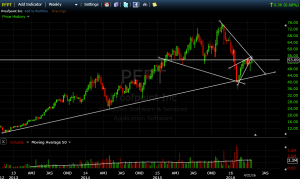

Within the context of the potential May bearish outlook I articulated here and here my read was that this week and next will begin to surface some stalling in the Nasdaq/Russell (risk-on), while the DJIA/S&P (risk-off) maintain the veneer of relative strength in the face of ATH. In recent downturns, such as March/April 2014, the market bifurcated into 2 stratified groups: the bellwether, blue chip, low beta stocks viewed as havens for stability and yield (potential parking spaces for this year’s ‘sell in May crowd’) vs. the high beta, high p/s, no earnings, high forward p/e companies carrying debt and overvaluations in competitive spaces. I am of the mindset that components of this latter group will be the early targets for bears in this potential April-May monthly handoff and shift. One catalyst to nudge components of the latter group over the edge is earnings. From this latter group, the play that fits the bill for me to gauge/test this thesis is $PFPT, a stock I recently shorted before being stopped out at breakeven. Earnings were released after the bell yesterday. The company beat, guided up, traded up after hours, looks to be gapping, and is in the midst of upgrades. I marked up a weekly chart below.

The question is will $PFPT hold its gap today fueled by demand for risk, or will overhead supply prove resistance and reject price as market participants shift to lower beta alternatives. I’ll be watching price behavior around the 56-57 level for clues. I’m managing a $QLYS long (among others) in my swingtrade account, a competitor in the same software/cybersecurity space as $PFPT. Within this space, $CHKP reported this week and was met with selling. $FTNT and $VDSI report next week, and $FEYE and $CYBR the following week. Big player $PANW should be watched as well, and $SPLK attempted a breakout yesterday before fading a little. Some players in this space are better positioned than others (correlations among the group don’t have to run high), but in general the $HACK (pattern on this ETF still looks good) group should be monitored for the market’s appetite for risk. It’s another data point in the construction of an approach and thesis to this market. This space should be in play as rollover candidates OR the beneficiaries of a rotation if we continue to drift higher.

Stay nimble.

If you enjoy the content at iBankCoin, please follow us on Twitter