I took some chips off the table in my WYNN short, and sold out of my UGAZ long today inside the 12631 Trading Service.

I took those chips up to the “cage,” as it is known in the casino, or the cashier. I did this mainly as Steve Wynn will be stealing the show on his earnings call next week.

Here was my note to members about WYNN:

Covered 1/2 of 1/2 (position) $WYNN short @ $204.37 from $212.18 entry to lock in partial profits into today’s weakness. Earnings are coming up next week so I am inclined to take gains rather than add to a winner. 1/4 position short left.

Overall, the market has an orderly feel to it for a down day on the Dow. This can be construed as either a good sign of a lack of panic or, instead, an ominous sign of complacency and more pain ahead.

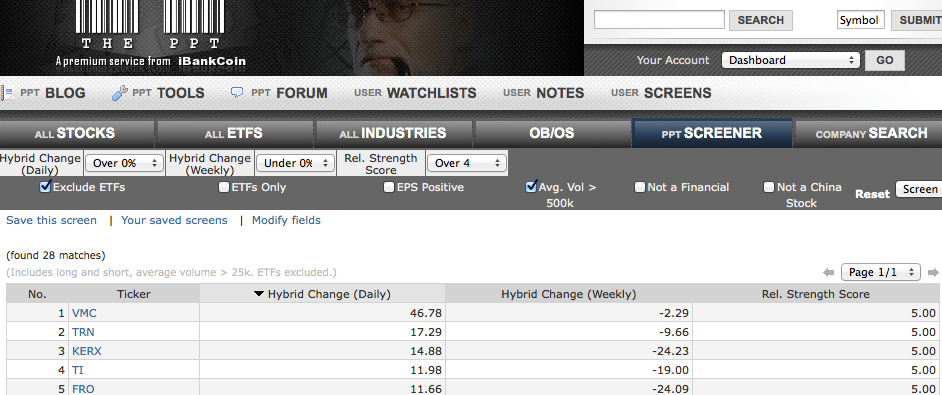

Simply put, I am focusing on what is working well, which continues to be sniper shorts, natural gas and metals/miners longs. Obviously, the miners have been outperforming the metals. So, I am betting the metals will play catch-up.

As far as long ideas, keep an eye on a name I have previously mentioned as a beaten-down short squeeze candidate: ARIA, for further strength.

Comments »