I have seen much discussion of late about how the bull market has been going on for more than four years now, so any strength we see simply must be a bull trap. The more people look at a monthly chart of the S&P 500 and see the prior 1500-1575 all-time resistance from the 2000 and 2007 tops, the more expect that area will be a brick wall.

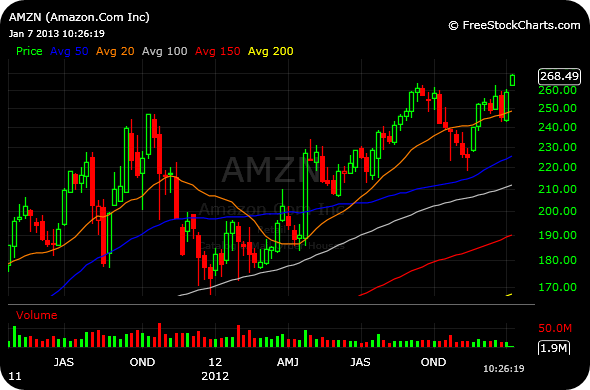

I do not necessarily dispute that view, though timing does matter. The fact is that top-callers can go many quarters before they are proven correct, during which time the market overshoots dramatically. The poster child for that thesis might be my current 12631 holding, Amazon.com. The stock caught an upgrade this morning an is popping over 3.5%, giving me a nice way to start off the week.

Amazon is a hated stock by many traders driven by fundamentals. They simply cannot accept a stock trading with such a high multiple. Such as value investors chased the shippers all the way into the low single-digits over the past few years, so too do they short Amazon because of a disconnect between the market’s pricing and their financial models.

Once again, eventually they will likely be proven right. I expect Amazon to eventually became a stodgy large cap firm which becomes a value trap after undergoing a dramatic correction. The issue comes down to timing, as it always does. Amazon (and the market) could top out this week, this month, or this year. But until it shows some actual technical evidence of doing so, I am going to play what I see, not what I think should be.

______________________________

If you enjoy the content at iBankCoin, please follow us on Twitter