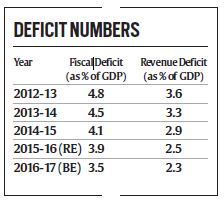

This week brought the highly anticipated Union Cabinet budget 2016 in India. Most were pleased, as India’s Finance Minister, Arun Jaitley largely kept to the fiscal deficit reduction roadmap previously outlined to the market.

Note: Trending in the right direction

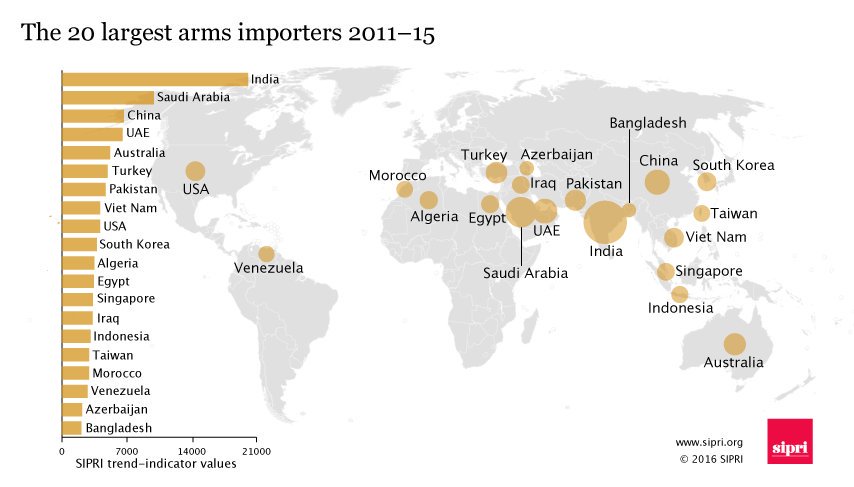

In India, the government financial year runs from 1 April to 31 March (like Japan). Increased spending plans include agriculture reforms, infrastructure spending, healthcare reform and rural development. Government workers got some love with a much overdue pay raise slated in the most recent budget, after a decade of flat pay. Corporate taxes were cut by 5% to 25% in the latest budget. Little coverage has been dedicated on this point, but defence spending was up 13% in the budget, with India already the 5th largest defence budget globally. India was the largest importer of arms over the 2011-15 period as outlined graphically below.

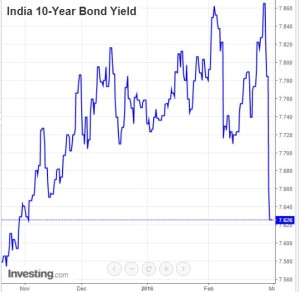

USD/INR (US Dollar to India Rupee) stands at 67.69 at present. The SENSEX is up nearly 2% today, but remains down almost 12% year to date in 2016. 10 year bond yield have rallied smartly this week on the fiscally restrained budget.

India’s primary imports are crude oil, cooking oil and gold. The drop in oil prices provides a sizeable lift to India which already is growing at a near world leading 7.6% (2015/16). Gold imports have proven to be a tough one to manage for India. The populace has a near unsatiable demand for gold (42% jewelry demand, 50% investment driven and 8% industrial), consistently importing 1/4 of global production (>$50bln per annum). China and India have similar demand profiles, but China is also a major gold producer, hence the effect on their current account is less troublesome (along with the 5X+ bigger GDP thing). India would not be as concerned with running a current account deficit if it were from foreign direct investment, but gold (a non-essential) importation is something they have limited patience for and have shown little success in curtailing.

Duties and taxes have been the abatement weapons of choice. The import duty on refined product with purity > 0.995 is 10% and 8% for dore (unrefined) bars. Some expected India to cut import taxes on gold in this year’s budget, but they did the opposite, much to the chagrin of the many Indians. The tax on dore bars goes to 8.75%, lessening the tax arb with refined at 10% and a 1% tax on all gold sold in India was instituted (last removed 4 years back).

A lot of work goes into avoiding these taxes, as one might imagine. One alleged means is to import lower purity gold (i.e. 0.994) free of duty and refine it onshore back to 0.995 (good delivery standard). The India government has a Gold Monetization Scheme (GMS) and a Sovereign Gold Bond program where they are attempting to have greater numbers of retail holders and rich temples surrender their physical gold in exchange for gold-backed interest bearing investments. What one pledges get melted, hence not ideal for treasured heirlooms. As noted, a big segment of the gold market is held in jewelry form.

Note: Looks like about 600 grams or so

Prime Minister Modi also announced in November 2015 the intention of launching an Indian Gold Coin (and Indian bullion). The 24 karat purity (0.999 fineness) coin has the national symbol Ashok Chakra on one side and Mahatma Gandhi on the reverse.

As a point of reference, the American Eagle (USA) and Krugerrand (South Africa) are both 22 karat purity (0.9167 fineness) whereas the Panda (China) is 24 karat (0.999 fineness), with a new coin design on a annual basis since 1982 and the Maple Leaf (Canada) is also 24 carat with “quad 9”, 0.9999 fineness. Conjecture will begin on when Trump might “Make the Eagle Great Again” and move to 24 karat as well. In it’s current form the American Eagle gold coin is 91.67% gold, 3% silver and 5.33% copper.

After all, “Life is too short for 22 karat”. JCG

If you enjoy the content at iBankCoin, please follow us on Twitter

$20 is $20

https://m.youtube.com/watch?v=easYw7iRcEQ

JCG, could you explain why India would want to slow down, or as you put it, curtail gold importation? Also, what do you mean by “India would not be as concerned with running a current account deficit if it were from foreign direct investment?” Always enjoy your work; gives us a view outside of our domestic markets. Thanks in advance.

