_____________________________________________________________

Crushed? Debilitated? Blown out beyond all reason? Yes, you could say that.

Sentiments levels? Dead!

Long term bull trend? Dead!

Neidemeyer? Dead! (Ok, so Animal House was on tonight)

All kidding aside, we saw a similar “interruption” in the last great secular bull cycle in the mid-70’s (’74-76) when the Fed and the Fisc made promises to “Whip Inflation Now.” That 50% pullback from was followed by a 350% price move to the peak in 1980. Are we in for the same shennanigans? Well, we’re now 36%+ off the highs in the gold price, and more than 67% off in the Gold bugs ($HUI) index.

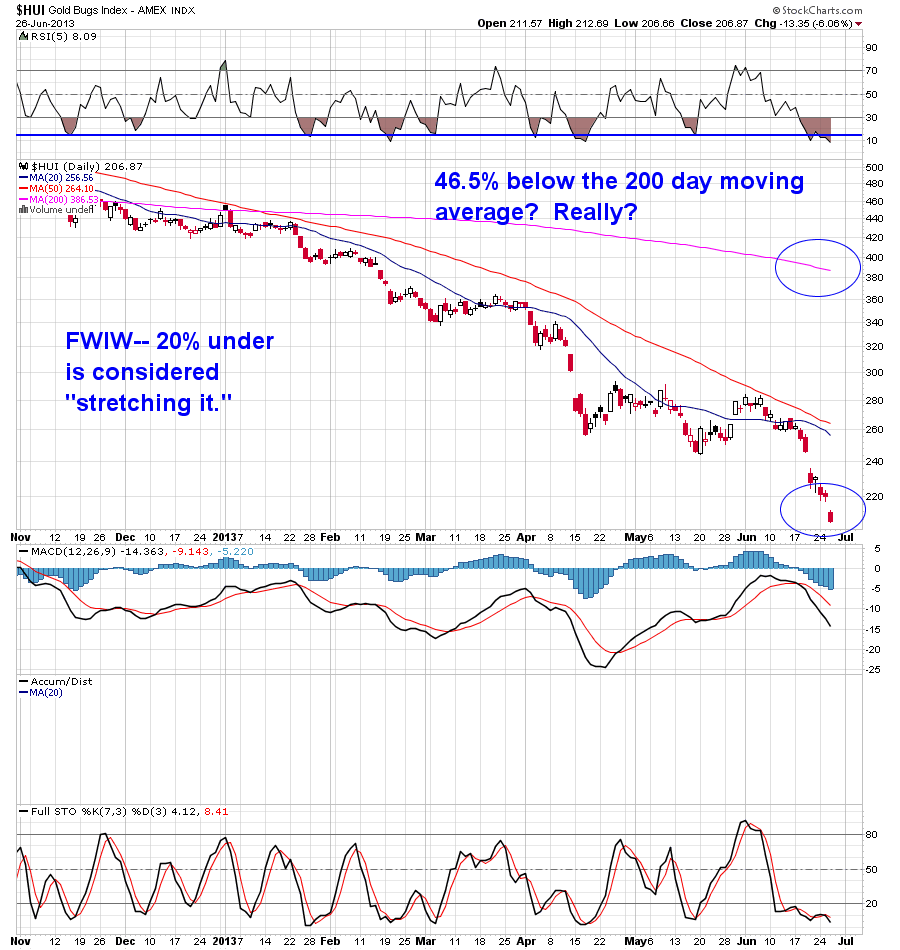

What’s even crazier is the stretch $HUI has taken below it’s 200 day moving average, the traditional “revert to the mean” line of demarcation. Usually, if we get more than 20% below that level, we are going to see a reversion. We are now 46.5% below the 200 day Simple Moving Average.

If I had any credibility left I’d tell you I’m looking for a bounce here. So maybe consider that comment ironically, if that helps….

My best to you all, really!

_____________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

Last night I visited a jeweler friend of mine.

Guy is a complete mess, literally losing his mind.

Physical business is frozen, inventory is unmovable, wholesalers are on a fritz.

