Whether you support PPACA (self-labeled by now remorseful allies as Obamacare) or not, I invite you to read this article in its entirety. You see, I actually work in the insurance industry (writing for this site as a hobby), and have worked in the insurance industry for some time and in several capacities (wearing different hats, as it were), including as a risk analysis actuary assessing long term liabilities (reinsurance, IBNR reserves, captive funding, etc) and on the agency side of the health, life & disability industry. And as such, I have knowledge about not just the products at play here, but also how those products are underwritten and the…vulnerabilities…of the mathematics at play.

Naturally, there will be those of you offended by what I am about to write. You will decry my bluntness as needless political trash, unworthy of a finance site. You will pray the Fly and others fire me. But I don’t really care; one of the blessings of a) having actual industry experience and b) a track record with this site of verifiable, excellent investment outcomes is that I generally feel the leeway to stray off the path to say what I want on this subject, when I want.

Obama and his friends are at present on about the fifth or sixth lap of the Victory Tour, and it’s pretty much horseshit. It doesn’t take more than a few minutes to point out why, but I’d rather take longer to really set the concrete shoes before pushing this parade into the water.

So Where’s The Proof?

Our story begins in July of 2012. The Supreme Court has just come out with a verdict that the Federal Government cannot force States to expand Medicaid. This leads the CBO to reissue estimates of the impact of ACA.

CBO and JCT now estimate that the ACA, in comparison with prior law before

the enactment of the ACA, will reduce the number of nonelderly people without

health insurance coverage by 14 million in 2014

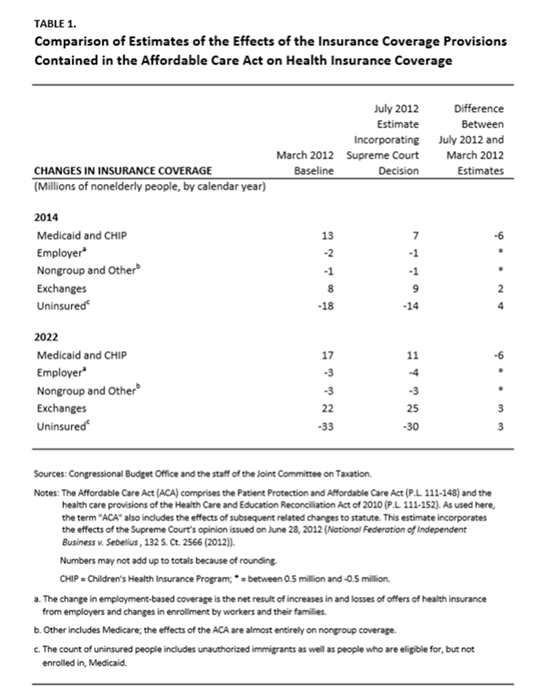

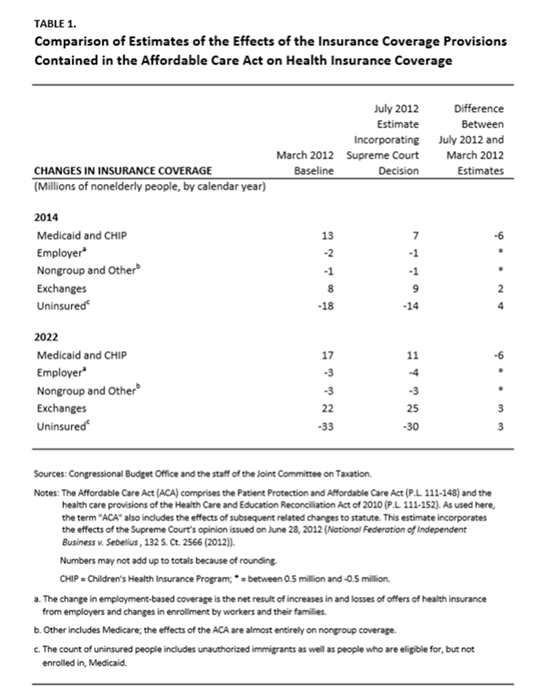

The CBO then issued a convenient breakdown of their assumptions, of which enrollment is contained in Table 1 and Table 3 (pages 18 and 20 of the report).

