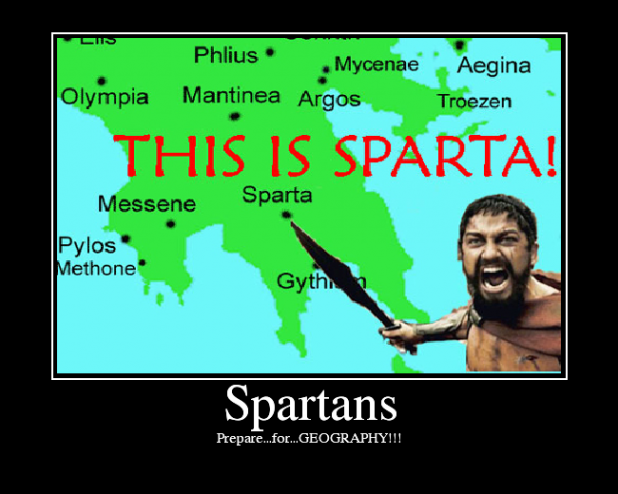

There’s a lot of Dr. Seuss read in my house these days, so doing tricks with bricks and blocks is something with whch I’ve become quite comfortable. The candles in the charts are another trick brick block tack I take on here as well, as you know, and this weekend I’ve got three “outliers” for you.

Here are three charts for stocks I’ve been looking at recently and which I believe are showing some short and long term promise. Keep in mind, the Jacksons are our long term picks, and while some of these may be good for a longer term hold, I wouldn’t characterize any of these as “buy & hold” for the duration type vehicles. I’ve put some targets on these for your reference. OTB-style traders rejoice.

First my old friend from the crazy days [[ARTC]], which is now trading pink sheets thanks to some accounting problems a few years back. They’ve got a new management now and it looks like they may even re-list soon. You can see from Friday’s spurt that the market has gotten a bit more accepting.

Again, this is one you want to watch closely, but you might get a nice pop to at least the 200-day EMA here ($14) and perhaps a bit higher before it breaks of this current momentum run. Not a long termer, so I just give you the daily chart:

Next is a stock with a little bit more long term potential, hence I’m going to give you the weekly look. [[TRID]] is a digital chip maker that supplies the LCD market, one that’s gotten all kinds of hot here in just the last two weeks. This is one The Fly likes a lot and as a consequence, has had the PPT (are you enrolled yet?) buzzing for the last two days. Again, note the short term targets, and the “fantasy targets” well north of there.

My last look is a cousin of the Jacksonians in [[TIE]] the titanium producer. As you can see, it’s broken above some significant resistance here on the weekly, and I think the 38.2% fibonacci is a promising target for the intermediate term, above $17-. [[RTI]] is another significant mover in this space, but I think TIE has more room to catch up here, and so could be the more promising for a trade.

As alway, please remember that dabbling in any stocks in this dicey of a market will likely lead you to a freak lawnmower accident while pricing John Deere “Zero-Turns” at the local Home Depot. I’d much rather you convert all your money into Franklin dimes, put them into Mason jars and salt them throughout your in-laws’ backyard.

Best to you all.

________________________________________________________________________

Comments »