Right now, you really have to approach this market like a military General. It’s a battle out there, and you have to pick and choose which battles you want to fight. I know a lot of you out there are feeling like me… afraid to click the button. But looking back at yesterday’s meltdown, it happened “on the news.” What a lame way to selloff. We should get back most if not all of those points. Or not. Again, pick your battles!

I outlined yesterday a scenario that I would like to get, and I’m getting closer and closer to taking a shot at the bears. So far, we have scenario 1 playing out (this is why you blog, or take notes, so you can go back to them and see how to attack back):

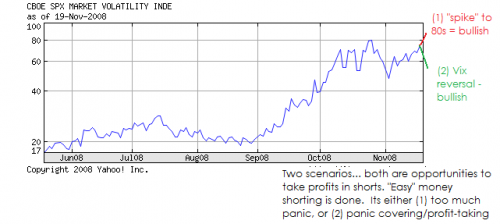

Right now the Vix is following the red line, and this is my strategy there:

(1) Vix spikes showing more bull panic: We already had one “vix spike” that occurred on 11/05 – 11/06 which was a jump from 47.11 to 64.78 (a 37% spike). Tomorrow, I am hoping we gap down a little so that we can get that second “spike” to the mid 80s. That would mean +20% move in the Vix in 2 days. That would be a great spot to get long or hedge your shorts, aka “buy the panic.” [http://ibankcoin.com/gioblog/?p=2346]

… amazing. That is exactly what happened yesterday, but unfortunately the Sisyphean Bulls decided to roll the boulder up +140 points and mess with my scenario a little. And as we all know, Paulson came, opened his mouth, and kicked the boulder right back down. But at least we have Vix @ 80. This is VERY VERY fearful guys. Its almost as if 95% of the community is betting on a complete collapse of the American economic system. I would like to think it is a little stronger than we give it credit for.

There’s two problem with the Vix though. First, intraday, we got our 80, but we got it twice. Once on the morning gap down, and then later in the day. That tells me the Vix still can go a little higher from here, maybe 85 or (and I sincerely hope it doesn’t) to the 100s. I do not know what problems a Vix100 could bring to the entire investor community. Second, if we add yesterday’s move up + today’s move up on the Vix, then we have a “spike”, however it was a weak spike. I would have liked the Vix to just get it over with and hit the high 80s. Again, what a Vix “double spike” means, is that the investor community has acquiesced that the market is going lower, and that fear is more thorough (an “confirmed fear” in my eyes). Therefore, what we can draw from this is that it is NOT a good time to enter new shorts here, and that profits in shorts must be taken (at least 1/2), or at the very least hedged (I mentioned buying SKF puts in December).

So, with that said, I haven’t entered any longs yet. None! Not even in yesterday’s meltdown, mainly because I turned the computer off and went out to enjoy the day with 2 hours left of trading. I am still waiting for mid-December, where I suspect heavy trading will take place in anticipation of quadruple-witching day. And so, I will only nibble on longs whenever I see a good entry. Right now, its clearly the winning trade to be short, but with the Vix between 80-85, is not a good time to short. I said that already.

I wish I stayed to trade the close, but maybe leaving that day might turn out to be a blessing in disguise. The only thing I did enter was starting a shorting position in some inverse ETFs. I tell you, they really hurt me. I went from +5% to -15% in a matter of minutes! Wow! … but I take this as a good thing though. It’s good to be in the middle of the battlegrounds, to get cut up a little, because now my senses are up, and I’m working hard to find a good setup, like a sniper in the trench. It kind of forces me to be alert, and search for good setups, the ones that you will kick yourself if you missed them.

See you on the battlegrounds!

———-

Aloha to my new twitteraddicts!…

| Skyb0x

|

||

| PiterSwenson |

yup, i almost sold on the Vix 80 at the close… but i got caught up looking for more data to prove i should ride this thing down further.

i, like yourself have missed many closing day trades because of “more important things”. And so, in a sense missing these swings (collapses) is tempered with a good day doing other things.

i plan to get out myself and find a new position come monday. The weekend might bring bullish news that will totally smack the bears, but will provide yet another shorting opportunity. Theres a slew of bad news coming next week as well…

yup, i almost sold on the Vix 80 at the close… but i got caught up looking for more data to prove i should ride this thing down further.

i, like yourself have missed many day closing trades because of “more important things”. And so, in a sense missing these swings (collapses) is tempered with a good day doing other things.

i plan to get out myself and find a new position come monday. The weekend might bring bullish news that will totally smack the bears, but will provide yet another shorting opportunity. Theres a slew of bad news coming next week as well… housing, consumer confidence, job claims… yada yada yada

Do me a favor guys…. next time Paulson decides to speak about our economy, let me know. That way i can clear out my portfolio. One would think this guy is more powerful than Bernanke right now.

Gio,

What do you make of this mega gap up. Kinda puts a dent in the gap down scenario and now we are faced with trying to initiate shorts with this pre-market shenanigans or chase the long side. Of course the latter has been a losing proposition thus far.

Thanks

Gio,

$BPNYA has worked like a charm to go long at these levels.

http://stockcharts.com/h-sc/ui?s=$BPNYA&p=D&yr=1&mn=0&dy=0&id=p53880483647

My two inverse ETFs I shorted arre now green. Lol. HOw’s that!… -400 Dow = EEV -15 points, Dow +0 = EEV – 15 points.

EEV and FXP

… I will sell EEV this morning and buy back later. Right now these inverse ETFs are overpriced.

Covered EEV @ 109.6. Shorted @ 112 yesterday. Lol.

Hey iBC peeps

If you havent heard already…

HTX has an awesome dividend that will on December 2. $13.55/share… However, you must be an owner of it by November 25…

So, there you go… There’s my contribution in the face of volatility…

And i bought some puts to protect the actual stock…

Hey iBC peeps

If you havent heard already…

HTX has an awesome dividend that will pay out on December 2 or 3. $13.55/share… However, you must be an owner of it by November 25…

So, there you go… There’s my contribution in the face of volatility…

And i bought some puts to protect the actual stock…

stucktrader: because it is a special dividend, the effective strike price of the option will be adjusted downward by the $13.55 dividend amount.

Basically, this adjustment occurs with any special dividend of $0.125 or more per share.There are some twists to the rule, but the $0.125/share guideline is good enough.

Stuck… 13.55 per share? how is that possible?