Photo: NBC

Operation Warp Speed:

The COVID-19 vaccine race officially goes into high gear with the announcement of USA’s plan to test the 6-odd top vaccine candidates across upwards of 150,000 volunteers (min. 100,000 pooled from VA hospitals and through participating pharmaceutical company recruitment efforts) in the coming months. The goal is to prove out both efficacy and safety in record time, with the lead candidates ferreted out by the end of 2020. The public-private funded ACTIV is a key driver of the initiative.

Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV):

(ACTIV) has identified four priorities in its effort to develop an international strategy for quickly developing therapeutics against the virus:

- Develop a collaborative, streamlined forum to identify preclinical treatments

- Accelerate clinical testing of the most promising vaccines and treatments

- Improve clinical trial capacity and effectiveness

- Accelerate the evaluation of vaccine candidates to enable rapid authorization or approval

Partners include 18 biopharmas, up from 16 when ACTIV was first announced on April 17. Eisai and Gilead Sciences have joined a group of participating companies that included J&J and many other global biopharmas: AbbVie, Amgen, AstraZeneca, Bristol-Myers Squibb, Eli Lilly, Evotec, GlaxoSmithKline (GSK), KSQ Therapeutics, Merck & Co., Novartis, Pfizer, Roche and its Genentech subsidiary, Sanofi, Takeda Pharmaceutical, and Vir Biotechnology.

Cov-SARS-2 – What is does to the human body, from Valvular Heart Disease blog, valvereplacement.org :

“Cov-SARS-2 doesn’t put you into rapid ARDS (Acute Respiratory Distress Syndrome) like SARS and MERS did. It slowly and progressively attacks your surfactant production. Surfactant is what our lungs make inside the alveoli (air sacs.). This is like lube inside the lungs; it makes the tissue stretchy, and the more of it you have the easier those little sacs open (the less pressure it takes.). With lower amounts it is harder and harder to inflate each minuscule sac, like trying to inflate a new balloon vs one that has been blown up a bajillion times. Eventually as the surfactant gets low enough, if you are not pushing to keep those air sacs open, they’ll stick/fuse together at the edges and no longer inflate at all. You are slowly developing more and more atelectasis (collapsed air sacs) and your lungs are regressing to be like a premature infant, born without prenatal steroid treatment. You cannot breathe without a vent, eventually.

