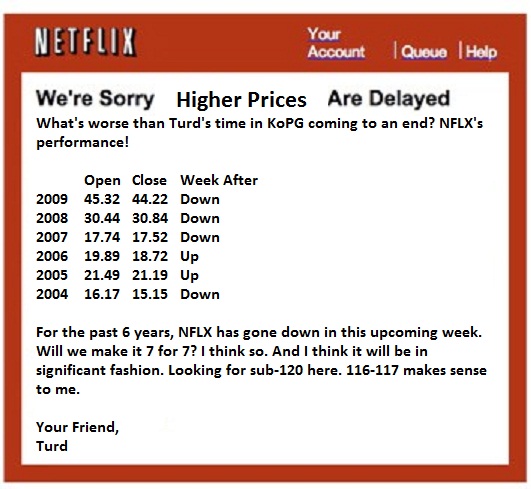

As far as an earnings play, I think AEO and TIF deserve a good beating, however, don’t forget to watch NFLX’s slow drop to below 120 this week. Why? Because only fucking fucktards bought NFLX above 130. Resistance for fucking morons is 120. Then we get to asshat 110 level and so on…

Comments »