Well, this is what I wanted to happen. I wanted the readers of the blog to experience the psychology of a drawdown and losing streak in real time (but hopefully not in their real accounts).

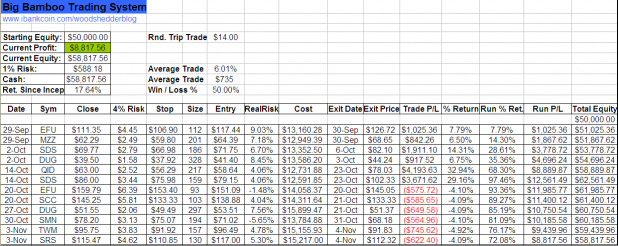

This morning [[TWM]] gapped down beneath the stop, so I closed the position out at the listed open. This unfortunate circumstance is a very real threat to anyone using stops that are left on overnight. The gap beyond the stop caused the system to experience its biggest loss on a single trade, equal to rougly 1.25% of equity.

[[SRS]] was also stopped out, but did not gap beneath the stop on the open.

But back to the drawdown. 6 losers in a row is the longest losing streak the system has ever experienced, in the two year history available for the ETFs it trades. The win/loss percentage is now beneath the 2 year average of 60%. Perhaps this is a good time to consider trading the system, formally, by the book. I will be sure to note here on the blog should I do so.

My fear is that the Big Bamboo switches to the long side, just in time for the next leg down. If it does, it won’t stay that way for long, but it would be tough on the psychology to catch the wrong side of a move, twice in a row. Should that happen, the hypothetical 20 losses in a row may become a reality.

For now, the Big Bamboo is still looking short.

No New Entries for Wednesday

law of large numbers… next flip should be tails.

does the bigbampoo take into account certain external variables, like news or major events? i think that’s hard to program in any system without human intervention.

Gio, sort of the law of large numbers, but not entirely. The Big Bamboo exhibits some dependence in terms of the streaks of wins and losses, meaning that it wins and loses in streaks that are longer than one might expect from the flips of fair coin.

Of course this is fun when it is winning.

i just posted the iBC update and the market is still pretty far from anywhere “overbought” on a weekly scale (but charted in days). On a daily scale it is way overbought.

I expect that the market will trade lower (but may be stopped out), guess that old chiner still has enough time to make some successful long trades before we get at least the LoBV in a range where it tops out.

But that line of reasoning expects a full cycle to overbought, and it remains to be seen if the market is strong enough for that. It would sure be a fantastic suckers rally.

*by suckers rally I mean buying at the top of the LoBV cycle.

elections days don’t count. Take 3 of those losses off the books. All this tripe is way too fucked up for even the most advanced model

Wood:

My uninformed guess is that the low volume of this phony, albeit continued rally, is what could be tripping up the bamboo.

My gut tells me the bamboo was the way to go but the tape said otherwise, with lousy volume.

If this was the turn, the volume would be double or triple what we are seeing.

Pinball, my guess is that the market, when experiencing times of great turbulence, becomes even more fractalized.

What that means is that price changes develop a very strong memory of recent price changes, and they are continually influenced by them. The day to day fluctuations become even more dependent (i.e. not 50/50 chance) on previous movement. Hence, once it starts to go down, it keeps on going, and vice-versa.

This causes the market to become very self-similar, which means it could rally just as hard or harder back up than it fell on the way down.

I expect things to stall out soon here, if nothing else, to take a breather before digesting the Employment Situation, on Friday. I also expect that the market will begin to again focus on economic news, rather than on the elections.

Is it possible that the system has a bearish bias?

What, the system right now is only trading bear ETFs. So, I guess from that perspective, it is biased. Once the system determines there has been a trend change, it will only trade the double long ETFs.

If the trend is no trend, and moves sideways, it will alternate between long and short (which would likely not be good for performance, at least that is my assumption).

6 winners in a row, 6 losers in a row, does it matter? Although not statistically significant, these results so far are pretty impressive. 50% win rate on the trades, but when it wins, it wins much more than what it loses. Nice job so far! Thanks for sharing.