_______________________

Listen up kids, I don’t do drugs.

No, really.

No, I get high on… silver highs. New one’s especially. ‘Fact, I might even OD on breaking all-time highs, but I am doing wind sprints and having my sons jump out of random closets at me— “Cato-Clouseau-style” — in order to get my adrenaline glands in good condition for the eventuality.

Cause I’m pretty sure it’s coming. Tonight we have new 31-year highs at $33.12, which is making me very happy. Mind you I started buying physical silver at about $4.50 an ounce, and have never sold any of it. That’s over 630% since 2002. I wish I could say the same for my silver stocks, which I’ve traded perhaps with over-zealous vigour (sic). In truth, they’ve been even more volatile than the commodity price itself.

My favorite silver play continues to be the royalty play Silver Wheaton — SLW— which does not dirty its fingernails with crude dirt-scratching but instead secures royalty payment in silver at a certain price in exchange for financing miners. Would you screech out loud if I told you that SLW had arranged to be paid in silver at the equivalent of less than $5.00 an ounce? That’s like taking a time machine back to 2002 and rifling the unsuspecting corner numismatic storedfront for less than appreciated 100 oz. ingots, only to return to February 2011 and have them assayed for over $33… and counting.

Can you see why I’m so excited about royalty plays? They are, in fact, leverage for the leveraged price of the precious metal, as that is what the miners do — they allow one leverage on an increasing precious metal price. The royalty play is one step higher up the chain of amped return. Is there risk of default and other mining related problems? Of course, but like a bank, a diversified portfolio will absorb some of that volatility.

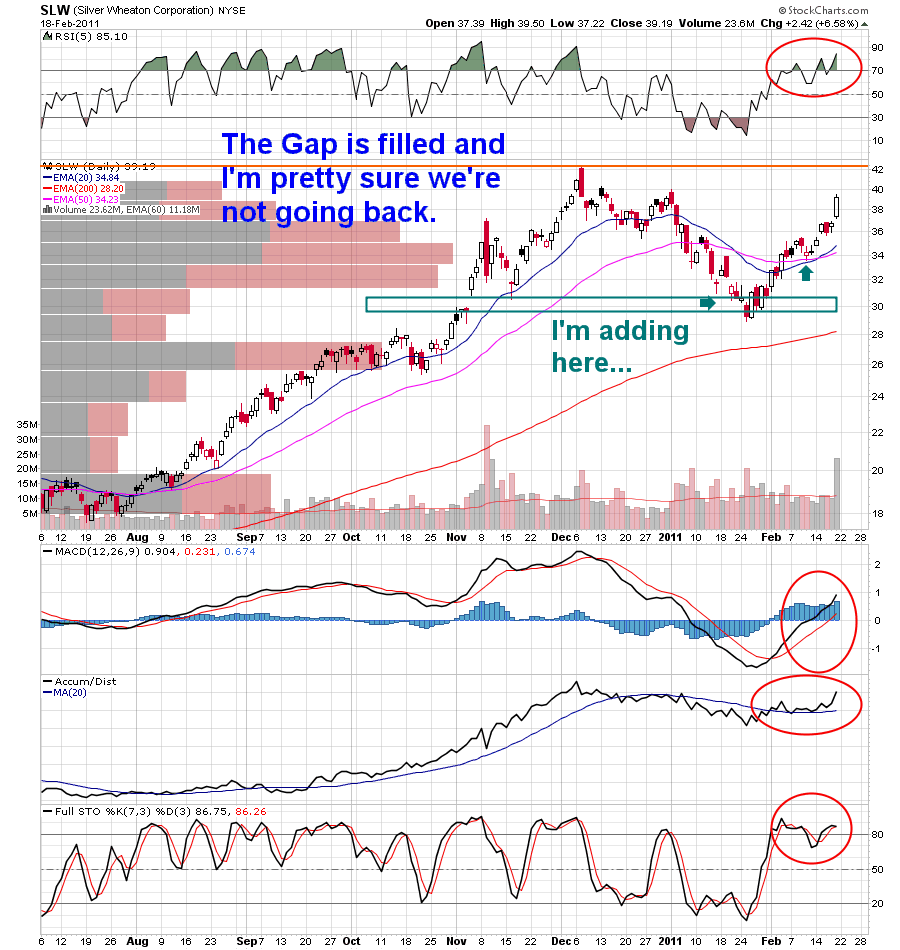

Remember this SLW chart from a couple of weeks ago? The two arrows are the places where I’ve made recent buys. We’re still not back to our old December highs, but I think we’ll be there, maybe as soon as this week.

Royal Gold — RGLD — is another royalty play, this time on the gold side, and with an even more diversified portfolio than SLW. That’s another Jacksonian you want to own.

I also like EXK, AGQ (be careful with this one), PAAS, MVG, SVM, AG, CDE (small), and SSRI. Another great catch all for all of these (or most) is SIL, the silver miner ETF.