First, notice two things. When the PPACA law was first enacted, the CBO faithfully estimated that 18 million uninsured would gain coverage in 2014. Following the Medicaid hit, they promptly slashed those estimates to 14 million.

But second, as of July 2012, the CBO was estimating that 14 million uninsured would gain coverage in 2014.

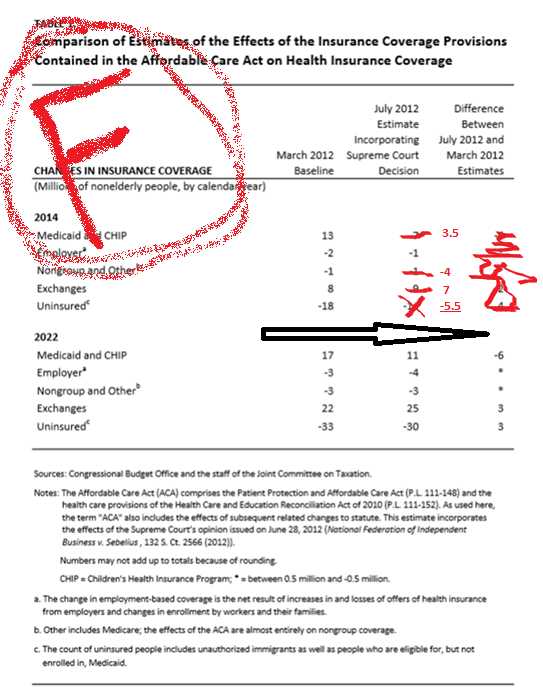

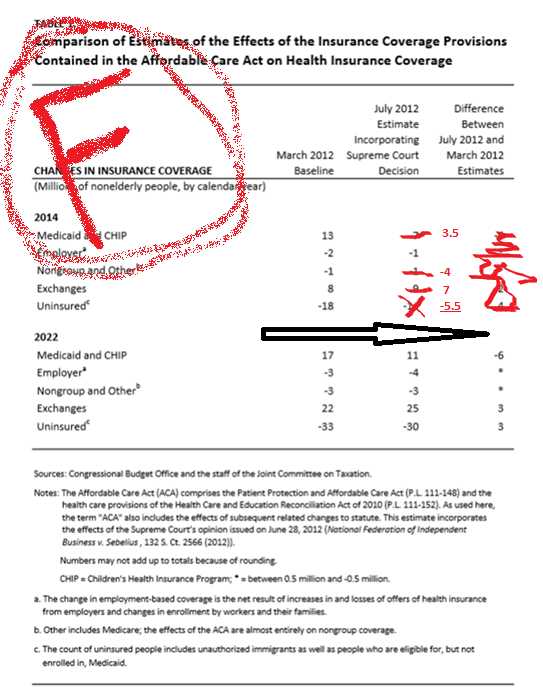

Now, as of today, if we take the administration at their word, we’re looking at 8.9 million Medicaid eligible; but that’s not the same thing as covered, is it. The NY Times reports 3.5 million newly insured under Medicaid. And now, with our fancy new website just crossing the 7 million exchange signups mark, that puts us at 10.5 million (I’m not getting dragged into the enrolled/paid debate, I have no way of verifying those numbers anyway).

So let’s just take this whole process at its word (hah). Original projections were 9 million through exchanged plus 7 million Medicaid, to get us to 16 million, minus a million or two amongst friends, with a 14 million net covered.

That’s the goal post.

So we’re now at 7 million exchange plus 3.5 million Medicaid (Whoop Whoop), but oh, right, now I look at those other assumptions and realize 1) Nongroup and Other (mostly Nongroup) is only allowed to drop by 1 million enrolled in order to stay in line with my projections.

Nongroup being individual insurance market. Individual insurance market being that group that received mass coverage non-continuation notices starting in October. That being the thing that sort of set off this napalm bomb on Obama’s popularity rating in the first place.

“Oh yeah, right”

Based on initial CBO estimates, we’re at insuring an additional +5.5 million people, versus promises of +18 million (a 70% fail) as early as three years ago. Even after they moved the goal post once, slashing expectations by 23%, they still fumbled the piss out of their own enrollment goals by over 60%.

