“Waiting it out” is an interesting phenomenon in a bull market, as the stigma of sitting in cash is often seen as a worse investing/trading sin than suffering large drawdowns during corrective periods. I suppose if I actually cared about stigmas to the point of letting it affect my decisions, then my trading style would be different. But, in the end, speculation and gambling are inherently individual sports–You do what works best for you and pay no mind to just about anything else.

I am not inclined to chase much of anything higher here, despite the potential for a further melt-up next week. In my view, this type of price action smacks of the final stanza for a mature bull.

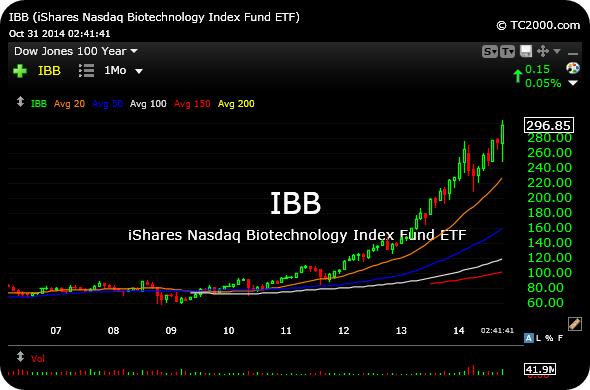

The biotechs largely have kept me out of trouble on the short side, with their inability to reverse lower in recent weeks being my “tell” to not become a gunslinger with shorts, just yet. Today, however, biotechs are lagging a bit.

More importantly, though, the monthly chart for the biotech sector ETF is going out for the month of October printing a massive candlestick after a very steep uptrend. Typically, this does not bode well going forward the next several months, as the wild price swings amounts to violent indecision with bear slowly creeping back into the market picture. Then again, this market has been atypical and we know anything is capable of happening.

I will run through the rest of the market with an objective eye, as well as talking through actionable trading ideas and price levels to watch, in my Weekly Strategy Session this weekend.

_______________________________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

Well played. I jumped the gun. however I had to the odds of big price move down were too large. I am not covering yet as my downside is defined. The CBs saw the same set up and they are scared. This is a coordinated effort. Both shorts and longs should be very careful.

Biotech is relatively weak today no? GILD gapped up and faded badly, CELG too.

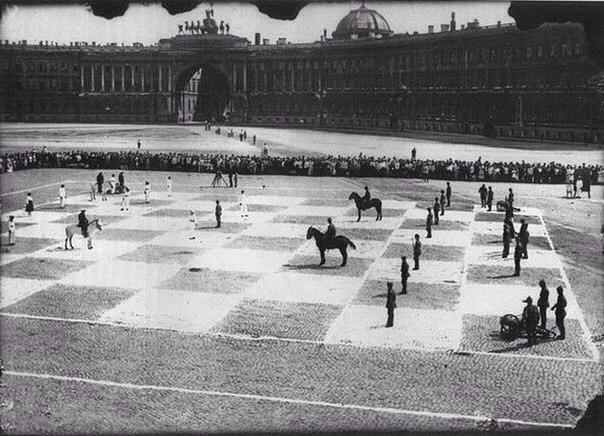

Chess – I’ve come to appreciate this very concept that you’ve been trying to teach me for years. It’s just like your strategy of hustling the poker marks only after they were drunk & tired. Take the play where you have an advantage. Until then…. wait & formulate.

Hi chess, do you think TWTR Is worth dabbling with down here? Thanx!

A little FYI, big money is position in the Healthcare sector so…

Past couple of years has made the buy and hold strategy look like the right one versus trader, when you consider the expended time, effort, and distraction of a nonsensical market.

I buy VTI on dips, the mgt fees are cheap and all I have to do is to pay taxes on DIV and INT. And I see no reason to be sitting on the sidelines here, the market is healthy.

Chess – I’d love to see your current take on the Sotheby’s Indicator sometime. Maybe the WSS?

Will try to do, Unc

You’ll probably be on the sidelines for a while. The markets are now parabolic state something can continue for some time. Even more so when combined with CB manipulation.