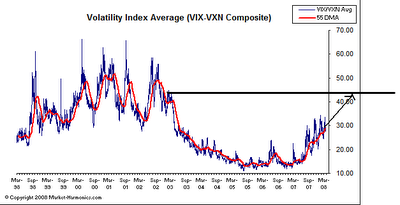

Fear fear fear fear fear fear. I’ve been waiting for this setup:

1) a break above 35 resistance

2) a “double spike”, where “spike” = > 12% move. One from 26-32 = 23% spike, and one immediately from 30 – 36 = 20% spike. That leaves you with a total move of 38% in 3 days (wow!), and a staggering 94% jump from the September lows. WOW! This is epic fear fellahs.

How to read this? There are several points and theories to consider:

- First, remember a real bottoming process takes weeks, perhaps months. I manage a number of SEP retirement accounts and a lot of these people are foolishly and desperately closing them out. It will take a few weeks before the last of the rats jump ship. I use my own clients as an indicator… how evil!

- Second, the talk of fear in the media has reached very high levels. I want them ALL to say uncle.

- I tell you this, pretty soon the Inverse-ETFs will become a better indicator than the put/call ratio. Well, maybe not better, but at least a strong contrarian indicator. You heard it hear first.

- Every Vix double spike does NOT lead to a bear market rally, but almost EVERY super bear market rally occurred after a Vix double spike. Its a probability thing.

- A bear market rally is very near, and my numbers point to tomorrow (Thursday’s) final hour of trading as a good place to look. Therefore, it would be MORE BULLISH for the open with a large gap down, to give the market a chance to fill the gap.

- In my plan, I always had Vix40-50 as the ultimate bottom. But lets say the “next double spike” above 40.

- How to trade this? Ha, I knew you would ask… a Vix double spike means nothing more to me then: Do not short here. Cover your shorts if you have them, the “easy” money shorting is done. Sometimes, it will mean more… if VOLUME increases on a double bottom on any of the 3 major indexes, then I will get long or short an imbalanced inverse ETF. Oh yeah, I always go into the day thinking the scenario will NOT play out. That way if it surprises me, then I’ll make a move. Given the current economic status of our country, we could very well continue to fall… but I like the chances for a wall of worry here.

- Hence, I will wait for first, an intraday reversal, and maybe if there is follow through, I will play a multi-day squeeze.

Hope that helps! Remember, Vix is relatively low right now. To keep things in perspective, I posted this in March at my old blog:

whoa… http://biz.yahoo.com/ap/080918/eu_central_banks_dollars.html

“The European Central Bank said that it had joined with the Federal Reserve, the Bank of Canada, the Bank of England, the Bank of Japan and the Swiss National Bank to pump more short-term dollar liquidity into the financial system.”

… Swiss National Bank?! What the? I thought every franc in Switzerland was backed by gold. Global panic. Lets see how this will effect the Vix. IS there a global vix?

Hahaha. Funniest headline on Yahoo Finance tonight:

“Bush cancels fundraising trip to deal with economy” (http://biz.yahoo.com/ap/080918/bush_markets.html)

.. I was imagining him skipping a girl scouts car wash event to go pick up trash on the beach a few minutes before a tsunami.

Gio, does yr vix chart take into account the fact that pre 2003 the vix was measured by using the old S&P 100, back then it was called the vox and post 2003 the vix used the S&P 500 making the vix also less volatile. so, yr chart above may be misleading and you might have to add a significant % to the post 2003 readings to compensate. no doubt there must be more details about this somewhere

Look at fucking HANS ! thanks GIO !

what’s with the ibc website? All the writing is broken up with ” _LongTerm_” Better get your IT guy on the case.

In the “long_term” that “Long_term” stuff won’t happen.

I think fly uses this site _long_term_to figure out subconscious patterns in the commenters to get a feel of overall market sentament….. then it spits out whether or not each statement represents a long_term____—__ or short term trend, and up or down. For some reason, rather than transmitting the info to his IBC machine, it spit out the info on the IBC site.

There was some real “web bot” that apparently could interpret market senatament, but it still came out unscrambled but still slightly scrambled.

This “web bot” also said 2012 was armagheddon or something.

I don’t see the LONGTERM stuff that was up there before… either got fixed, or maybe it only shows up on iphones

lol

your comments are as gibberish as trying to read what’s written on this site when the dialogue is continually interrupted with the “_long term_” insertion virus,

If this is a rally or bounce, it is weak. Look out below.

This post will go down in history. Whoever stumbled upon this fell into loads of profits. 😉