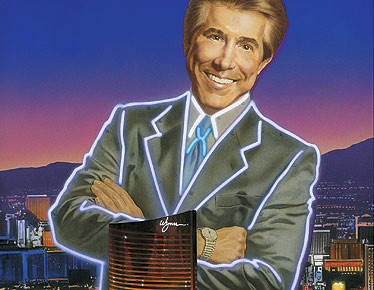

So far, so good on the WYNN short which I posted here and inside 12631 yesterday afternoon.

Getting ahead of the House, though, is nothing new. Las Vegas casinos were built on fool’s gold for gamblers who became overly aggressive emotional, and cocky with some initial luck at the tables.

My short entry was $212.18 with a cover-stop over $218. I am playing for a quick dip before 01/30 earnings, at least down to the 20-day moving average.

If the stock holds under $210 today I will consider adding to the short.

Let’s see if the “casino hosts” try to throw some comps my way to keep my playing.

________________________________________________________________

Comments »