…………………….And get in the Funnel!

__________________________________________

No more screwing around funnel dogs, you’ve had your play. Now it’s back in the funnel with all of you.

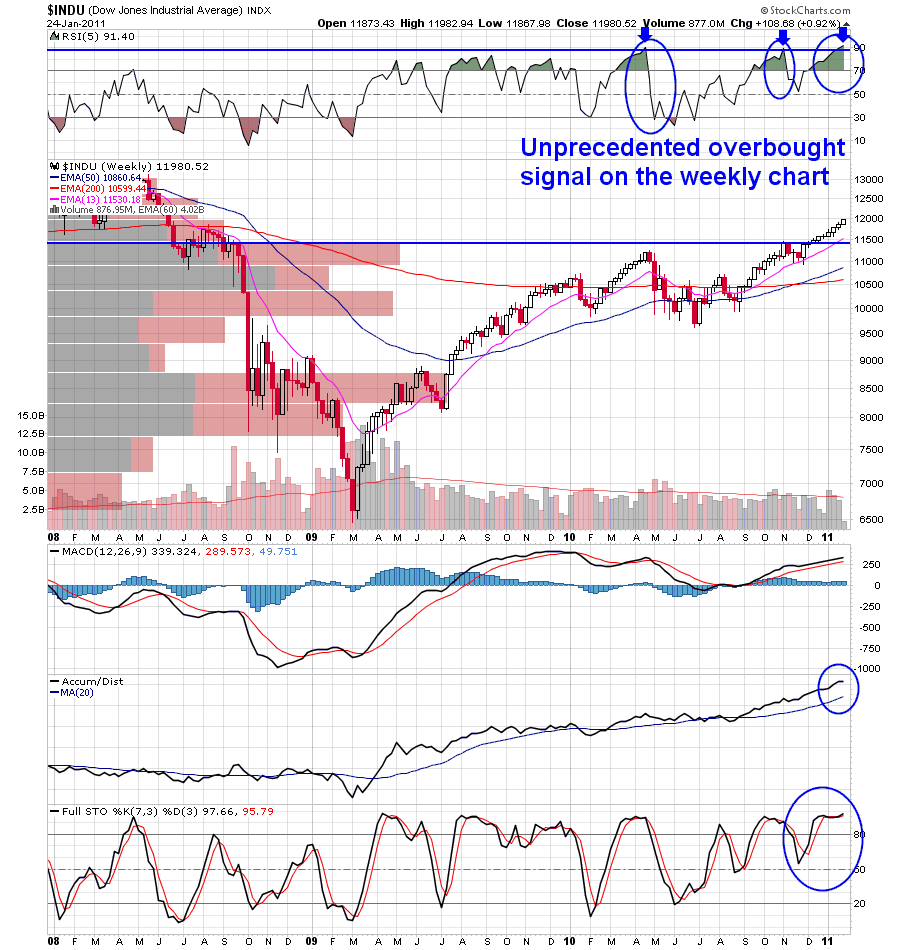

I added some DXD today to my egregious whip of S&P and Russell 2000 short ETF’s. Why? Because the $INDU weekly chart is as overbought as I’ve seen it in the last five years.

Take a look at this weekly:

Sorry this is an abbreviated post tonight, but I’m having a hella time seeing and saving what I’m putting into the blogging box. Could be some antepasto was spilled on the server, or maybe it’s WordPress, but I’m getting out while I’m ahead.

This is your time to hedge up. Continue to sell here, raise cash, and Saint Francis University.

Best to you all.

_____________________________

Cool dog. My grandfather, aka Paw Paw for us real southerners, had one just like it. Kind of dumb, but real friendly (the dog, not Paw Paw).

Yeah, that’s gotta be some kind of hunting dog. I got the pic for the cone of shame, however. It is the true funnel for dogs.

______________

Cone of shame … hahaha, I swear dogs really ARE embarrassed to be seen wearing that thing.

looks like a coonhound … Redbone or Plott

Chocolate Lab.

Are you the same as Go2mars? What’s with the back and forth name changes, what are you, dpeezy?

Either way, you’ve just added the subject of dogs to the list of subjects of which you know nada. S.t .Francis U.-

I think the German Short Hair call is the winner.

__________

One of my buds had a chocolate lab that looked just like that. Golden eyes, et cetera. The distinction is apparently a slight fur curl along the shoulder hump, but it is blocked from view. I am no expert. Just my guess. Sue me.

