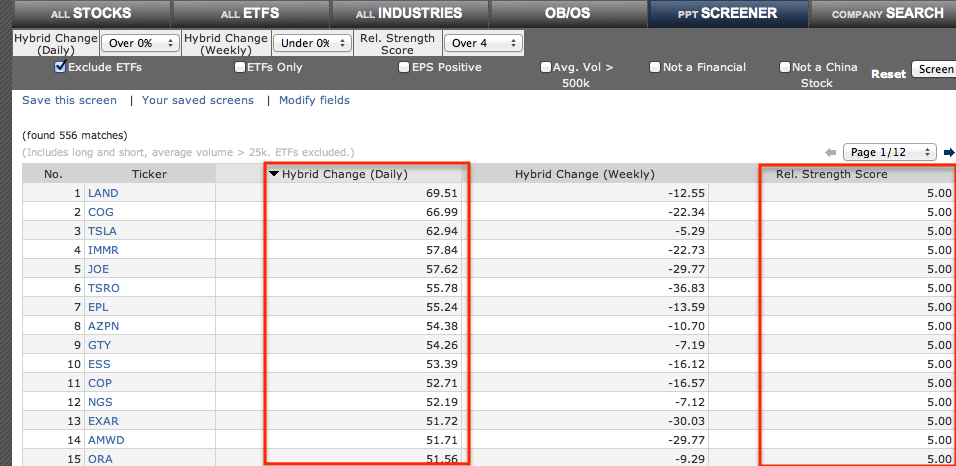

My “12631 RELATIVE STRENGTH” saved screen inside The PPT algorithm seeks to identify stocks which have seen a surge in their respective PPT Daily Hybrid Scores (combination of technicals and fundamentals) while suffering a negative Weekly Hybrid Score from the past several days of trading. In essence, this amounts to a positive divergence which, when cross-checked with the 12631 way of filtering stocks through human technical analysis, yields a focused and cogent list of issues emerging from consolidation or turning back higher after a recent pullback. To put the icing on the cake, I filtered the screen to make sure all stocks had a very strong Relative Strength Score (according to The PPT algorithm).

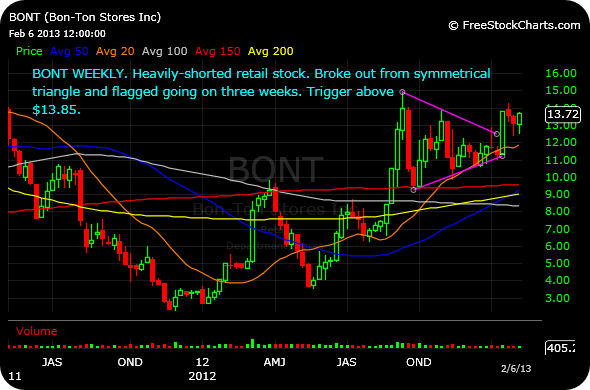

Here are tonight’s top fifteen results, with some quality charts there to have in mind, should the market’s bullish theme continue.

Members of The PPT and 12631 can click here for the screen.

(Click on image to enlarge)

Comments »