For gold, the old standards, ANV, EGO, RGLD, IAG, GDX, GDXJ, NGD are recommended, and newcomers IVN and AAU to taste. I continue to believe also that the rare earth metals will resume their volatile climbs, and I like AVL and QSURD best.

Nothing going on in the U.S. stock markets tomorrow, but the precious metal, U.S. dollar and futures markets should be fun. Ciao for now.

_______________________

If you enjoy the content at iBankCoin, please follow us on Twitter

Not sure why the chart doesn’t “shrink to fit” on this one like it usually does, but if you click on it, it will open to the right size so you can see the entry.

Jeremy must be into the pasta again…

_____________

Jake,

You’re the best!

Thanks for keeping us updated on you current thinking, and for explaining how you’re arriving at said conclusions.

Jake,

I have to admit I followed this site for about 1.5 years before I made my first foray into one of your PM stocks. I got in EXK back in the very low 4’s and bailed around $7. But I also decided I like your picks and when you told me (well everybody actually) to load up on SLW I did so. Bought it just over $34 and have no complaints obviously.

Good day to you fine sir.

Don’t feel bad, it took Fly even longer than you to break his PM prejudice. Happily, he is now an honorable “CementHead Club” Member.

___

I’ve been watching NEM.TO (NEMFF.PK) for a rare earth play. They seem to be one of the few companies that is actually generating cash flows at this point.

Might not be liquid enough for you to play on the Pink Sheets, but it trades rather well in Canadia.

I’ll wait for the liquidity, but keep an eye out, thx.

_______

Thank you so much for your brilliant insights. I have some NGD but no silver holdings, is it too late to get on the SLW bandwagon?

No… in fact, I think the opportunity will be on a break of that $42 area. Probably will be a bit of a pullback after that, I imagine. That’s when I’d grab a load.

_______

“which does not dirty it’s ”

fix it sir

I KNOW you are not proof-reading my schit now…

_______

My eyes have trouble when I see such words: royal(ties), silver, gold. My greed bug stares me in the eyes like a staring contest with a giant kimono dragon (even as crazy as that sounds). Neverthebless, I’ll accept a few of your $ 5 ingots to proof read for you JG? Sorry. That was wrong. But…, and this query falls in the conspiratorial camp ground (read: I don’t know nor have the facts), how many of these publicly traded bullion corporations “own”, as in titles / deeds, the land? When I travel the states, I note a similar story written by the gov.’s hand explaining how various homesteader’s properties somehow, somewhat mysteriously, were either “taken” or escheat to Uncle Sam’s (Ben? & Co.) coffers. More plainly, do many of these operations lease as in Nevada or Arizona units do (on BLM)? Many thanks!

Nationalization risk is a real component of due diligence on some of these foreign miners, which is why I like to stay in North and South America, for the most part.

Even South America has grown increasingly risky.

As for Bernank and/or Obama stealing US assets, I wouldn’t get too concerned about it now.

_________

Smoke on! Muchas gracias.

Now up to 33.47 and still climbing…we are only a month away from the 31st anniversary of the all time high of 48.70, courtesy of the Hunt bros. Wonder when that record will finally fall?

Wouldn’t be surprised if it was this year.

Maybe even this summer.

_________

and that was in old (valuable) dollars

That picture is cold.

Silver is Hot. Holding RGLD NGD might get back in the EXK…strange days….PM’s going mainstream….get in the funnel.

Get in the smelter!

That picture is a bit mean, but I was looking for images for “crack cocaine” and that one popped up. I laughed, if evilly.

______

As a long standing silver and gold lover, if this stuff goes mainstream I have no idea how high they can go. I would be shocked if even 10% of all investors have a 1% metal allocation.

I was so excited I miss typed my own screen name……

Jake, why be careful with AGQ? Simply because it’s leveraged… or is there another reason?

Thanks always for your insights. Much appreciated.

Yes, for that reason. It can whipsaw the hell out of you. Not unusual for it to be up or down $30 in a couple of days.

__________

Thanks for the insight on AGQ. I will probably go in and out on that one.

Jake;

What percentage should the average investor allocate to silver and gold? I was thinking 15% toatal with 10% in silver and 5% in gold. Is that in line with most investors or am I too conservative? Any suggestions anyone?

I have about 40% of my retirement portfolio in silver bullion. 15% is in gold. The rest is in stocks (mostly precious metal stocks right now; looking at oil stocks this week also).

I recommend buying junk silver bullion coins as well (90% coins, for example).

I have been in precious metals for two years. Nothing but big gains so far. Silver still has not gone mainstream yet. Lots of updside potential still.

Those are some pretty high percentages. Not sure I wouldn’t diversify some of that bullion, maybe to more liquid ETF’s like SLV and SIL or sometihng.

I’d want at least 20% of my port to be precious metals, at least as an inflation hedge.

___________

you for thinking of me Jake. I have been loving silver and enjoying the new highs, and especially loving all of the paper weights I bought around 17.