The banks got the much needed bounce to start the week as the $XLF, the ETF that tracks the financials, was close to breaking support levels last week. Now the bears get to defend the 200 & 50 day moving average, see below:

___

___

Inside Exodus, our hybrid screen is littered with financials: $GS, $MS, $BAC, $JPM, & $WFC all lead the charge. For a look at today’s full mover screen in it’s entirety, click HERE.

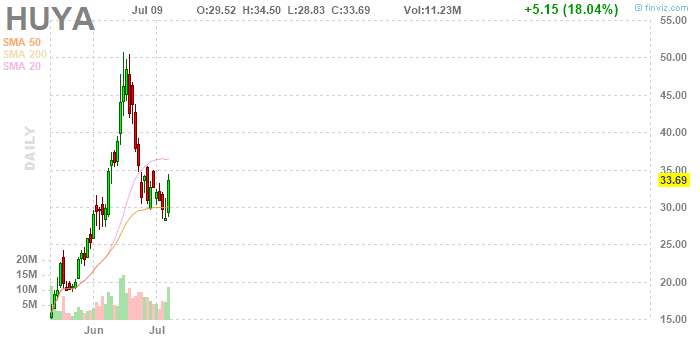

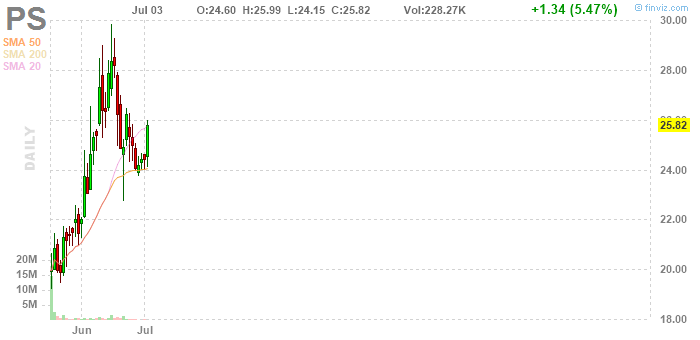

I’ve listed my favorites below, so keep an eye on these as we begin the week:

See you guys at the open…

Comments »

__

__ __

__ __

__ __

__

__

__

__

__

__

__

__

__