First and foremost, if you own shares of “Ti-met” please click here. That’s right… +10% in two days! Anyway, I’m “cashing out” Pacific Ethanol today, so I’ll keep the current return logged for performance purposes. Too many insiders are selling, maybe they think it’s overbought. Pacific Ethanol is one stock that made my Momentum Trading Screen, check them out below!

Market Summary

Well, it’s Monday and here’s a market summary and articles I’m reading. Very intriguing stuff:

- Signs that Real Estate is starting to,

, slide. - Want to buy gold? Wait for a correction in commodities.

- Rambus pulls a RIMM, in news and stock price.

- A very very very very very useful market snapshot site.

- People to watch this week, and of course, watch their stock price too.

- The dollar is a piece of junk. Thursday Bernanke speaks, and the market will respond.

- One of the best ways to screen for stocks is to let the pros do it for you. Check this screen by IBD, for highest rated stocks w/ low P/E ratios– “cheap companies”. Hey Gary, notice how Goldman Sachs and Valero are there, while for me, Chaparral Steel picked up #6.

- Why I am bullish on ethanol in the long term.

- Travel Zoo simply amazes me.

- “Guidance” could seriously hurt steel stocks, like TIE, CHAP, and most definitely ATI. ATI reports this Wednesday, 4/24.

Momentum Trades & Swing Trades

Here is a list of stocks with tech analysis & buy and sell points. These are short term trades (1 day – 2 months). You can ride the wave, or swing trade.

Chinese Medical Technologies (CMED)

On its way back to thirties. Reaffirmed impressive guidance. Volume will pick up.

Buy Target: < $26.39

Sell Target: $29.29

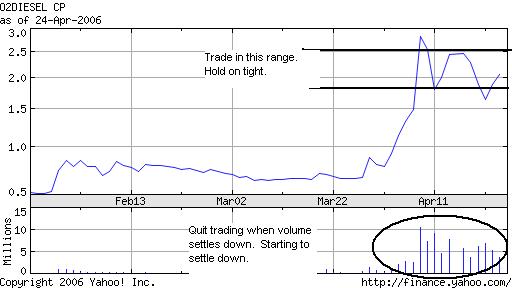

O2Diesal Corporation (OTD)

Ever since their huge contract with the Department of Defense, this stock has been a swing trading favorite! Should be a good week for this stock.

Buy: < $2.00

Sell: $2.47

Ballard Power Systems (BLDP)

Another alternative energy stock. Very abnormal trading volume. Other pullback candidates include Hawaii based Hoku Scientific (HOKU), day trading victim Fuel Cell Technology (FCEL), and fuel cell stocks Plug Power (PLUG) and Hydrogenics Corp (HYGS). All have risen because of “Earth Day” this past Saturday. How in earth did we miss that day?!!

Short: > $12.50

Cover: $10.85

BE Aerospace (BEAV)

First quarter profit triples?!! Wait for the market to catch on. Wait for a Cramer Pump.

Buy: $29.00 – $30.00

Sell: $33.35

Sun Microsystems (SUNW)

CEO steps down, stock steps up. Investors thinking “fresh start”, perhaps a “fresh breakout”?

Buy: $5.00 – 5.20

Sell: > $6.00

… that’s all for now. Wow that took a while to do. Other stocks that have momentum power are Pacific Ethanol (major correction coming!), Alleghany Technolgies (looks like a sell off before earnings is brewing), Ameritrade (beats expectations, but stock gets beat down). If you spot some swing trades, please email them to me. For momentum trades, in addition to having abnormal volume, I like stocks that have:

1) huge news in the sector

2) huge news for the stock (good or bad)

3) heavy insider buying