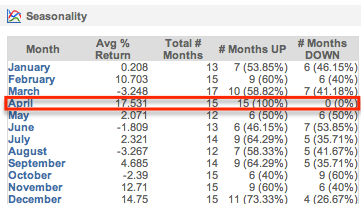

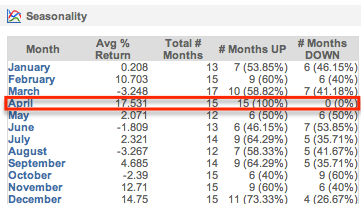

With less than two weeks to go until April, consider this a heads-up about one of the best seasonality plays I can find inside The PPT algorithm. Biotechnology firm Medivation has been up 100% of the time in the month of April, with 15 data points to boot. This stock has been a monster in recent years, as the first time I brought it to your attention in 2011 it was trading at $17.02, and is now at $45.05.

Beyond that, the average return for this stock in the month of April is over 17.5%. The evidence is right here, via screenshot courtesy of The PPT. No losing April’s for MDVN.

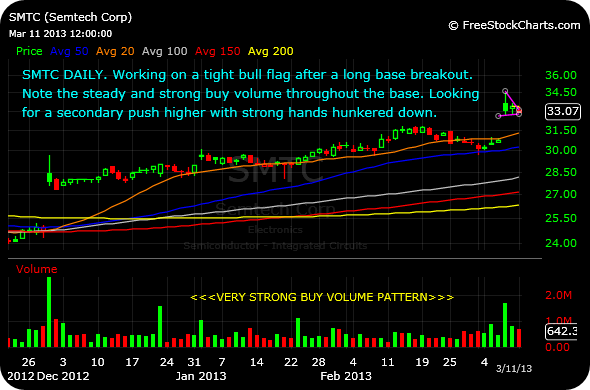

Furthermore, observing the daily chart below we can see that the stock has been struggling of late, in a clear corrective pattern since early-February. However, the stock gapped down on Monday and then reversed higher for a reasonably strong close.

In this context, after a downtrend, that candlestick for Monday can be seen as indicating an imminent bullish reversal; a hammer, hammering out a bottom, if you will.

When you couple this technical setup with the looming April seasonality, Medivation becomes an intriguing play to watch going forward.

_______________________________________

Comments »