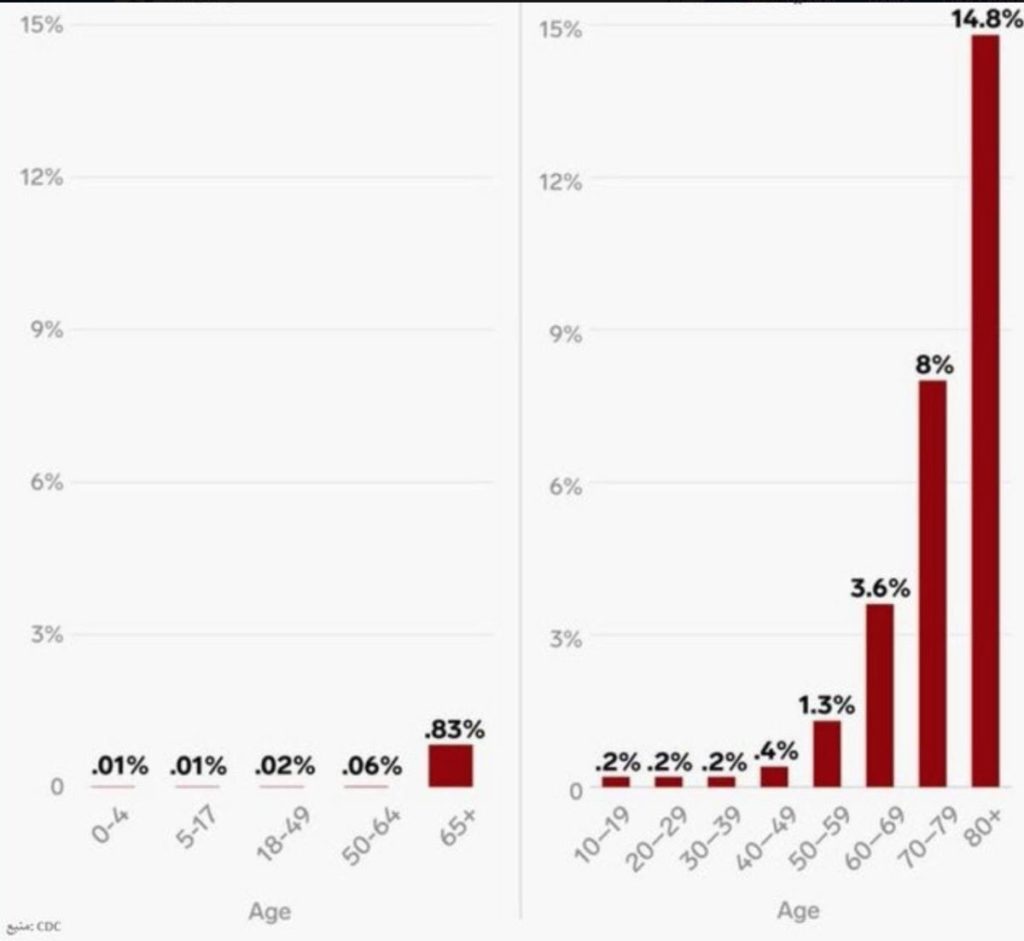

This is why (it seems) it is hitting newborn infants hard and leaving most children alone; children’s lungs after they adjust to “life on the outside” make a crap ton of surfactant; you have to lubricate lungs VERY well to allow them to grow. Surfactant production starts to drop statistically much more quickly after age 50y. Surfactant is used up faster in some lung diseases like asthma. Diabetes affects surfactant production. It fits. The science is not well enough researched to be sure, but so far what we know for sure has not refuted this model; so far everything fits.

The problem is the EVENTUALLY. What is killing people on vents is only partially their lungs. Most of it is organ failure, a cascade that has always been nearly impossible to reverse. If it were just their lungs we’d have a decent chance.

The trouble is that CO2 diffuses vastly more rapidly across the alveolar matrix than oxygen. This isn’t a problem, it’s great, usually. Our bodies use acid/base pH sensors to monitor our acid status constantly (CO2 is an acid when dissolved in blood) and so we change our breathing to adjust. If we have too much CO2 we breathe faster. If we are making acid (working out, fever, too hot, drank engine cleaner, septic/poor circulation), then the acid monitor tells us to breathe faster. We feel short of breath; we breathe faster/harder and that ramps up our oxygen delivery. Oxygen goes up as a lovely side effect; when oxygen goes up our tissues are happier and make less acid. Solid system. Almost every form of lung disease comes on quickly enough, or affects the TISSUE of the lungs in such a way that BOTH CO2 and O2 levels are affected, so the breathing difficulty is fairly readily apparent. We can tell by talking to you, getting a history, watching how hard it is for you to breathe.

COVID doesn’t do that. As it picks off your alveoli one by one, you lose lung function so slowly that you may not consciously realize it other than feeling fatigued or chest pressure. If your CO2 levels remain stable, and there is *just* enough oxygen to go into organ failure, you may just feel off/tired/flu-like. This allows it to remain silent. Eventually your oxygen will drop. When it drops enough for your tissues and organs to start to starve, they will make acid and you will start to work harder to breathe. By the time it is obvious that you need to risk the ED to be seen, your oxygen levels may be as low as 40% EVEN THOUGH YOU WALKED INTO THE ED UNDER YOUR OWN POWER. The lowest reported so far is 38% in a patient who DROVE to the ED and WALKED in and was TALKING ON HIS CELL PHONE. But he was in multi system organ failure cascade and was dead within 18 hours. Not because they didn’t have a ventilator; because his oxygen had been too low for too long and his inflammatory cascade from organ failure was too severe. As oxygen drops below 80% the blood becomes more viscous and more likely to clot, increasing stroke risk.

