This note is to Janet Yellen, her other Central Bank Proxies and you my fellow investors.

We have what looks like a left translated intermediate cycle top unfolding. Rather than bore most of you with what that means I will be brief: It is very bad and means the market should fall apart here and correct. It should take out the December low and then some. However, I am a suspicious man and I also believe that Janet and her cadre of traders and technicians see this set up as well. If they were to act to erase this set up they need to do so soon. I expect a few well timed phrases and perhaps some rapid fire E-Mini Futures buying via a proxy either tomorrow or Thursday.

The invisible hand is no longer invisible. I see you Janet! Make your move! However, if you intervene and the rally fails to stick then you have lost control. If you do nothing then we know you are finally letting this market go. If you succeed in your meddling then we shall be seeing this same scenario playing out again in a few weeks. It looks like we are getting close to forcing your hand. Let it fall and be free of this burden or announce QE4 too soon and risk the dissolution of your institution by having to explain to a Republican Congress why another QE was needed if the economy was so good.

As I and others on this site have mentioned recently the only play here is to be short until the market is much lower and Janet has cover and more data to announce QE4. Then get long for one last hurrah.

The market forces of deflation are finally forcing your hand Janet. How are you going to play this? We see you Janet!

Comments »

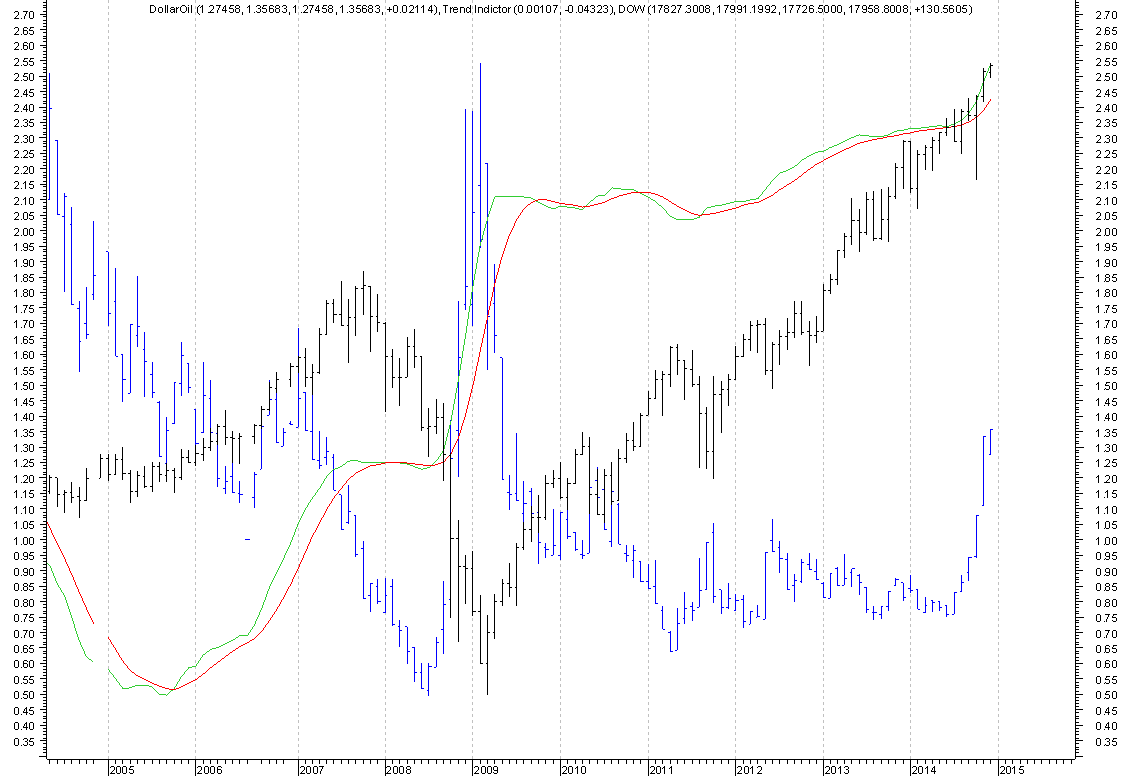

Tonight it looks like the oil market wants to retest the $64.38 level which is the 61.8% Fibonacci support from the 2008 low. We tested it last Monday and it bounced but it has lately slid lower over the last week. If we should take out that level with conviction then we are going to the low $50’s to test the next Fibonacci support.

Tonight it looks like the oil market wants to retest the $64.38 level which is the 61.8% Fibonacci support from the 2008 low. We tested it last Monday and it bounced but it has lately slid lower over the last week. If we should take out that level with conviction then we are going to the low $50’s to test the next Fibonacci support.