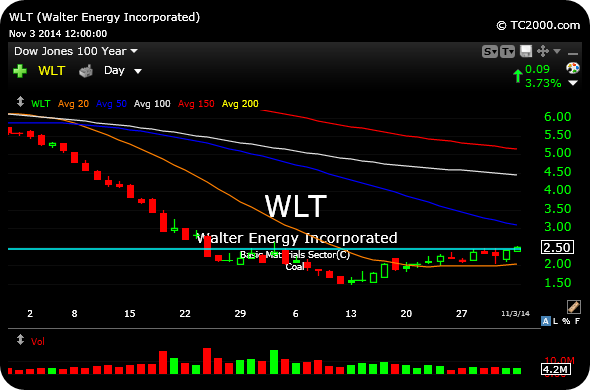

With a prospective political win coming today, coal may very well stage a snapback rally, now that everyone has assumed the industry is finally dead.

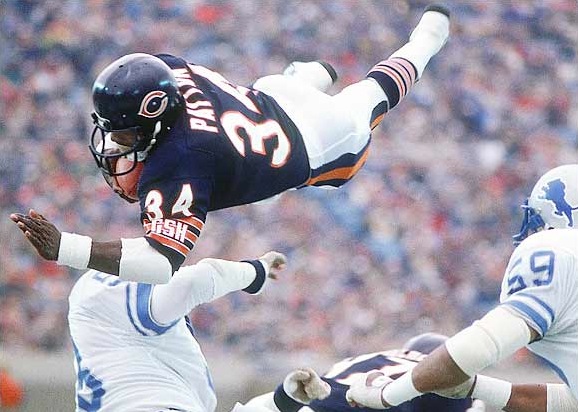

Walter Energy, not related to the above-pictured Walter Payton (“Sweetness), is as viable as any of them for a squeeze higher from beaten-down conditions.

I am stalking it on any further strength as a long.

__________________________________________________________

Comments »