I asked him to get me some coins, to which he replied:

“Impossible, nobody will sell or buy anything, regardless of premium. Whole world is waiting for bounce to dump inventory. Why would you get involved in this replay of 1981? Gold is dead! Go get some stocks or bonds”

To check, I placed online order. It said they have coins in stock, Lets see how long it will take them to ship

My friend is a great jeweler, but a bad investor, plus thoroughly brainwashed by MSM. He believes that gold is down because dollar is very strong (actually he said “Thru the roof”), and Fed is raising rates. His jeweler-friends all agree that if 1200 is lost than 1000 is not going to hold, and gold goes to 600-700, and…There Is No Upside.

He is positively 100% sure….

I think I’ll place another order today

try provident metals.turn around time for me has been 7 days.from time of order,to delivery.they have what ever you want to stack,and other wise.i’ve placed many orders with them and very very happy with the way they transact bidness.now,on to your jeweler friends dilemma,(which really isn’t one.) he has to do what all the coin shop folks are doing,(holding out) to a degree.notice what the premiums are doing,they are disengaging in a manner where true price discovery for pm’s will soon be revealed, by the very same people in these shops.they are the true denizens on the front.for example: you have noticed the dollar has moved up ,right? well there is a price war going on in money,(not paper),remember that.just this week, the price of a pre 64 quarter jumped like a kangaroo,and it scared the crap out of the market. the demand for these coins,which is phenomenal,has literally pushed the dollar up, and nothing else.2 months ago,i was buying 4 pre 64 quarters for 20 bucks.thats 5 bucks per.this roiled the markets.the dollar is not getting strong,real money is becoming stronger,gold,silver, and the hold outs who have all the inventory are forcing real price discovery.it’s a hard fight, but the holders really are winning.i’ve seen 1/2 oz gold coins for 89 dollars over spot,and they are calling that a discount.if thats not disengaging,i dont know what the hell is.there multiple outside forces,that are now beyond the united states’ control,dont be fooled,this very shit show for the last 5 years in the market and with pm’s is all kabuki until the dollar fails to be the reserve currency.too bad i’ll witness this in my lifetime.but your jeweler friend,and the miners,and the coin shops,they are considered the enemy now. can’t you see the picture the puzzle is revealing.those who have been collecting and stacking,have seen the picture,we may have lost on paper,which is meaningless when you hold the real deal in your hands,were all keeping silent really,and buying the dips.there is a giddiness in all of this,to those who know where all this is leading to.let em keep knocking the price down.doesnt mean anyone is selling, and the demand keeps growing, until the true price is discovered,you witnessing this now.

I see you are still liking provident; good for you. You say there has been a jump is pre 64 quarters (pre 65 I presume). I have not found this to be the case at all. Provident has $1 face for $16. I actually got pre 65 Franklin halves at a local coin shop for $16 per $1 face! Don’t believe they hype about skyrocketing premium, shortages etc. There is a ton of cheap silver out there. If you want to buy big, premiums are so low it’s insane. Keep buying, but don’t overpay.

hey narwhal.they sent me an e-mail last night advertising a ten dollar roll of bu grade silver halves pre 65. 243 bucks @1.99 for the premium. which is great,but the gold coins they are asking almost 39 over spot.thats great if they can get it,but i wont touch that. they are still the best place by far to buy from,and their premiums do fluctuate, which i like. local guy is still selling a bucks worth for 19 bucks,now he won’t come across at all,used to be he would let whatever go out the door,now he’s playing it too close to his chest,to me that says a lot. hey,a shout out to ya for turnin me on to them,these folks there are straight up. thanks man.

@ bergamot,blogger named gordon gekko did a guest post on zh that you will find very interesting.it’s posted on his blogsite.something your jeweler friends will definitely see a new light to there ill’s on,and get a better grip in their decisions going forward.truely is a must read.

Agreed 100% on Provident. I’ve had nothing but great experience with them.

😀

the Jake, hanging tough!

Romney loses, gold crushed, miners destroyed .. but the Jake keeps on keeping on …. we all just gotta keep that nose to the grindstone, .. particularly when things go against our wishes

Yeah it might bounce before it goes lower. lol. Theres a video clip on The Reformed Brokers site of a Gold Fund guy from Van Eck. He didnt so much as speak but sort of timidly murmured his words out. Poor fella.