So help keep your lungs open. Deep breaths at least a few once an hour while awake. Blow up a balloon once an hour. Dig out that old incentive spirometer plastic thingy they sent home with you from your last surgery that you never threw away. Do it preventively, and especially if you get sick. Report to your doctor if it is getting harder to do by the day. Check your oxygen if you even think you are sick, with a pulse oximeter; preferably one that is not a knock-off piece of crap, but even the knock off ones are more likely to unnecessarily scare you than to miss a real low (though some are misfired so the HR and the Pox show up in reverse fields, but still work; work out a little to raise your HR and see what happens.). If your O2 is consistently dropping less than 95% let your doctor know, and insist on at least a Telehealth appointment if you are below 90%. Early lung exercises, and home oxygen, may be enough when the disease process is caught early; it’s easier to prevent a snowball from rolling downhill than to stop the avalanche.

The countries with robust in-home state care programs instead of hospital based focus, that stored up on Pox and on PEP flutter (home lung therapy devices a little more advanced than balloons and incentive spirometry) are finding if they catch the low oxygen before it causes shortness of breath and use home oxygen that the mortality rate plummets. Still preliminary, but the science is good.

Stay safe, stay well, as we slowly take more risks out of necessity. Please feel free to share the information above with friends and family, but if it’s not our immediate relatives then try to copy and paste to keep my name out of it; I don’t want to go viral. Information accurate insofar as I know as of May 2, 2020.”

Asset allocation:

In the BRRRR …. phase of global central banking, any stock with a ticker symbol, save opaque financials, have spouted wings since the March equity lows. Some investors clearly want more, all facets of COVID-19 plays from all corners of the planet vie for your investment dollars. Chose your horse, and you stable carefully, as the majority will likely be glue factory feedstock. With a well proportioned allocation to invest/wager on the outcome, this mosaic is meant to frame the optimal allocation across the COVID-19 field on offer.

Antivirals / Vaccines / Therapies:

There are 224 candidates in development for the treatment of COVID-19 currently. Given the breadth of the product offerings by the “big boys”, an allocation to them has much less risk than the single product “hail Mary”plays. My basket will include ACTIV name hopefuls.

$JNJ Johnson & Johnson – Yet unnamed adenovirus-based vaccine with 2 back ups. $1bln agreement with the US biomedical research unit BARDA to advance efforts. $380bln mkt cap. Subsidiary Janssen key player. Not a 5 banger, but needs to be in your C-19 basket. Spot $77, down 14% ytd. Like placing a wager on the favorite at 7:2 odds. Securing additional capacity deals enabling JNJ to make 1 billion doses by the end of 2021. Please assign a name to your drug, even as a place holder (Ivankavir?).

$GILD Gilead. Most recent Remdesivir test results show broad but subtle improvement in human trials versus placebo. Not enough cowbell for a $1k/treatment drug with IV only as a means of administering. 1.5mm initial doses to be donated, enough for 200k patients. It will make the grade for further testing, but will not make the grade for my C-19 basket. Note : owned in May 2020 via calls, since sold (June $70 strike sold $13). Spot $73.34. No C-19 wager, but I’d like Gilead to buy $SGMO for $40 in 2021.

Generic drugs made by $TEVA, Teva Pharmaceutical Industries Ltd., $MYL, Mylan NV, $SNY, Sanofi, $NVS, Novartis AG, $BAYN.BE, Bayer AG and others. Hydroxychloroquine, chloroquine. Hydroxychloroquine and chloroquine are anti-malarial drugs that have been tested in other outbreaks. Decades old, they’re available as lower-cost generics., as in $1/pill. Trump is a fan. Safety concerns abound, but if there is a role, especially on a supervised basis, these drugs should be in the mix. Carrying rocks straight uphill despite the cost advantage as the World Health Organization has temporarily halted testing on hyroxychloriquine in its COVID-19 drug trials pending more data because of safety concerns. The Lancet published a study which linked the drug to an increased risk of death and heart ailments.

