What in the world was that close?

Wow, sorry for these late posts. I’ve been getting a lot of questions about the VIX lately and with my schedule right now I haven’t been able to answer most people’s question.

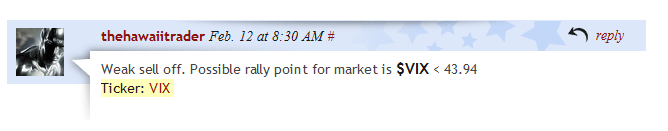

Here’s today’s close, with the market squeezing after the VIX reversed at 46.80. Notice the breakdown in the VIX right at 44.54, I actually had that as my “rally point” in the market, but the market was already rallying at that 46.80 reversal. That was all hindsight, but I’ll take you through my thought process intraday…

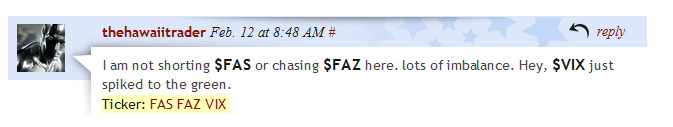

One nice lesson we had with the VIX today was that despite the market being down -2% (about -200 points) I felt the sell-off was weak. I even warned intraday NOT to short FAS or go long FAZ (I was looking like a fool when the Dow dropped another 40 points, but I still didn’t believe it).

Why did I feel not to chase bears? Simply because the market down that much today while the VIX was barely even green! That’s nonsense. A market sell-off needs volume + panic, otherwise it is what I called or describe as a “trader-controlled” tape. In other words, KEEP THURSDAY’S TAPE in your archive and recognize these unusual and backwards patterns because they are rare and could hurt you if you get caught trading them. For example, compare today’s tape against Tuesday’s selloff. You will notice Tuesday had a “proper correlation” with the VIX spiking up while the market tanked. Today we had the VIX gapped up, but trickled down as the market went down… total imbalance! This was a “weak sell-off”. Even the leverage ETFs fell for that trap as I saw with irritation FAS down -14% at one point. I don’t know how else to explain it, but try to imagine the entire market as one individual stock and then you’ll probably see where I’m coming from.

… I was pretty close. I called the sell-off weak when the Dow was down about -180 points. 43.94 was within the VIX spike down. However, the true rally point was a reversal at 46.80 (see chart above). At least I was looking in the right direction.

The cool thing about this was that I went through the day knowing that the selloff was fake. I mean, just knowing and understanding that gave me a huge edge. I’ll admit, I didn’t ride FAS in that end of the day rally, but I also didn’t try to short it or buy FAZ earlier in the day for a daytrade. I think many technical traders would have bought FAZ on that “breakdown.” However, at the end of the day, we squeezed and that caught people off guard. I was NOT off guard because I trusted the anti-pattern in the VIX was telling me something was not right. So I made no trades on the short side.

I think Chart Addict refers it to a WTF pattern. Well, that WTF pattern was basically the market “re-balancing” itself.

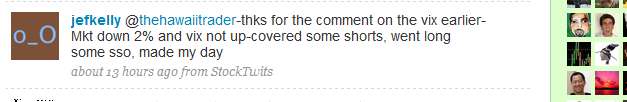

And as always, even if I didn’t make money off a call, I’m happy if someone else can.

Hey, that’s great! Eventually I hope you all can figure out this VIX business, or at least create your own feeling and sense of it. I mean, I would rather show someone how to use a hammer than go out and hammer every nail for them. And let’s face it, do you really want to hold the nail as I’m hammering away? Lol. I’ve hit my fingers a few times.

I know there’s a lot of new traders out there, so I’ll remind you once again, as great as the VIX is, there are some tapes that it just won’t work. So, be flexible and dynamic in your trading strategy, adjust when needed and learn how to use different indicators for different scenarios/environments; oh yeah, and keep it simple. Now that’s easier said than done.

A hui ho,

-Gio-

(“until we meet again”)

If you enjoy the content at iBankCoin, please follow us on Twitter

some babe on CNBC 10 minutes ago was chatting about the dynamic of VIX being neg correlated with the market, to soon be changing.

kayden,

slightly loud-Storm

Funny how GW (his post around the time) and I were concerned about the VIX, the panic that wasn’t there, and the low volume in the selling pressures.

Schedule????

Come on.. You guys don’t have schedules in Hawaii.

Yes we do.I’m scheduled for the beach at 11:30 am.