I’ve been trading stocks since 2001, right after 9/11. I was nineteen at the time, and was somewhat intrigued by equities. I had no prior Wall Street knowledge whatsoever, but decided to dive head first into the game.

I made a few lucky bets in the beginning, and from that point on stocks became my passion. However, now it is 2009, and the world looks as if it is going to end.

Nobody wants a part of equities anymore, so it seems. But, in fact, this is exactly the time where you can make a few lucky bets. I started this game in a time of travesty, and made a bunch of coin doing so.

I’m willing to bet, had I been involved with stocks prior to 9/11, I would have been scared shitless to buy another stock. The key was, emotions, I had none.

Now maybe this time is different, maybe it’s not. I’m not here to say we are done going down, but I am here to say don’t forget to put away a few names while they’re on sale.

It’s easy to get caught up in emotions when we’re immersed in negative news, but controlling emotions is a huge ingredient to success.

Go into tomorrow like it was your first day trading. What would you buy? Why? After you find the answer, why not buy a little? Odds are your position will be green in a few months.

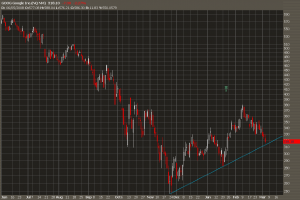

In short, we are closer to a bottom, than not– my opinion. Why not buy something?

______________

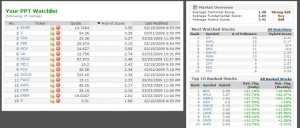

Here is an excerpt from Fly nightly post in The PPT:

“The key to market success is knowing when to go “all in” and when to fold. We are at a time when going “all in” can be an extremely rewarding bet, providing our Government instills an iota of confidence into the market place, which I am doubtful. In my opinion, betting on “it all going down the toilet” is a gamble not worth taking. I much rather be in cash, watching the carnage, than risking my capital into a short squeeze.”

Comments »