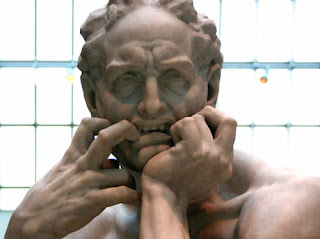

There is no Bernank, Only Zuul

__________________________

I don’t have a lot of time this morning, so I’m just going to feature the chart I put together last night. As you know, I’m increasingly bearish here, and more so on the financial sector than any other, primarily because they are — like our internal deficit and debt problems — another can that has been kicked down the road.

Back in 2008, when the world was melting into a hardened polystyrene ball thanks to the implosion of the easy money real estate bubble, banks were allowed to escape (some just barely) thanks to the ministrations of the Fisc and the Fed via TARP and other more nefarious and clandestine sources. Worse, Freddie Mac and Fannie Mae, the twin dogs of Zuul the Destroyer, were allowed to remain in their positions of power “for the good of the market.”

In other words, little was done in regard to true reform save “shoring up” for “the good of the industry and the economy.” Bad mortage loans are still on many books, and real estate prices have been frozen in a glacial slide to the sea, rather than being allowed to correct in a more natural — if radical — manner.

Ironically, it is not those mortgage time bombs which will kill the banks in the immediate term, as the “propping up” methodologies of Congress, The POTUS and the Fed are actually hurting the taxpayer while assisting lame banks. No, it will be the regulatory overkill administered in the fecal kludge which is Dodd-Frank Reform Bill, also known as “the second 2,000+ page bill that no one read before voting through.”

To give the Congresscritter some defense however, we can’t blame them for the criminal act of not reading the bill, since there were hundreds of pages of regulations YET TO BE WRITTEN found within its pages. In my opinion, this is the far more egregious and unconstitutional sin. In the case of signing a law that carried unknown legislative directives in it, Congress is yielding it’s power to an unelected alphabet soup of Federal financial bureaucracy.

Banks are just now beginning to “implement” some of the new regs. You are already familiar with the loss of revenue due to debit card restrictions, but there are other capital and revenue limiting aspects which will also affect banks both large and small.

Ultimately, this will likely lead to another round of consolidation,which is what the cronies in Congress would like, as they loathe competition and it’s messy donation collection implications. Until then, banks will be a mess, and I would steer well clear of them. If you are adventurous like me, you might even take an interest in their downfall:

As you know, I added to my SKiFfles the other day, along with a position in TZA and more TBT (which remains a hair shirt). What you don’t know, unless you are a member of The PPT was that I also loaded up on EXK, GDXJ and AG calls yesterday afternoon.

Yet another reason to look into a subscription for The PPT as soon as possible. My best to you all.

_________________

Comments »