While it may have seemed we only experienced a slight pullback day for the market, today was in fact a sad day for the Jacksonians, as we saw another original candidate get the old “heave ho” out the door for lack of performance. I will admit, I gave Natural Resource Partners LP [[NRP]] a little more leeway than I did Tesoro Corporation [[TSO]] , as it carried with it a phat dividend (over 10% as of today) and it was a royalty play rather than an operating miner (much like fellow Jackson Royal Gold, Inc. [[RGLD]] is a gold royalty play), which I thought gave it some “rent safety” over the operators. No such luck.

You see in prudent Jackson land, there’s only so much loss a play can take, and when NRP broke $19.31 today (a significant support level), it hit our stop, and we sold the remainder (207.555 shares) for a loss of 19.9%. Luckily, I only had 1/2 a position left, having sold the first half at $20.50. Still the bludgeoning (before dividend payments) was substantial.

What was I thinking picking a stock with a symbol so easily dyslexia’d into the acronym for National Public Radio, anyway? Should’ve been a sign to me …

Luckily, despite these minor setbacks, the rest of the Jacksonians are hammering along hard enough to keep the overall returns over 21.6% since inception on May 1st. The Andersons, Inc. [[ANDE]] and Teck Cominco Limited (USA) [[TCK]] remain my top winners (even as I added to my TCK a scant few weeks ago at current levels, my blended return is still 40%).

I believe the gold and silvers are going to take off here as we head into the last months of the year, as they are wont to do historically. In that regard, IAMGOLD Corporation (USA) [[IAG]] , Eldorado Gold Corporation (USA) [[EGO]] and Silver Wheaton Corp. (USA) [[SLW]] are my top performers, with returns of 44.64%, 39.13% and 30.05%, respectively, since May 1st inception. Of those, I think SLW will have the greatest momentum as we head towards Christmas, because silver continues to be undervalued compared to gold.

_________________

Speaking of gold opportunities, I threw out New Gold Inc. (USA) [[NGD]] yesterday, and although it didn’t move an inch either way today, I continue to think it a strong play here, especially on a pullback to the $3.30 area. If we’re not that lucky, I believe it’s a buy over $3.55 as well.

I also wanted to point out another junior that I think will be a mover going forward here — Rubicon Minerals Corp. (USA) [[RBY]] . Have a look at the daily chart:

And really, I think the weekly should cinch it for you. It’s so eeeeeasy– a cup and handle, for goodness sakes! And on the weekly, no less. My take: wait for that break of $3.21, and then… blammo!

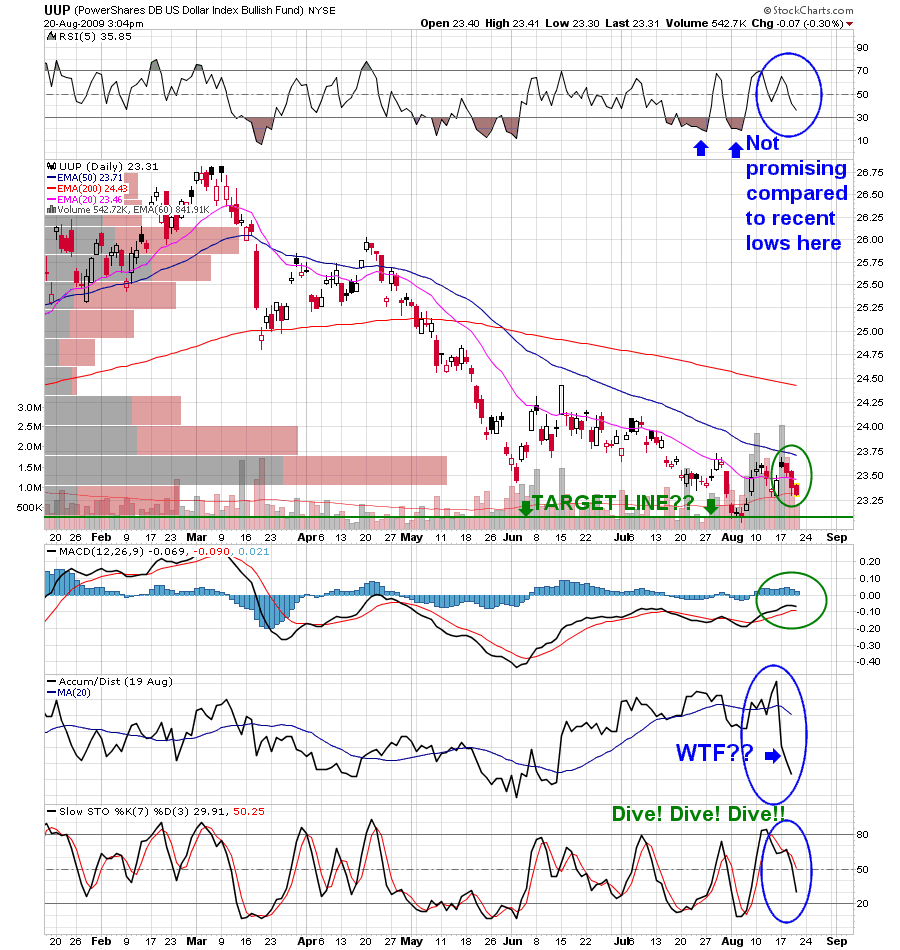

One last admonition — watch [[UUP]] tomorrow for your signal. A break above $23.31 or so will mean a little bit more waiting on the gold selections. But if UUP turns down again– towards my target of $23.05, that will probably mark the break out run of a great many junior gold and silver plays.

Best of luck to all my Jacksonian stalwarts.

___________________

Comments »