$MRNA Moderna is the current COVID-19 darling. $69 and sporting a mkt cap of $25.6bln. Moderna’s mRNA-1273 utilizes messenger RNA to prompt the body to produce a key protein from the virus, creating an immune response. Moderna’s novel approach should have less safety concerns as well. A near term caveat is Moderna’s questionable executives who sold $30 million in stock concurrent with the stage 1 announcement (pre peer review) and promptly issued a secondary stock offering while the ducks were quacking ($1.25bln). Despite investors needing PPE to protect from the slime, it is hard to bet against this mRNA filly. Highly connected with $489 million in government funding (huge support in relation to their market cap). The NIH (National Institute of Allergy and Infectious Disease) ran the phase 1 trial. Phase 3 trials are expected to commence as early as July 2020. Owned adult portion early (high 20’s) and sold in low $30’s. Seller remorse has impeded my re-entry (humans), but this name will be in the COVID-19 basket. mRNA-1273 will with near certainty make the cut for the “warp speed” program.

The Coalition for Epidemic Preparedness Innovations (CEPI) has granted considerable support to several names:CEPI has moved quickly and collaboratively to rapidly develop vaccines against the COVID-19 virus. CEPI are also collaborating with GSK and will use their pandemic vaccine adjuvant platform technology to enhance the development of an effective vaccine.

$GSK GlaxoSmithKline plc and Sanofi ($SNY) are working jointly to develop a drug Sanofi already employs in one of its flu vaccines. Unnamed viral protein vaccine (yet another, bad move as noted).

$SNY Sanofi. Oseltamivir, sold under the brand name Tamiflu, is an antiviral medication used to treat and prevent influenza. Formerly owned by Roche.

$ABBV. AbbVie’s HIV drug Kaletra is being tested, both stand alone and in concert with other drugs for the treatment of COVID-19. AbbVie have taken the approach of giving up patent rights to the drug to lessen shortages and open the floodgates to generic versions of the medicine.

$MRK, Merck has been quiet overall. Their animal drug Ivermectin (sold as HeartGuard for Dogs) a drug for parasitic infections is getting touted as having some potential. No human testing has taken place yet (i.e. all in vitro).

Edit: ** Merck breaking news** (Big) After me chiding $MRK for being “quiet” they pulled the trigger, 2 actually in the COVID-19 space, 4:45pm Tokyo time (3:45 EST); Merck Says IAVI and Merck Collaborate to Develop Vaccine Against Covid-19 >MRK

Merck and Ridgeback Bio Collaborate to Advance Development of an Oral Antiviral Candidate for Covid 19, EIDD-2801 >MRK, “Oral anti-viral”, Merck (MRK) to Apply its Industry-Leading Vaccine Development Capabilities to SARS-CoV-2 Vaccine Program Originated by Themis and Institut Pasteur, Merck To Acquire Themis >MRK, Merck Says to Make Any Vaccine or Medicine It Develops for Pandemic Broadly Accessible and Affordable Globally >MRK$.

Merck: Deal to Accelerate Development of Themis Covid-19 Vaccine Candidate >MRK

[7:49 PM]

KENILWORTH, N.J. & NEW YORK–(BUSINESS WIRE)– Merck(MRK) , known as MSD outside the United States and Canada, and IAVI, a nonprofit scientific research organization dedicated to addressing urgent, unmet global health challenges, today announced a new collaboration to develop an investigational vaccine against SARS-CoV-2 to be used for the prevention of COVID-19. This vaccine candidate will use the recombinant vesicular stomatitis virus (rVSV) technology that is the basis for Merck’s Ebola Zaire virus vaccine, ERVEBO® (Ebola Zaire Vaccine, Live), which was the first rVSV vaccine approved for use in humans. Merck(MRK) has also signed an agreement with the Biomedical Advanced Research and Development Authority (BARDA), part of the office of the Assistant Secretary for Preparedness and Response within an agency of the United States Department of Health and Human Services, to provide initial funding support for this effort.

