Interesting look here, courtesy of The Economist’s Daily Chart.

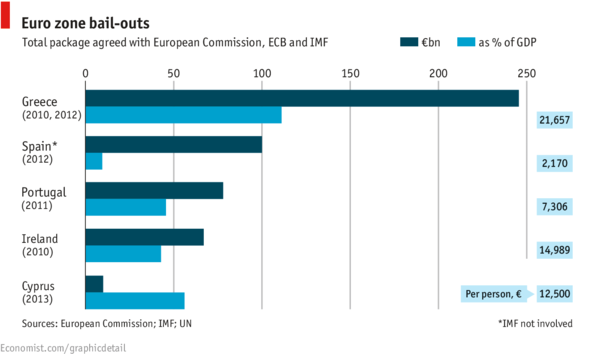

If you enjoy the content at iBankCoin, please follow us on TwitterTHE Cyprus bail-out package agreed on March 25th between the European Commission, European Central Bank and the IMF is the fifth euro zone rescue operation in three years. At €10 billion ($13 billion), or €12,500 for every person on the island, it is tiny compared with the previous deals in Greece, Ireland and Portugal, and the partial bail-out for Spain’s banks. Greece’s two bail-outs together amounted to €246bn, more than 110% of its gross domestic product. But the Cyprus deal is the first to impose a levy on the country’s bank deposits: all those over €100,000 will be hit. One thing certain is that the island’s financial woes are far from over. What the fall-out will be for the euro area, however, is less clear.

the u.s. did the same thing, but we just printed more money, the fall out has (also) yet to be seen.

Absolutely gun-to-the-head suicidal, on multiple fronts.

Never mind the fate of the island’s banking system, but how would you like to work for a Cypriot bank with the place crawling with p-ssed off, digit-relieving Russian gangsters?

____________

Confiscating people’s capital, even on a samll scale at this point, opens a new can of worms. If it’s “successful” it can be applied to other nations and bigger situations.