Yeah, I didn’t say it would be my much more than a bounce. But it could be a pretty massive trade from here if we get back to that $1545 breakdown level from here.

And no, I don’t think “gold is dead,” but I do know how technical damage gets repaired. Perhaps I will post the 1970’s chart so you can see that ride….

________

Hey Jake,

Thanks for posting!! Would love to see that 1970’s chart and any other ideas you might have about how this may develop from here.

Thanks!

I think he means the period from about 1974-1976

See this Forbes chart

http://blogs-images.forbes.com/jamesgruber/files/2013/03/Gold-1970-1980.png

Its a Lotto ticket for sure i think. Play with beer money.

Tom McClellan’s take

http://www.mcoscillator.com/learning_center/weekly_chart/?utm_source=McClellan+Chart+In+Focus+-&utm_campaign=e2ff30d478-CIF_Gold_is_Following_2009_Footsteps_6_26_2013&utm_medium=email&utm_term=0_9e79f8200f-e2ff30d478-151423361

Hey Jake and other gold people!

I’ve been talking to clients about what happened in the 1975-76 period.

Jake, you are right, this time is very similar.

But the jump up from the lows back then was actually more like 800%+, from just over $100 an ounce, to over $850.

Something like that will be repeated, but AND THIS IS VERY VERY IMPORTANT…in 1980 Volcker was forced by other central banks to rescue the dollar by raising rates. The dollar was supported by other central banks leasing/selling gold. The reason the Europeans and oil money nations supported the dollar the? Simple, there was no other currency in the wings to take the dollar’s place, and the world would have plunged into a massive messy depression, with no easy way out.

So, this time around, when gold has it’s final leg of this bull run, and the shit looks like it is really hitting the fan, there will be no rescue of the dollar-based system, because now the Euro is set and ready.

But the paper gold price is likely to collapse then, big time. DO NOT SELL YOUR PHYSICAL THEN, but get out of the miners then.

Gold will go to the moon after the reset (priced physically, no paper market), but the miners will be nationalised/taxed on the windfall.

If you are curious, go read about freegold, it’s a deep subject going back to the 1930s, but worth knowing what lies ahead.

PS China/Europe both now tightening, to burst the US/UK/Japan bubbles…all geopolitics, USTs being sold too.

Stay tuned, I will post updates here as time goes by.

Good luck.

you’re/we are already seeing the slow destruction of the BULLSHIT PAPER gold and silver etf’s. another chunk of disengagement has just occurred in the last 14 days.. please read gordon gekkos’ piece he posted on zh today.should clear up a lot of confusion.

Fan, you are saying to get out of the miners after the collapse. I don’t understand what you mean. I am not being a smart ass. Serious question. Thanks

Sorry for late reply.

Get out of miners sometime during the next bull run is what I meant (assuming there is another one!).

Paper gold will be crushed by the rush to physical before this is over, so miners will be crushed too.

It’s possible this could already be happening, but I reckon there should be another bull run up.

Interestingly, I’ve seen speculation that the ECB (when it resolves banks in the EZ) will treat unallocated gold account holders as just creditors in the banks, and their paper will be wiped out, so speculation the rush from the LBMA paper is already up and running.

We’ll know soon enough, if paper gold prices go much lower and stay there, we’ll have a gold crunch, and the ECB/BIS will launch a physical-only market, egged on by the Saudis of course.

If you have miners now, no option but to sit tight and wait for the bull run, or the revaluation/new market. But sell ’em quick, as govts will be all over gold mines like a rash.

For more info, check out freegold stuff, but it’s deeeep subject, monetary history stuff, but the forecasts are coming true.

I’ll keep posting updates for you here.

This could be the tipping point – the Indian buying – who knows.

I’m silvered to the gills already but may add some tomorrow am.

http://kingworldnews.com/kingworldnews/Broadcast/Entries/2013/6/30_Eric_Sprott.html

From Rick Rule: “I was talking with Eric this morning on the phone, and what he reinforced to me was that he built Sprott from a ten million dollar manager to a ten billion dollar manager, by the aggressive deployment of capital at times like these. Eric has always said, ‘Don’t be afraid to be right’. That’s where we are right now…This is the time when the ’A’ players go to war.”

Warpaint On.