In the previous post Floating Relative Strength: Bears Have the Edge, we examined the results from a study which had one selling short the SPX next open anytime RSI(2) closed greater than 90 for 3 days in a row. The study also showed the results for buying the SPX anytime RIS(2) closed greater than 90 for 3 days in a row.

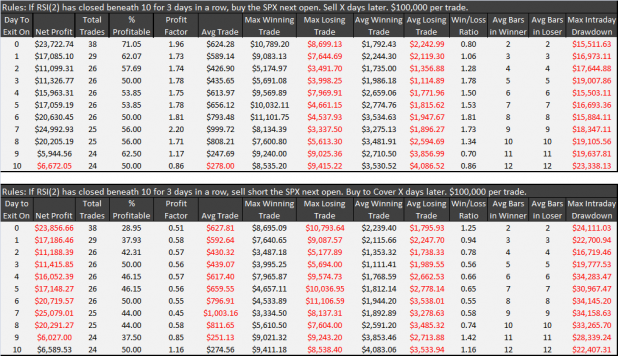

The current study will examine the opposite of the previous one. Anytime RSI(2) closes beneath 10 for 3 days in a row, one will buy the SPX next open. We will also look at the opposite side which is to sell short the SPX after the entry criteria is met.

As expected, the contrarian purchase after a depressed RSI(2) has the edge. Selling the opening of the 8th day yields the highest net profit.

On the short side, one would have to suffer for at least 10 days after the entry in order to see any positive expectancy.

The measure “Day to Exit On” is calculated in a way that might be confusing. The buy/sell short is made at the open of the day following the 3 days of depressed RSI(2). The day of entry is treated as day 0. The next day is treated as day 1. The trade is sold on the next open, following the Day to Exit On. If the Day to Exit On is day 0, then the trade is sold on the next open, which is really the open of the 2nd day, counting the entry day. Hence, Avg. Bars in Winner is calculated at 2.

It may be worth noting that this setup has had 11 fewer trades than the opposite setup, which is 3 days of RSI(2)>90. This is likely due to the upside bias of the markets.

Finally, the SPX is showing an RSI(2) reading of 12.22

The Market Rewind Blog has a similar study published here: RSI Mon Sez – Falling RSIs, Think Ahead! This study shows immediately higher odds of a next day gain after a depressed RSI.

Good stuff.

Here’s a question I’ve been meaning to ask. How do you balance performance in determining which of the strategies to use?

You’ve tossed out so many ideas since I’ve been reading your blog that I wonder how you decide when a strategy is not working…

Cuervo, that is great question. One thing to keep in mind though is that some of these are just ideas that might give one a short-term idea of where the market is heading, as opposed to full-blown strategies.

When and how do you balance resources between strategies is an excellent question, and one we are working on. One of the easiest ways is to just plot the returns on a percentage basis for all the strategies, and review it monthly. On a graph it looks like just a bunch of lines but over time you can get a sense of what is out-performing or under-performing.

I have heard other folks suggest plotting a moving average of returns.

Ultimately, what I am working up to is having a few strategies that are in the market 90%+ of the time, and allocating say half of capital to those while saving the other half for the more surgical trades that come along 80 or so times a year.

I would welcome any other ideas on this topic.

Cuervos,

I believe the first question you need to answer is what type of trader are you? Day, swing, or trend follower? What is your primary style?

Answer that question first, devote most of your capital to that specific trading system/style, and then, if you so desire, develop other systems that help offset the major weakness of your primary trading system.

For instance, if you are primarily a trend follower, then the major weakness is the absence of a trend. Choppy markets can lead to significant drawdowns, so developing a secondary system to offset that weakness could lead to either day trading, or using a mean reversion strategy such as RSI(2).

What it all boils down to is your individual preference and psychology. Are you most comfortable and disciplined trend following or swing trading? Go with your strengths for a primary system/style, then supplement accordingly.

I don’t believe choosing a system(s) based primarily upon performance criteria will be effective because the best performing systems may not be compatible with your psychology, which means you won’t stick to the system, so why bother?

Unfortunately, I think too many people put too much emphasis on performance first rather than psychological compatibility. It is not difficult designing a system that can outperform the overall the market. In fact, doing so is rather easy, but developing a system that is personally tradable takes a lot more effort and time.

This is a really long way of saying only you can decide what the optimum balance is between systems because each trader is very different. There just isn’t an easy answer to your question.