Is this really what Healthcare Reform’s proponents are dancing about? If this were the private sector, entire departments would be getting fired for this.

And More Trouble Is Coming

So what, you ask? The website is working and enrollment is off to a start. It’s all downhill from here.

Too bad that’s probably not the case. Keep in mind that these tits also promised an obscene amount of savings to every enrolled member ($2,500 bucks per person, I believe), suggesting that as much as 30% of all insurance premiums are “fat” (complete bullshit).

But the demographics (which ultimately drive insurance rates) are not looking so hot. The young and invincible have not signed up for insurance.

There is this talking point circling from the Kaiser Foundation that somehow, missing the numbers on youth enrollment won’t be that big of a deal – “We just need healthy people in all age categories” or some such drivel.

Yes, and people in hell need ice water. Or, more politely, “I disagree with the good folks of Kaiser on this.”

Practitioners in insurance understand what happens when you miss allocate young enrollees. You see this all the time when a company hastily offers a pooled HMO product alongside an experience rated PPO product – usually on the advice of some twenty nothing salesman who won’t be agent for very much longer. Because what you get is year over year 20% renewals until the PPO drags the corporate budgets through the 9th gate of the seventh circle of Hell.

The authors of that piece focused on how much more the elderly pay (up to 3X the young’s rate!), while conveniently ignoring that 1) the rate for young enrollees is artificially inflated while the rate for elderly enrollees in artifically lowered and 2) those rate differentials exist for a reason.

Older people consume vastly more healthcare. And, more importantly, the 10% of an insurance population that end up originating 90% of all claims are statistically, overwhelmingly likely to be found in older age categories.

You lose the young, it’s just free money slipping through your fingers. Free money that was supposed to stabilize the premiums.

And Speaking Of Stability

You don’t realize it but the first blow to the program has already been struck. I tried pointing this out to a couple of Tea Party types on Twitter a few months back, to see if they’d run with it. But they weren’t quite smart enough to figure out the point, and seemed to prefer trying to convince you that 100 million people were about to lose their health policies or talking of Reid’s hatred of cancer patients instead (not much has changed).

Back in December, when the website woes were at their worst, and the administration was actively blaming insurance companies for all the problems, they had something of a conundrum pop up – those same insurance companies were completely in control of the fate of Obamacare…and subsequently their accuser’s future.

That puts a guy like Jay Carney in a rough spot, needing to blindly pass the buck and all but risking retaliation from disillusioned insurers. So the Obama Administration did what any good political entity does – they made a trade.

But first, let’s chat about reinsurance. Reinsurance is sort of insurance for insurance companies. It allows an insurer to spread risk associated with one line of business to another entity, in much the same way an insurance company let’s an individual spread risk of specific life events to the insurer.

Reinsurance acts as a “stop loss” (and in self-funded medical circles that’s what it’s known as). Stop Loss/Reinsurance tends to come in two flavors – specific coverage (per individual/claim over the course of a contract year) and aggregate (all individuals/claims over the course of the contract year).

Now, the PPACA has a reinsurance pool. They sort of had to. No way insurance companies were going to be daftly lured into a new healthcare scheme without a backstop. And, it’s important to keep in mind, no traditional reinsurer was going to be dumb enough to touch any of this with a fifty foot pole. Not that the traditional reinsurer’s would have been big enough to do so anyway.

So the government decided to provide the reinsurance. And to fund the move, they added a tax of $63 per member per year (which scales out over a three year period).

That money goes into a giant pot, which covers every insurance company at 80% of any individual claim that exceeded $60,000. And in theory, that pot was balanced based on real claim activity for the $60,000+ layer, plus a margin of error, (plus some leftover slush fund for the sitting committee Senator…just assume it’s true).

So it’s the end of 2013, the website is processing a smacking half dozen enrollments a day, the administration has egg all over their face, they’re attacking people they critically depend on, and so all quietly like, they announce that the attachment point is getting moved from $60,000 down to $45,000.

(Sizzle) that’s the sound of insurance company outrage fizzling out.

Because that may not seem like it, but that’s an enormous giveaway.