NVAX Novavax, NVX-CoV2373 has snagged $388 million of CEPI funding for their vaccine which is meant to bock the protein “spike” that the virus uses to attack/infect its host. Up 2x in May alone. $2.7bln mkt cap. Human trials are now underway. The mere mentions of human trials we enough to get the markets to giddy up over the Memorial Day long weekend and it appears this week’s winner’s circle will include a photo op with Novavax. Theoretically rational investors love flocking to the latest craze, crypto, cannabis and now C-19 vaccine hunting. As they say, if you can find a bubble, “buy it”.

$BNTX, BioNTech SE, $PFE Pfizer Inc. BNT162. BioNTech’s BNT162 is another messenger RNA vaccine, the German company is developing the potential preventative treatment with Pfizer. In China, BioNTech is co-developing the vaccine with Shanghai Fosun Pharmaceutical Group. Given the geopolitical situation between the quad tension points of PRC, Taiwan, Hong Kong and the USA, solutions without a leg in China (esp. USA domiciled) are likely to garner more investment. 50% off its giddy highs of March. No micro-cap at $11.5bln. Makes the grade for the C-19 basket nonetheless.

Imperial College of London (private), unnamed. Researchers have received funding from the United Kingdom for their vaccine project and have said they aim to begin clinical trials in June. Not investable, it should be noted. The other direction is “game on” though. An MIT professor that invested in Moderna early is worth $1bln, on paper.

$AZN. Oxford University (private), $AZN AstraZeneca Plc, ChAdOx1 nCov-19. The vaccine is made from a harmless virus that’s been altered to produce the surface spike protein from SARS-CoV-2. After stating they had an 80% chance of success, lead Dr. Adrian Hill is now back-pedaling hard and stated this weekend that their chances are < 50%. $AZN have said they could have 30 million doses ready by September. There is less apprehension for European involvement than China obviously, but there is still a clear preference for a “made in the USA” label on a successful COVID-19 vaccine.

$VIR Vir Biotechnology Inc., $GSK GlaxoSmithKline Plc, unnamed drug. The companies plan to use the gene-editing technology Crispr to find antibody targets for the disease. (2 discrete candidates). Even the mention of “Crispr” tech has seen those plays catch a bid; $CRSP, $NTLA and zinc-finger leader $SGMO. $GSK stable has a couple of horses in the race and as such gets a full weighting. $VIR with a market cap of a mere $1.7bln, Vir is a baby amongst giants and is worthy of a place on your C-19 betting card. The stock, while up 170% ytd 2020 is 44% of its highs, incl. a -9% “bag tag” on Friday coming into the Memorial Day long weekend. In the C-19 shopping basket it goes.

$FUJIY, Fujifilm (pharma subsidiary). Favipiravir, sold under the brand name Avigan, is an antiviral medication used to treat influenza in Japan. The government has decided to postpone approving Fujifilm Holdings Corp’s Avigan drug for the treatment of COVID-19 until June or later. Shares slumped last week after it was reported that an interim study showed no clear evidence of efficacy for Avigan in COVID-19 cases.

$INO, Inovio Pharmaceuticals Inc., INO-4800. Inovio’s experimental vaccine uses DNA to activate a patient’s immune system. $14/sh, $2.2bln mkt cap. Up 4.5x ytd 2020. Testing underway in China, a caveat for me on this one (with Beijing Advaccine Biotechnology).

