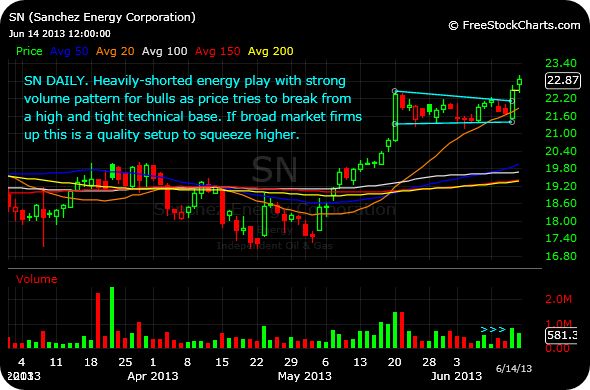

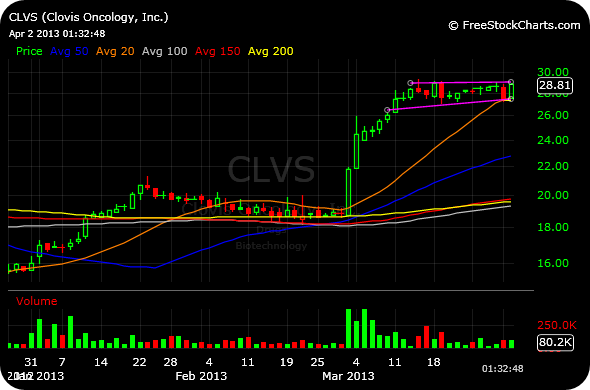

If the market is going to immediately recover from last week’s selling for a thrust higher, then you can expect leadership to almost assuredly be far more pronounced that what we have previously seen in 2013. The many breakdowns we saw likely need time to heal, though some appear close to a tradable bounce.

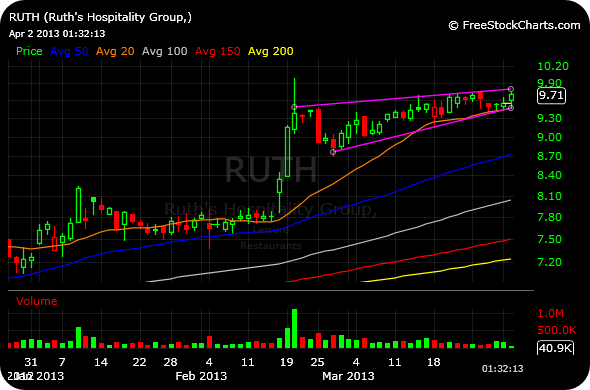

In the event of further resilience on the part of bulls, consider the private equity and asset management firms. Blackstone appears to be taking on a leadership role of sorts, while the other related firms charted below all printed potential bottoming candles on Monday, in the form of a “hammer.” Keep in mind, a deeper broad market correction would easily render those hammers to be merely a short-term bottom for perhaps a few days, rather than a durable low for weeks or months, even with immediate upside confirmation.

In other words, we are still not out of the woods.

_________________________________________

_________________________________________

_________________________________________

_________________________________________

_________________________________________

Comments »