Here’s why:

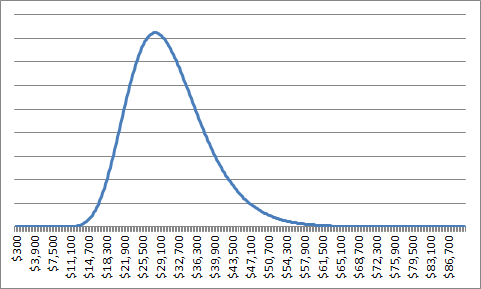

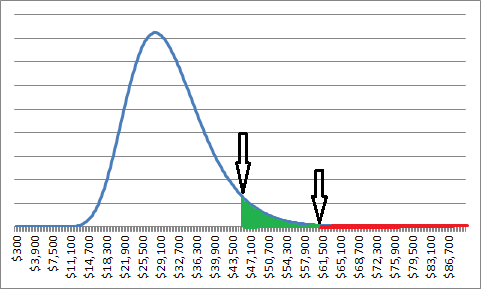

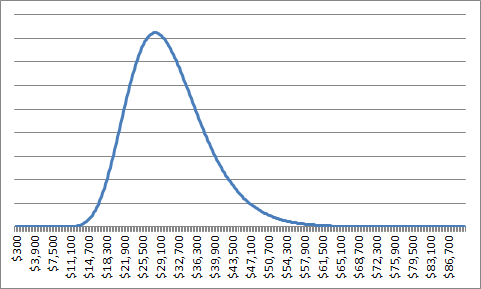

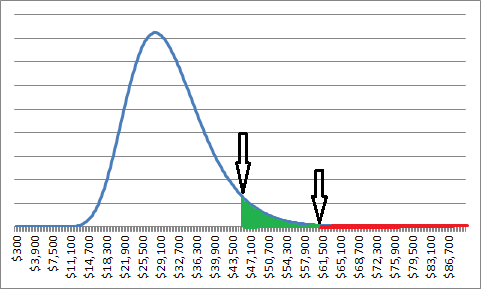

Let’s say that we have claims that occur with a distribution, as displayed above (useless fact: most risk insurance use a log-normal distribution because that offers a compelling fit, with maybe a pareto at the 95th percentile to add a fat tail and keep the reinsurance market solvent/profitable/happy).

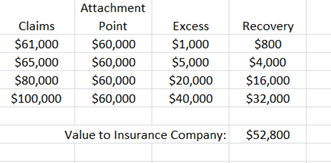

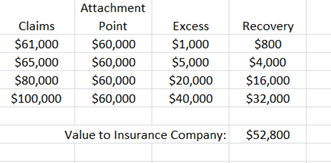

Under the reimbursement method in place originally, once a claim hits $60,000, any amount above that will be reimbursed to the insurance company at 80 cents on the dollar. If I have 100 claims, and 4 of them are greater than $60,000 (let’s pretend $61,000, $65,000, $80,000, and $100,000), then my reimbursement is the difference above $60,000, multiplied by 0.8.