$BTI British Tobacco. Drug; Tobacco. In April, BAT announced that its biotech subsidiary, Kentucky BioProcessing (KBP), was developing a potential vaccine for COVID-19. Since then, British Tobacco have been completing pre-clinical testing and are pleased to report the potential vaccine has been shown to produce a positive immune response. As such, the vaccine candidate is now poised to progress to the next stage which will be Phase 1 human clinical trials pending FDA authorization.

There are any number of other names, some worthy of vetting, and even perhaps rental from an ownership perspective, but they will not be in the “ACTIV” basket.

$SRNE, Sorrento Therapeutics, Inc. $4 to $10 and back to $5. Their approach seems “far fetched”.

Therapies:

$REGN Regeneron Pharmaceuticals Inc. and Sanofi. Kevzara The biotechnology drug targets a pathway known as interleukin-6 or IL-6, which can affect inflammation. It’s already approved for rheumatoid arthritis and could help very sick Covid-19 patients in respiratory distress. $REGN has run like a scolded dog, up 53% ytd 2020. $570/sh.with a $64bln mkt cap.

$RHHBY Roche Holding AG, Chugai Pharmaceutical Co., Actemra, alone or in combination with the flu drug Avigan. Actemra is an arthritis medication that also targets IL-6, like Kevzara does. Roche is enormous, > $300bln mkt cap. In the basket, but equal weighted (not cap weighted as most ETF’s are).

$TAK, Takeda Pharmaceutical Co., Convalescent plasma (TAK-888). Takeda is exploring whether blood plasma from recovered Covid-19 patients, which can contain infection-fighting antibodies, can be used against the illness. Similar treatments have shown promise in treating other serious infections. The Japanese drugmaker plans to start clinical trials in July and could file for approval of a plasma-derived treatment for Covid-19 in some regions by the end of the year. U.S. studies will be done with the NIH. The FDA has also offered guidance to researchers and hospitals that want to use convalescent plasma on an experimental basis.

$INCY Incyte Corp., $NVS Novartis AG, Jakafi. Jakafi, or Jakavi as its called outside the U.S., belongs to a class of drugs known as JAK inhibitors that target inflammation and repress cellular proliferation. In April, Incyte and Novartis started a 400 patient trial to address a potential deadly reaction to the disease, called a cytokine storm, in which a patient’s immune system kicks into dangerous overdrive while trying to kill the virus. The drug will also be available for emergency use for Covid-19 patients in the U.S.

$LLY Eli Lilly & Co., Baricitinib. Baricitinib, an existing rheumatoid arthritis drug marketed by the brand-name Olumiant, also belongs to the class of drugs known as JAK inhibitors.

Sources: Bloomberg, Company Websites., Press Releases

$QDEL; 4 key investable names; $TMO Thermo Fisher $340, $134bln mkt cap. Roche $RHHBY $44.70 mkt cap $310bln. $QDEL Quidel Corp, $173.50, mkt cap $7.3bln and $QGEN Qiagen NV $43, mkt cap $9.8bln. As only 25% of the C-19 allocation is to “picks & shovels” inclined to go with $QDEL for full allocation. USA baby, San Diego, CA headquarters and the Cadillac player in the diagnostics/testing space.

Thermal imaging:

$FLIR $45, mkt cap $5.9bln. Orders up 7x yoy. GM latest big order and more on the follow as the US re-opens. Turn key solution. Little upside for going cheap on this equipment in the current environment. Demand, pricing power, service contracts. Winner winner chicken dinner. Get in the C-19 basket FLIR Systems.

PPM:

$MMM, 3M Down 19% ytd. Sales down 11% in Q1 in the middle of a pandemic. No thank you as an investment, but keep those critical N-95 masks coming.

