Caught a cool mention on MarketWatch (iBC Peanut Gallery in the building!) for a piece about a potential bearish May setup which I’ve further contextualized here. Just wanted to say thanks to Fly for the opportunity to share with the iBankCoin community.

While the market lazily lulls loafers into a serene spring sedation, the spring portfolio cleaning, especially in bull markets, often gets pushed further down the daily operations priority list. We succumb to internalized voices coaxing us into inaction. “The market is ripping…ATH’s looming…just hold on a little bit longer and it’ll all come back, break even. Don’t focus on the duds. That one’s a long term hold, remember? This one’s a legacy position, right? It’s not your fault.”

The origin of said positions are the banes of our portfolio and approach to the market. They spread like a cancer in our account and burn us from the inside out. We let them fester, thinking “I’ll average down, and down, and down”, or, “They’ll come back, eventually.” Sometimes the market falls so precipitously and positions blitz us in a blink that in order to cope and maintain some semblance of put-togetherness, we force ourselves to deny the severe implications of the price action. At the same time, our processing speed can’t catch up with speed of the deathdrops. Take tech/software/internet/social media stocks in March/April 2014, oil/gas stocks mid-2014 to early 2016, basic materials stocks late-2014 to early 2016, 3-d printing stocks, or the recent blow-ups in $VRX, $SUNE, $CHK, $LNG, $TWTR, and $FEYE. Many times, we console ourselves with pseudo-calmness in the face of a relentless onslaught, waiting for a bounce to sell into, THAT NEVER COMES. When we should be frantic and take action, we are instead numbed, cemented in the mire. As a result, these positions become permanent fixtures we face daily when we fire up the trading turret (or avoid logging in, because the loss hurts too much to see). They are sources of angsty frustration and imprison us in the could’ve, would’ve, should’ve feedback loop. Utter regret.

How should we view these positions productively to limit their (re)appearance and frontload the pitfall catalysts to avoid relapse? They are representations of blown stops, mismanaged entries/exits, misallocations, the omnipresent potential PTSD gapdown, nasty visceral price action that we didn’t/couldn’t adapt to, and the botched handoff between planning and execution. What’s worse than the monetary scarring (wait, there’s worse?) is the rattled, mutated mindset. The perpetuation of fallacious thought, crumbling logic sequences irresponsive to market context, and a legitimization of our faulty actions since we believe we can still ‘make it’ despite stage 4 terminal bagholding. We lie to ourselves when we should embrace truth and reconstruct.

Trading is a relentless performance art (backed by an imperfect science) requiring a nimble approach to adjust on the move – deciphering when to stick to your guns, when to change sides, and when to sit out. The field of behavioral finance explores the way market inducing stress physiologically changes us through a feedback loop with the brain; subsequent thought constructs, hormone releases, and behavior are all linked, inculcated, and restructured. Talk about conditioning…the unforgiving Multivac market works to make you the cattle – stagnant, predictable, unevolved, and left behind. A shadow.

The question remains, do you really want to succeed at this? Or, will you concede being a marionette trapped in syllogistic schemas and emotional paradigms? Because at the end of the day, shouldn’t this matrix of monikers and avatars stand a fighting chance against the house?

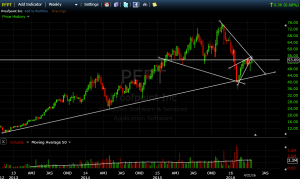

P.S. In my swingtrading account, I’ve been trading around some bags over the last few months. I’m looking to lighten up and mitigate future visits to this turd factory. What bag will you be spring cleaning?

Comments »