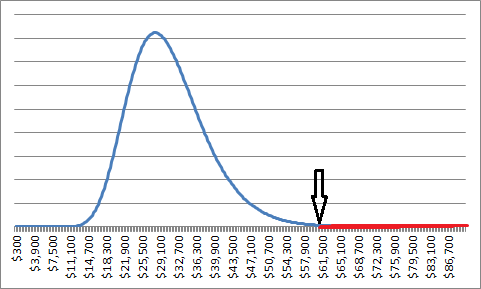

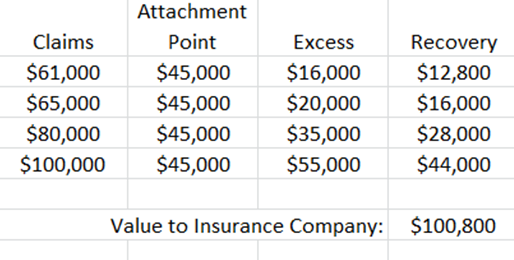

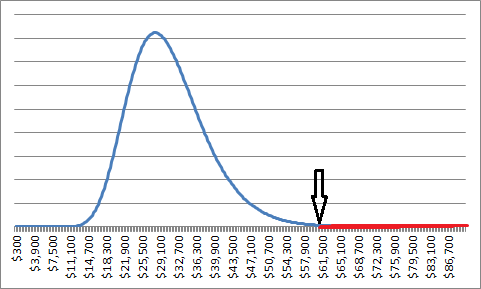

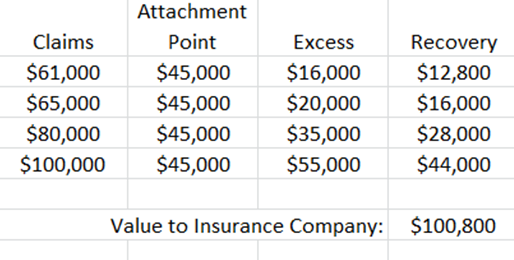

Now, first off, watch what happens to those claims when I move the attachment point down by a $15,000:

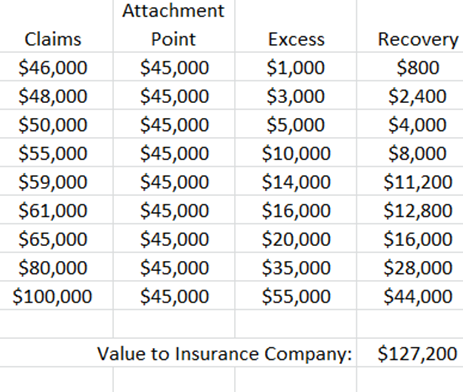

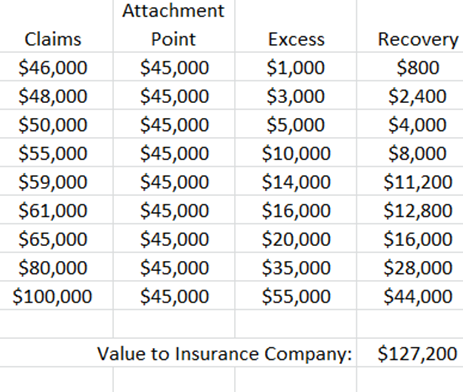

But that’s only half the story. Because by definition with reinsurance, most of my claims are below the attachment point. And as I lower that, the number of claims subjected to reimbursement grows alarmingly fast.

(Keep in mind this is just an illustration, the effect is likely exaggerated somewhat, I’m not working from a real claims database here)

The takeaway is that as I move an attachment point lower, the reimbursements on claims I’m already making get more generous, PLUS I’m now reimbursing more claims.

It is very easy for this kind of thing to double or triple (or worse) the liabilities of a reinsurance fund – if you’re looking for a familiar example, think what happened to the high risk/high yield tranche layers of MBS back in 2009. A few percent uptick in defaults was enough to erase the lower quality, less secure assets – small changes create big waves in the tail.

Think I’m exaggerating? The American Hospital Association doesn’t.

“Given the current enrollment uncertainty in the marketplaces, the AHA does not believe that CMS should lower the 2014 attachment point, thus ensuring that enough funding is available to pay eligible high cost claims and stabilize the markets.”

Nothing To Celebrate

We’ve spent trillions of dollars on this program. We’ve missed our own goals by a staggering 70%. And we’ve committed to drain the stability mechanism that’s supposed to keep this system level for a full three years in what could be as little as 12 months.

So how is this being received?

Well, supporters of the law are cheering. Opponents of the law are complaining about fraudulent counting (a claim that will probably blow up in their faces). And meanwhile, everyone seems to be missing what’s obviously staring us in the face.

We haven’t hit our own goals with this program. It’s been very expensive, and thus far we’re at less than half of where we thought we’d be. Meanwhile, we’re draining the fund that was supposed to play bridge to 2017 (a three year period when Obamacare, still in its infancy, is going to be very prone to sudden disruption or even a complete loss of faith), setting ourselves up for big rate hikes as early as the end of this year, or the next. Rate hikes that will very much effect real people (plenty who didn’t realize they had to worry about this in the first place).

So yes, by all means, let’s have ourselves a fucking party.

Comments »