ETF:

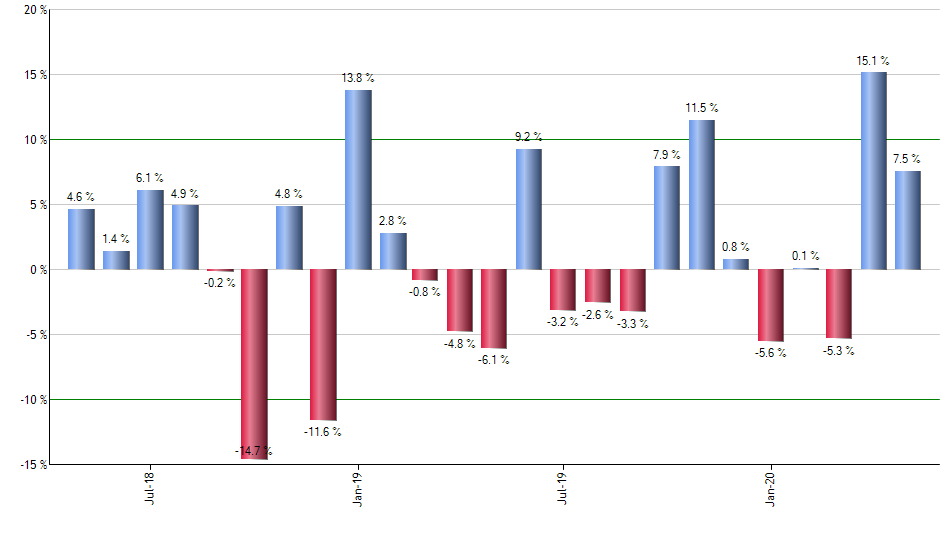

$IBB iShares Nasdaq Biotechnology ETF is up 11% ytd in 2020. A stellar result without the idiosyncratic risk of bespoke single name exposure, but it does not give one much COVID-19 name exposure. The ETF hold 8.9% in Gilead, $GILD which as noted I would not buy presently. Also included is 6.6% in Regeneron, $REGN, 2.5% in $INCY, Incyte Corporation and 2% in Moderna, $MRNA.