Top of the house, India imports more than it exports, hence importing gold widens the deficit. Not as bad as it has been with the current account deficit (CAD) just over 1.5% of GDP (it has been well over 4% as recently as 2012). Lower oil helps. Foreign direct investment is a longer explanation as initially a capital account item, but once the initial investment is made earnings that are not re-invested flow through the current account. Better to have productive business, employing people, producing goods than sitting on a non-producing (store of wealth / jewelry) asset. Glad you enjoyed the post.

Thank you very much for clearing this up, and giving further examples. Always appreciated JCG.

JP Morgan’s take on the India Budget. Equity focussed (summary, they remain overweight):

A Litmus Test on Modi’s Reform Agenda

Yesterday the Modi Administration released a disciplined and deliverable 2017 fiscal year (FY2017) budget for India. As analysts still cling to the high hopes of this Administration’s reform agenda, early reactions have been encouraging. The 10-year yield gapped down more than 30 bps to 7.6% immediately following the announcement. India’s equity market also responded enthusiastically, up nearly 6% at the time of writing. The Rupee appreciated 0.8% against the Dollar.

India has been one of our two preferred equity markets in Asia ex-Japan. The fiscal discipline exhibited by this budget, coupled with a progressive reduction on subsidies and targeted expenditures on key infrastructural projects, reaffirm our view and support our portfolio positioning. While we see more positive catalysts emerging from Indonesia – India’s closest regional comparable – in the near term, our bias is still tilted to India over the long term. After all, the Indonesian economy is much more externally constrained than a continental economy like India’s, which is driven by relatively more predictable and controllable domestic factors.

Some key takeaways from the budget:

First, this is the most prudent and disciplined budget we have seen since 2009. Deficit to GDP since then has been cut to 3.9% from 6.6%. This FY2017 budget cut it further to 3.5%, which is lower than consensus expectations. A 3% level is commonly regarded as a safety threshold (especially for economies with twin deficits). The tax incentives for start-ups bode particularly well for India’s IT sector. This market-friendly budget sends a signal that the Modi Administration’s reform agenda remains intact. More importantly, a disciplined budget would help incentivize the Reserve Bank to cut rates one more time in April, which has not been priced in fully by the market. A lower rate would go a long way to boosting activity.

Second, the government has found a better balance between pro-growth expenditures (infrastructure and the rural economy in particular) and spending reductions (civil servant wages and subsidies). In particular, capex on roads and rails rose 32% from FY2016 and subsidies shrank to 0.3% of GDP. Both these figures are essential to Mr. Modi’s creditability and plan.

Third, the budget looks deliverable. The assumption to keep tax revenue in line with a nominal GDP growth of 12% is credible to the market. The non-tax revenue assumption, however, looks a bit aggressive: US$14.5 billion in telecom spectrum auctions and US$8.3 billion asset liquidations nearly doubled the ones generated in FY2016. Some local experts that we consulted believe the downside risk can be partly offset by potential upside risks from excise tax revenues. This is an area worth monitoring.

Fourth, the lower than expected public deficit financing bodes well for India’s bond market. Indeed, yields have gapped down across the curve especially on the longer end, as the estimated 750 billion rupee savings were greater than what the market had previously had in mind.

Fifth, as had been expected, the government budgeted 250 billion rupee for bank recapitalization. However the allocation will most likely prove insufficient. Based on Basel III, banks need to maintain Tier-1 capital at 8.25% of risk weighted assets by March 2017 and core Tier-1 at 6.75%. Local experts’ stress tests suggest more than 700 billion rupee might be needed to meet the requirements. Unless the government dedicates adequate resources to improving the banks’ asset quality, growth could be constrained. One cannot help but notice the contrast between the Reserve Bank’s vigilant directive and the government’s inadequate response in the budget. This might be the most disappointing part of the budget to the market.

The FY2017 budget is a true litmus test for Modi’s reform agenda, right at a time that financial markets have become skeptical about the Administration’s ability to follow through on campaign pledges. Admittedly, post-election expectations were unduly high relative to the challenges Modi was presented with. In our view, the FY2017 budget shows the reform agenda remains intact, however progress will continue to be measured and nonlinear.

That is not to say that alpha opportunities suddenly diminished. In manager alpha, for example, our experiences with active managers we hired have been satisfactory. Given the market’s depth and diversity, intra-market performance dispersion remains quite substantial. One should also remember that tracking error can be significant when managers venture outside of major indices (ours often do). In sum, we continue to maintain our overweight position in India.

A couple notes:

1. 22k coin is much tougher, and thereby superior. They can be handled with little risk of damage. It still contains 1 troy ounce of gold.

2. Panda re-sales are limited to coin dealers as nobody trusts them. Do not buy.

3. Since the American eagles are legal tender, they are protected from counterfeiting by the secret service. That’s no small matter.

Forgot about this: https://www.usmint.gov/mint_programs/buffalo24k/

For those that must have 24k legal tender coins from the US Mint.

https://upload.wikimedia.org/wikipedia/commons/9/90/INR-USD_v2.svg

No wonder Indians like gold, particularly when you factor in the USD depreciation over the same time period.

pb,

Of course you are correct in that 22k is chose as it is more durable. It is just too fun to pick on Trump.

Panda’s are not the way to go for a bullion coin, agreed. American eagles can also be held more readily in your IRA. For Americans the tax rate outside of a tax sheltered plan is 28% as a “collectable”. JCG

That is a maximum of 28%. Under certain circumstances, it can be less. Anyways, I just stick to the futures. Gold futures now come in 3 sizes, are taxed the same as any other futures contracts, and are far easier to deal with than a hoard of physical coins.