… thanks Phil, now you jinxed me. Lol. Anyway, for those StockTwitters genuinely interested hope this helps…

Educational Posts on IBC on using the VIX:

– January 27, 2009 Using the VIX to trade long side (FAS). (day trade)

– January 22, 2009 Using the VIX to trade long side by shorting FAZ. Head and Shoulder breakdown on VIX. (day trade)

– January 16, 2009 intraday reversal spotted using VIX above 50 for contrarian setup. (day trade)

– January 16, 2009 How to spot rare day-trading days using the VIX and technicals (day trade)

– January 15, 2009 Using the VIX to trade the bull side again. Long FAS. (day trade)

– January 13, 2009 Prepare for a battle to no where with the bulls versus the bears. Poker analogy to show that there is no edge, therefore bet small. (swing trade)

– January 7, 2009 Wave Trading Basics. A little tip on how to trade momentum tapes. (swing trade)

– January 6, 2009 Betting against the news. Using complacency in overseas market to time EEV on the bottom (rose 40% from this point in a few days) As a contrarian trader, I look for complacency on news headlines. If markets rally on low volume, then its probably time to bet against them. (swing trade)

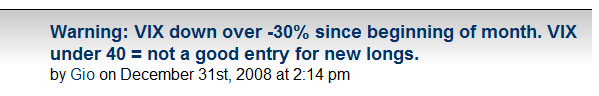

– December 31, 2009 Predicting the top of the Nov-Dec-Jan rally at VIX 35-38. Vix bottoms right below 40, sending Dow down 1,100 points (Swing Trade)

Improve your trading- use the VIX! Understand that the market is moved by fear and greed. It always has, and always will. People buy and sell on emotion, and when you figure that out and learn how to use that as a tool, you will drastically improve your trading. Now get out there and make some money.

ALoha!

-gio-

Ho! Womp that thing!

VIX ETNs.. http://vixandmore.blogspot.com/2009/01/first-day-of-trading-in-vxx-and-vxz.html

I’m sure I’m a bit dim, but I’m not sure how you can interpret the rules here.

I can understand that when the VIX has made a recently large move one way or another that it will offer a trading signal; especially in a ranging market. But I see no clear rules for the middle of the road.

For example, on 1/28 the VIX extended and then tailed. This was a clear sell signal. Now, however, the VIX appears rather neutral. Prices could pull back to the upside. The last couple of days could be a bear flag and as such bullish for the market, or the pullback that “could” happen might just be a temporary bump in the road to lower prices.

IOW, I see no advantages here either way.

@Don… Yeah, you’re right, the VIX is not the best tool to use when you’re in the “middle” of a market, especially for swing trading. that is why in the past few weeks I switched to using the VIX for day trading the news because there is fear and greed, even during the day. as for swing trading (longer holding periods) the VIX has been range-bound and quite tricky in January, hence I’ve been keeping swing positions very light and holding periods very short (see my Poker Analogy = no edge for bulls or bears, ie, need more “cards” to show). This is similar to what happened in December when the VIX lost power above 60 as volume evaporated from the market (although that is a more sever example).

Notice throughout January there was only ONE TIME I applied the VIX to predict the direction of the market. I stated that the VIX under 40, within 35-38, would be a horrible time to be long. In about 3 days under 40 the market began a serious selloff… the Dow dropped 1,100 points as the VIX moved back above 50.

… even though the VIX hasn’t been quite effective in January (trendless market) on the swing side, it has been VERY effective day trading, as so far, my theory holds true: Not every Vix reversal leads to a powerful market reversal, but every powerful market reversal is proceeded by a Vix reversal. Knowing that can give you considerable advantage.

Right now the market does not want to go anywhere, so, until we get a trend moving, then it makes little sense to use the VIX to time a trend reversal if we don’t even have a trend! lol.

Not a fan of the VIX ETNS, but I sure will start a study on them. who knows, maybe I’ll like them.

Oh, i just realized, there were 2 times I used the VIX to time swing trades. the other time was to spot EEV near the bottom (bearish).

I’ve said it before, I’ll say it again — Gio is kickass, and mercs the enemy deftly, like the ninja.

stupid cardinals.

Hey Gio what happened to BJ Penn saturday?

Loser!

I think it would be cool to find a trading strategy that actually included the new VIX ETNs!! … and who better to come up with one, but Gio!

–joe

Remember: FAZ party is above VIX 44.