[youtube:http://www.youtube.com/watch?v=gb_qHP7VaZE&feature=related 450 300]

Why Democracy Always Fails in the Middle-East

___________________________________________

The Cradle of Civilisation (sic) has been giving us quite a bit of trouble recently, wot? First we had 20 years of taming Mesopatamia, and now, in the stomping grounds of old Ramses himself, the crowds are making noises like they are going to throw off the yoke of old Catcher’s Mitt Face and his various progeny, including son Gamal (although I give Gamal Mubarak some kudos for marrying what has to be the best looking woman in Egypt, if not the whole damn Middle East); much like the Mesopatamians (with not inconsiderable help) gave the gallows treatment to Sadistic Saddam in Iraq.

Well, don’t bet on it, Tutankhaman.

Call me cynical, but I think when you are talking about corrupt, massively bureaucratic 7,000 year old civilizations, shit doesn’t just “Viva la Revolucion” into a new happy-dappy government — even the meta-Islamicist kind– without the intervention of many, many well armed troops, preferably of the non-Aegyptian variety.

That’s right folks, I said it. If anyone is going to take this ancient and corrupt shit-show on the Nile, it’s going to have to be heavily military-backed. And guess what? Last I looked, the defense ministry of Aegypt was taking down $2.5 billion pe annum in prime U.S. gelt as payment for the Sinai Accords some 33 years ago. Payments that are — by contract — slated to be paid IN PERPETUITY! You think that’s a payday anyone in their right mind — no matter how “Islamicist”– is willing to forego?

So with the Tea Party Congress coming into power, and eyeballing crazy-assed guarantees like that, what better way to illustrate to the world the value of that BRIBE than by showing just how fragile that geography really is? And oh, by the way? Our new Congress has also been grumbling (cough, cough- Rand Paul! — cough!) a bit about our subsidies to the State of Israel — another three billion per, and, coincidentally also contractually guaranteed in those same Camp David Accords.

Cynical? Yes. The way the Company has been operating the Middle East since it morphed from the OSS in the late 40’s? Um, also affirmitive.

So we’ll see what we shall see, but let’s not have any talk about cutting Aegypt or Israel’s money lines just yet, shall we? We wouldn’t want that awful Muslim Brotherhood to actually have to take on the trappings of rule, and really deligitimize Radical Islam once and for all, would we?

What would we have to talk about around the Danish bar, right?

_____________________________

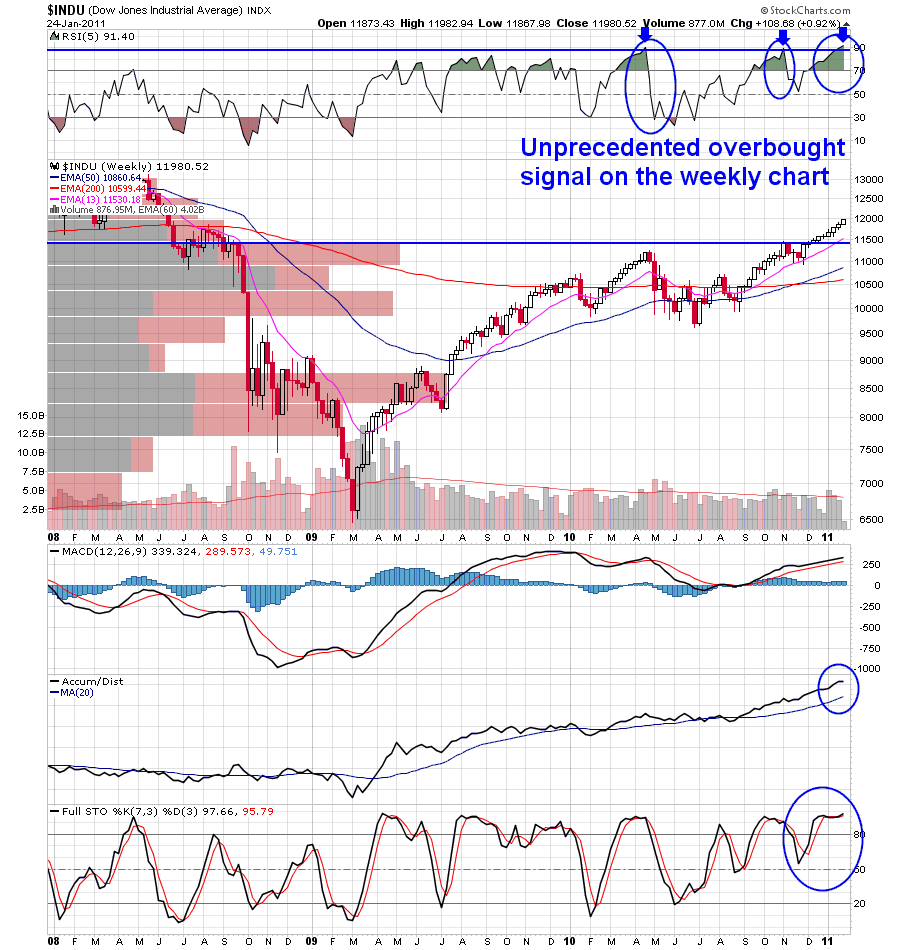

All the rest of you pikers can attend Saint Francis University about how Aegypt “caused” Friday’s much predicted cataclysm. For the last time, Aegypt was merely a convenient trigger– an trader’s excuse for selling of a broadly overbought market. The Ben Bernank has powers of levitation which are considerable when mixed with green ink and grey paper. They are not, however, immortal powers. Truth be told, they are more mortal than man.

So wise up. We’re in for a nice sell off here. If we get some levity tomorrow morning, don’t be stupid. Take that as you cue to lighten your load. And no, I’m not getting back into gold or silver miners either, although I am allowing my buy-stops to hit, like I did with SLW the other day at $29.05. My EXK buy stop was not hit, mind you, though I expect it will be still.

As I said on the previous page, I may be wrong, and I may be waiting too long to pile back in. But having the scars of many an early move on my back, I will hesitate here. I can afford it, after all, having outpaced the majority of the market by doing just this — riding the precious bull for all it’s worth, while avoiding major pitfalls as well as possible.

Best to you all. Wait for the signals.

____________________

Comments »