I am not going to lie. That was painful. Luckily I had very good timing on entry and somehow I have managed to still be up slightly. I may press my AMZN short. The divergence in that stock from the rally is telling you something. Their free cash flow is a lie and others are starting to catch on. Their recent $6 billion capital raise is not to fund new endeavors like they said, instead they are hemorrhaging cash and those proceeds will be used to plug a hole. Lets start a bear raid on AMZN. Spread the word. The recent divergence is all you need to know.

Now, Let’s have a serious chat. I don’t care if you are a Bull or a Bear but something is seriously wrong with this market. I am not here to be proven right or be a top caller for my own glory. I am seriously concerned that a big storm is coming. The moves in the currencies and commodities are out of this world. And now they are coming to equities. I want everyone to make money but I fear this volatility eventually resolves to the downside in a big way. Last week I wrote about the VIX and that its speed is telling us something is off in the markets. Here is a piece by Jared Dillon about the same thing and since he is an former options trader it should also make you think: http://www.mauldineconomics.com/the-10th-man/may-the-fourth

As far as I can tell, Janet’s testimony should frighten you a lot. That was hawkish not dovish. The Fed is so far behind the curve its not funny. If she was really worried about what is going on she would have said so and hinted at QE4 which is every shorts fear. She seems to be clueless that credit is disappearing into a black hole abroad and that contagion will be coming home soon enough. There was a time when the US could have shrugged off this stuff in the past but globalization and the amount of debt in the system have made this global slowdown very dangerous indeed. Nothing fundamentally has changed. The periphery is a mess and a global margin call is well under way. The next few months will be very interesting. In the short term it looks like we rally but I am very suspicious. Lets see what the next several trading days hold.

Comments »

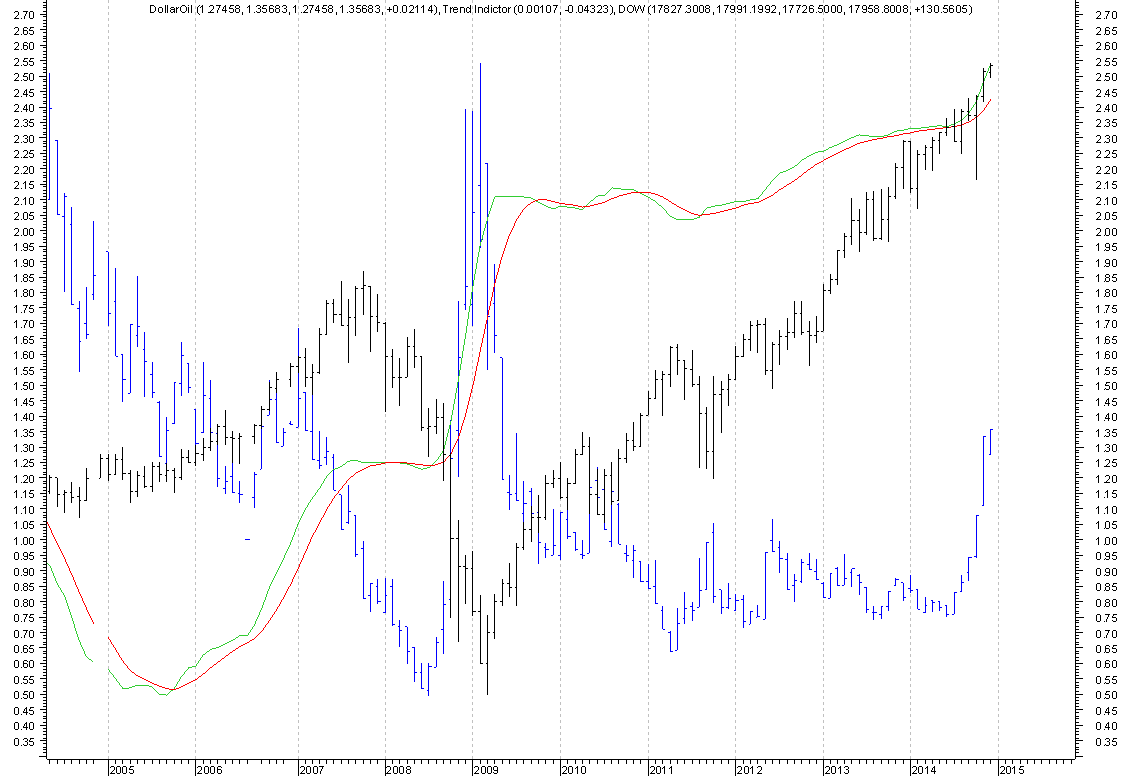

Tonight it looks like the oil market wants to retest the $64.38 level which is the 61.8% Fibonacci support from the 2008 low. We tested it last Monday and it bounced but it has lately slid lower over the last week. If we should take out that level with conviction then we are going to the low $50’s to test the next Fibonacci support.

Tonight it looks like the oil market wants to retest the $64.38 level which is the 61.8% Fibonacci support from the 2008 low. We tested it last Monday and it bounced but it has lately slid lower over the last week. If we should take out that level with conviction then we are going to the low $50’s to test the next Fibonacci support.