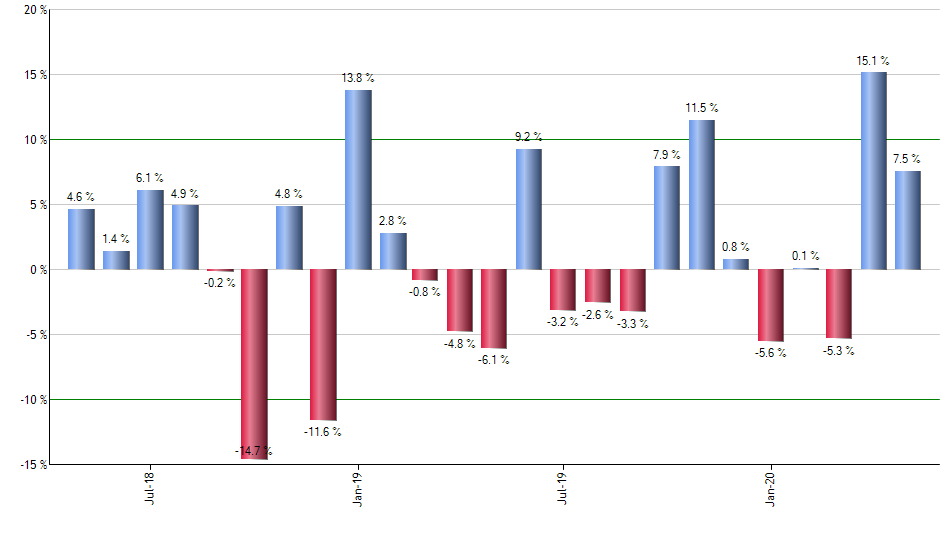

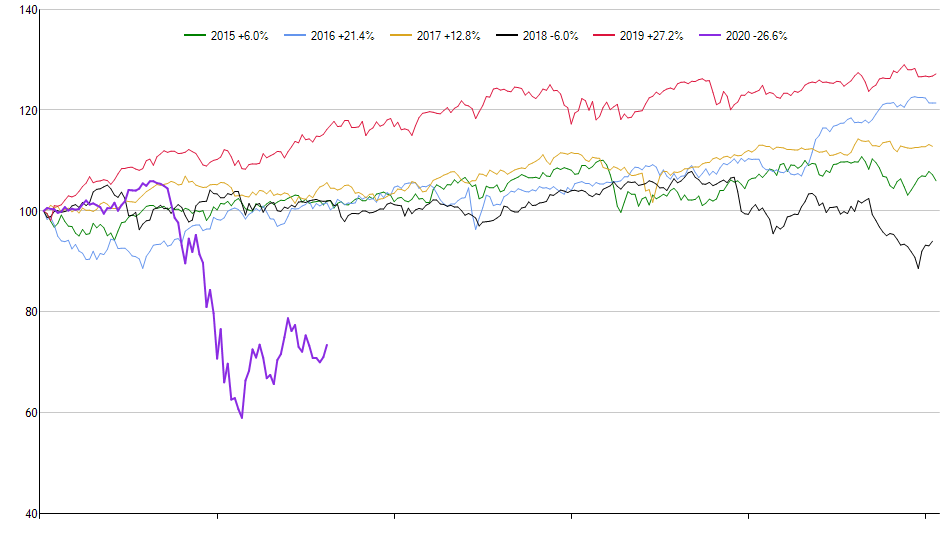

$IBB monthly returns. etfreplay.com

Summary:

Arm you immune system, regardless of age. Sleep, sun, a good diet, vitamin C, vitamin D (indicated low in 90% of COVID-19 patients), zinc and Quercetin. It is possible that no vaccine is found, or the ones that are developed work with efficacy levels that render them near useless. I’m no authority, nor a doctor, but remain hopeful that progress will be made on the slated timetable and that we have some pharma cover by the first half of 2021. The global A team is on the case.

Japan has lifted the State of Emergency for the nation and international travel restrictions should be relaxed by month end (China and S. Korea had been pressing on this point). Japan has had a total of 16,581 COVID-19 cases and 830 deaths. The US is 2.6x bigger from a population perspective, but is still adding a comparable amount of cases per day (1,700,000 total cases and 100,000 deaths). As previously noted, obesity rates are 4% in Japan versus 35%+ in North America. BGC vaccination for TB seems to result in milder cases for countries that employ it.

Doctors/scientists have successfully mapped the genome for Cov-SARS2, the strain of the coronavirus that causes the COVID-19 disease. It is spliced like a satanic DJ might mix his favorite rap, a bit of HIV, a touch of SARS, a dash of MERS and an Ebola finisher. It is no coincidence that the “B-side” of formerly attempted drug approvals for these maladies are getting airtime once again. Drugs used in combination are likely to have greater success, given the complexity of the riff, but the time line for testing is obviously elongated if this path is eventually deemed optimal. 6 choose 2 has 15 combinations. 7 choose 2 has 21 combinations. 7 choose 3 has 35 potential combinations, you get the idea. Vaccines are hard.

Europe’s COVID-19 cases crested well before the USA and even though Europeans are more inclined to go on vacation than back to work, their economic numbers should get “off the mat” ahead of the USA. (Near term € positive).

The 16 highlighted names (i.e. names in bold) on the vaccine / therapies / anti-virals space should give you broad of the exposure to the space (equal weighted despite marked market cap differences). The 2 ancillary names ($QDEL & $FLIR) should do well stand-alone, regardless of who comes out #1 on the vaccine.

Trade safe. Allocate prudently. Set stop losses. Casting such a wide net, re-balance periodically, increasing the weight in winners and cutting under-performers. This is going to take some time, with perhaps 4 core name long by early 2021 as you pare the laggards. A fast moving space. Correct as I could make it at press time, 4:22pm Tuesday May 26, in the year of our Lord 2020.

Regards, Caleb Gibbons, CFA, FRM

@firehorsecaper

Comments »