Face is too thin, I think.

______

Those lines you circle are all figments of your wild imagination.

That is a compliment, coming from our Imaginer in Chief.

________

Could be your Windows PC. My Mac seems to be just fine! 🙂

Funny you say that, as I was having trouble w. a couple of sites last night. I was on the kids’ comp, as I still haven’t pulled the trigger on a new laptop yet and I don’t want to use my work one…

Indecisive between that new HP Elite series and the Toshibas… they are both “veddy niiiice.”

__________

I was never a big fan of HP computers until I had my unfortunate laptop incident last year. When I was looking for a replacement one shop had a pretty good deal on the HP Pavilloin dm3. I said what the hell and bought one. So far so good, I really like it.

Is that the Notebook? I’m thinking bigger…

_________

I’ve got the HP EliteBook.

Does the jobby.

What are your specs (memory, speed, screen size, chipset, etc, etc?)?

_________

AG

(all good)

lol – who am i, Leo LePort? Bank issued…

http://www.hp.com/hpinfo/newsroom/press_kits/2008/siggraph/ds_elitebook8530p_nbpc.pdf

That’s older than I want, but not bad. Need Windows 7, though, too.

_____

http://www.shopping.hp.com/webapp/shopping/product_detail.do?storeName=storefronts&landing=rts_notebook&category=rts_notebook&a1=Brand&v1=HP+EliteBook&product_code=XT916UT%23ABA&catLevel=2

I just picked up this one but with the 500G hard drive. Nice machine. 14″ portable and powerful. Of course you might want the i7 chip set and maybe a larger screen if you were looking for a desktop replacement.

Anyway…for the most part computers are a commodity. Other than the durability of the casing / buttons everything else is the same brand over brand.

Durability is a big factor w. me. I’ve got kids and tend to drop things.

Thanks for the suggestion.

______

May be a coincidence (after my comment last night about gold drop and stocks) but with gold down about $20, the major gold stocks (NEM,ABX,GG,AEM,etc.) appear to be down just %.50 or so in the pre-market.

I am watching for the open reaction to see if this is a bounce worth trading (need to be quick or it’s deadly).

For the degenerate daytraders only.

None are so anxious as those who watch and wait; at these times, mournful fancies came flocking on her mind, in crowds.

That one, I didn’t make up. It’s Dickens.

________

A polymath you are, Jake!

That is why blood pressure meds were invented.

Didn’t have them in Dickens time, just leeches.

They all lived til about 35. Nasty London water, that.

_______

Not to mention the pestilent beavers.

I’d say German Shorthair, and an old one at that.

If anyone is interested in speculating in an interruptive technology, they might wish to check this out…

http://86.39.158.41/walter.Sidoti%20new.wmv

The people on the Board of this company are serious fuckin overacheivers. Disclosure, I do own stock in this company; and, I plan to accumulate more.

“404 – File or directory not found.

The resource you are looking for might have been removed, had its name changed, or is temporarily unavailable.”

wow, sorry, don’t know what happened there. An indirect way to check it out (the way I got to it) is through the yahoo message board…

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks_L/threadview?m=tm&bn=78384&tid=23183&mid=23379&tof=10&rt=2&frt=2&off=1

then click on the link shown. Or just do a search on yahoo for the LWLG message board.

Bottom being formed in gold (temporary probably- but who knows).

Majors looking good here- gold dropping more but majors are not.

Ahh St. Francis Uni, friend to said beavers.

“That’s ridiculous. Are you saying there are no subsitutes? You can reply on the next thread btw… (new post) —–>>>>>” -JG

I’ll do it for him. He is correct that there are many industrial processes for which there is no subsitute for silver. Catalysts, reaction screens, various solutions, etc. He is correct. (Obviously electrical wiring in houses uses something else nowadays, but there are still things which require the superior electrical qualities of silver. There are other examples. Certainly some have substitutes, but there are some applications that just plain need silver.

Question at JG and Warren G.

What price are you looking for for entry into physical silver? I’ve got a quarterly bonus coming and will be buying silver with it. Just a question of timing.

The Vancouver conference (which went just like the Strongbad conference = awesome), was very enlightening, and made me even more bullish on silver if that is even possible. And it wasn’t just what Eric Sprott had to say.

I’d get a quarter of it right here.

_______

Grazi. My thoughts were half, I appreciate your input. And your charts!