In addition to the chart on the shallow broad market corrections (even for bull markets) we have seen in recent years, @johnkicklighter on Stocktwits presents yet another one.

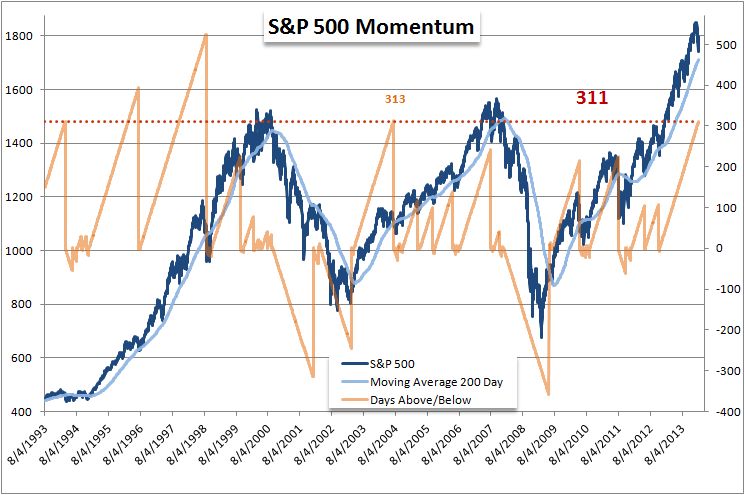

Here we can see that as long as the S&P 500 Index does not drop 87 points by this Thursday, we will beat 2004 bull streak of 313 trading sessions above the 200-day moving average.

I have discussed the abnormal length of this rally above the 200-day moving average for a while now. And hopefully this chart puts it into perspective.

What say you? A surprise failure to break the streak? In the bag?

If you enjoy the content at iBankCoin, please follow us on Twitter

There’s a feeling that no one is fully invested. That everyone is still cautious and fearful of another 2008 crash. If this is true we’re in for a shallow correction, if not… Volume feels light, but it also feels like the bulls won’t be buying in size, so this leaves the market to stew in bearish sentiment – while we trade higher and wait for the bears to mature – which doesn’t seem likely.

Good job using many words to say nothing.

The Box is rocking the just say no to grey club this morning. Multiples of 90’s talking heads. These old people have not been on the tube for months if not years. Wtf?

“TEAM” and “5 Things”. Crazy old people.

I’m seeing some retail investors both afraid to fully invest (as they feel they will get burned again) while others are in the most obscene investment vehicles imaginable… interesting dichotomy

Then attention will be focused on the 1994 record of 362 days, then to the 1996 record of 382 days and finally to 1998 record of 524 days.

“Money on the sidelines” and “underinvested” is PURE BS, there are no investors with $460 BILLION MARGIN DEBT, actual “invested” cash net is NEGATIVE backing out sweeps, mm funds, etc.