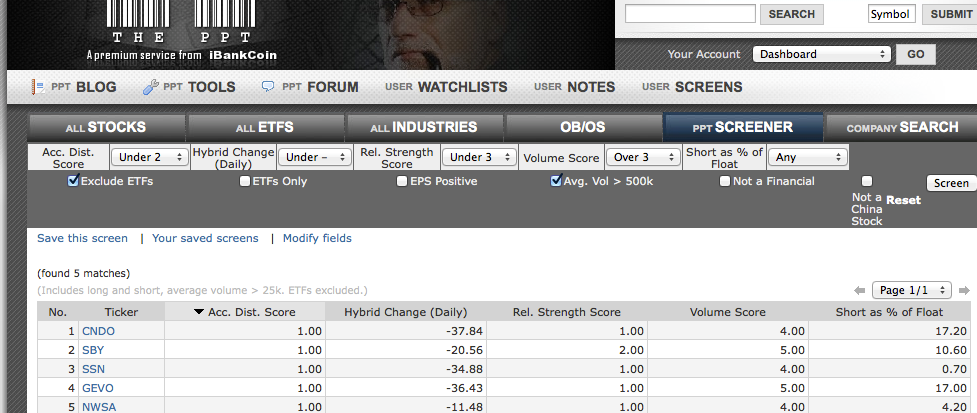

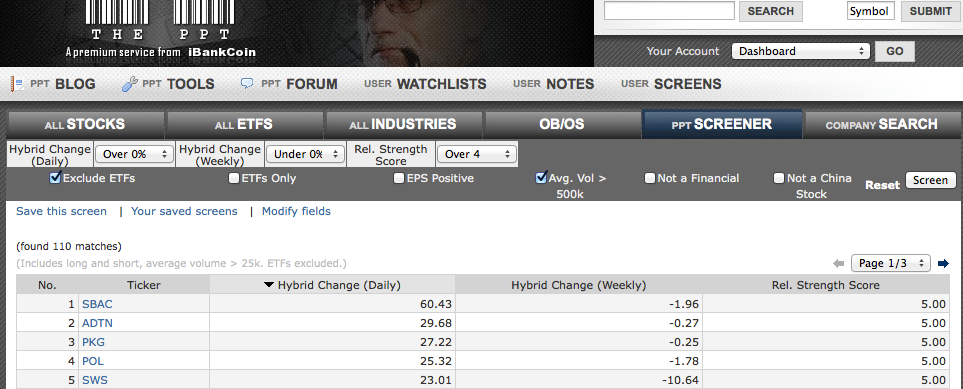

Here are some actionable short ideas on this list, especially if the market follow-through lower with tonight’s futures.

Courtesy of The PPT algorithm, here are some very aggressive ideas for short trades headed into Tuesday. If you are not comfortable shorting (especially in a bull market), there is nothing wrong with taking a pass. Keep those cover-stops in place.

Nonetheless, a good chunk of readers are always looking for short ideas.

Members of The PPT can click here to view and save this “Titanic” Screen, as I named it when I created it a few years back. The screen isolates stocks vulnerable to further weakness.

I have given long ideas in my video recaps and prior posts, and here are some short ones.

Please click on image to enlarge

________________________________________________________

Comments »