I was always of the mindset that before Obama leaves office, a nice bow needed to be tied on the housing sector (topped in 2006). Remember, it’s all about the retrospective narrative that will be attached to the president that picked up the pieces after what media historians deem the worst presidential terms in office in history (Dubya), littered with epic fails the media packaged and relayed to Americans – sure to be written into the history books – culminating in the bon voyage 2008 market collapse. The Great Recession, implication of the banks (assigned faces of evil manipulators), the destruction of the housing market (assigned faces of innocent manipulate-ees), etc… is still impressed in the minds of many. But wait, Obama the savior, en route to his final months in office has restitched the very fabric of America, threading (in)tolerance throughout society, improving employment and job prospects through robust economic foresight (hard to type this without laughing), and the return of a strong stock market, having recovered the gains lost since 2008 and then some to march the indices to all time highs.

Of course I’m being facetious, but the narrative that is scripted during and post- events needs to fit the promulgation of a vested American identity on which subjects within a society stake their perceptions, thoughts, and behaviors; it introduces an element of predictability into our matrix. See Baudrilliard regarding simulacrum and Althusser regarding ideology. Herodotus prefaced his “Histories” with the notion that the job of the historian wasn’t about uncovering and disseminating what’s true in the stories passed down in oral tradition, or from the stories preserved as part of our culture; rather, the job of the historian (and our job as traders) is to question, “What truth can we extract from those stories?” For us, it’s about reverse engineering narratives to collect data points (among our other methods/approaches, none of which can be weighed too heavily) to see what fits. The trial and error is painstaking, but over time, we get better at deciphering the code as it’s being written. It’s like Nolan’s Batman…”people deserve better than the truth, they deserve to have their faith rewarded.” Even if that faith is in…anyway…the narrative is perpetuated, the status quo is maintained, etc…The game is always the same.

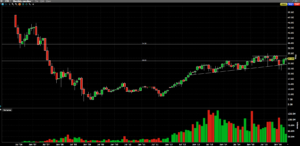

The monthly chart of the $ITB shows some base over base action, with multiple attempts lower being rejected/bought in January and February. At the moment, the midpoint of this compressing range is holding. I’m watching some attempted moves lower today in individual builders, like $LEN $TOL $DHI and $PHM to gauge if buyers step in and defend. $LEN looks like an easy-to-manage long here, trading at a significant price level; you can use a stop at today’s low if electing to get long. Into year-end, I will be watching to see if faith in the housing market is perceptually restored.

Disclosure: I am long TOL (see here).

If you enjoy the content at iBankCoin, please follow us on Twitter