On rare occasion, we trigger an extreme reading in weekly sentiment polling. Last night, we hit our first 80% result for the year in favor of the bulls. These extremes don’t happen often, but they’ve been 100% accurate since launching the service in 2013.

On rare occasion, we trigger an extreme reading in weekly sentiment polling. Last night, we hit our first 80% result for the year in favor of the bulls. These extremes don’t happen often, but they’ve been 100% accurate since launching the service in 2013.

An early market ramp located sellers above, and they’re laughing while stealing money from early bulls.

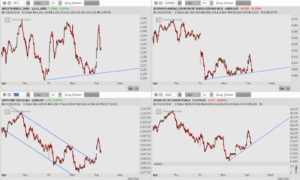

There’s an interesting divergence in the market here worth watching. Small caps bottomed Thursday. Tech bottomed Friday. The S&P and Dow…have they bottomed yet?

Watching to see if we have buyers below, but I watch for these divergences specifically to keep me in a trend or not.

Watching to see if we have buyers below, but I watch for these divergences specifically to keep me in a trend or not.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

all about that NASDAQ, IMO, and I’m looking for a secondary wave after the GOOGL MSFT sell rotation

Saw an interesting statistic that the SPY has not broken prior week’s low for the last 10 weeks. Not sure if MM”s can do it today but a break below 107.5 SPY and 108 in QQQ should flush out any remaining believers. Then we rip higher…….

“break below (207.5) SPY and 108 in QQQ….Then we rip higher”? I’m not following.

Do you mean a test+bounce off these levels? If there is a breakout below, wouldn’t that support a bearish read?

“You’d like to think that, wouldn’t you? You’ve beaten Nasdaq, which means you’re exceptionally strong, so you could’ve put the poison in your own goblet, trusting on your strength to save you, so I can clearly not choose the wine in front of you. But, you’ve also bested my Dow, which means you must have studied, and in studying you must have learned that man is mortal, so you would have put the poison as far from yourself as possible, so I can clearly not choose the wine in front of me”

Of course, following the scene, this would imply that the Bulls would be able to take SPY higher – which is against the 100% accuracy of the AHWOA signal….

I know – just having a little bit of fun….

There’s always a remote chance that the majority is correct this time. Rookie move is to short into a dull market. Wish I wasn’t so quick to unload TWTR shares this AM>>>>>>

excellent

Costanza trading — buy breakdowns, sell breakouts. If prior week levels are breached, stops below 207.5 (SPY) / 108 (QQQ) will get tripped and the weak hands will once again be washed out. Motivated buyer steps in and buys shares on the cheap and more buyers / short cover-ers return once levels have recovered above the aforementioned levels. Wash, rinse, repeat….

Separately — FCX hammer time!

kidstockibc, got it, thanks.

I see how that could work – tripping the levels quickly takes the market to oversold/overbought conditions. However, do you buy right at the breakdown? Wouldn’t you want to wait for the short-term bottom?

I miss the “Sell Now” poll by 15 minutes and don’t liquidate my positions immediately…

tank IBB, tank!

Renaming Turnaround Tuesday to Twitter Tuesday. Follow the leader……………..

run-up prior to earnings usually signals retail chasing and a tankage following earnings release.

Perhaps this time is different, like the majority being correct in OA’s poll.

I could re-post what I put above and substitute LNKD and YELP…..

Twitter Tuesday has more cachet than LinkedIn Tuesday or Yelp Tuesday. Either way — good to see folks are winning!

Im still holding options and I hate ER run ups. Doesnt always end well. But one thing Im trying to learn by using options is that even if they shit the bed you lose your premium which is what you could afford to lose in the first place. But if they beat you can get a 3-5x bagger.

Top option ideas right now:

FB May 115 Calls $2.47

FCX May 12.5 Calls .42

PYPL May 42 Calls .70

TSLA May 275 Calls $5.90

haha. folks have been waiting for PYPL to break for so dam long.

BAC July 16s were a big mover the other day. Stock is setting up real well.

Relentless bid in BAC — could run to 18 by July

Bought some YOLO weekly puts at 15. Thought it would be resistance but it looks like a nice consolidation.

Nice divergence taking place in Russell here

Based on Russell strength, my sense is the best the bears can muster is a break below yesterday’s lows. Buy ’em up — here and now.

Everyone is bullish now. hmmm….

OA, does this 80% reading trigger a trend change, i.e. marking the end of this run from Feb or something on a shorter time frame?

If I had a spare 10K, I would be a buyer of QQQ Mar 112 calls here for .34 or better

Lol.

10k is chump change. Any trade <50k is peanuts.

A 10% move in AAPL will move SPY by 0.34% and QQQ by a massive 1.17%, so between bulls and bears, it will likely turn on Apple’s earnings. Bulls will be “proven” correct if Apple beats, Bears will look “smart” if they don’t.

In other words, success with your bullish or bearish strategy may be more luck than anything else in the short term.

Coming from you, I definitely gave a fuck.

Good to know.

I just posted to express an alternative postition and to read what others think. If everybody agreed with me, then I would suspect my own idea and wonder if I’m missing something.

AAPL failed and got whacked for it, dragging down QQQ and SPY with it in proportion. IWM is unchanged. So it’s just a matter of time for the market to make the final arbitration.

No, buddy…what I’m saying is of course an AAPL move will throw a few points or subtract a few. It’s earning season. The divergences measure risk appetite, and whether or not longs are staying engaged here.

Ok, I get it.

BTW, right now QQQ is ONLY down in proportion to the APPL weighting if you work out the math, but otherwise unchanged. Meanwhile, most other large tech caps (CSCO, MSFT, GOOG, INTC, FB etc.) are down postmarket as well a significant (0.3 or more) amount, which means that either QQQ is overpriced (arbitrage) or the smaller QQQ holding must be up. Of the top 10 QQQ holdings, only 8 are down, one if up .1% and comcast is up 0.8%.

Yeah man, you’re preaching to someone who knows.

To put it more simply:

the top 10 holdings are down 2.32%,

QQQ is down 0.88%,

so the smaller holdings must me *up* 0.63% if QQQ is fairly priced

OA, I’m not trying to preach to you, just to others who can’t be bothered with the math.

When I hear 80% bullish and people talking about loading up on cheap stocks I get a very bad feeling. Better protect those profits with stops.

Ever wonder whether your poll is affected by your clear, explicit use of it as a contrarian indicator, or whether AHWOA subscribers are a good sample? I’d expect a (relatively) savvy bunch of AHWOA subscribers to not want to be too bullish at any given time, knowing they’ll be considered a mere cog in the wheel of the “moron bus” that exists only to be faded.

IWM, BAC and FCX — HOD. Follow the leaders, not AAPL & NFLX

(TWTR still has event risk tonight)

nice sell on JDST yesterday

Can’t claim victory on that yet. The payoff is tomorrow.

Someone rolled 10k GDX puts that expire Friday.

A couple of chart that caught my eye:

$CPST is my favorite.

$ZFGN

$AMBA (those premiums are nuts!)

Starting to shop for a list of oil shorts into the summer. The only short that caught my eye is $OLLI so far, if only because that doesn’t feel like the type of company that should go on the sort of run it has and it looks tired up here in the stratosphere.

…and UB – I just caught your reply from a few posts ago. Good to hear you’re busy. Me too. Smart to not be trading through it. I’ve been trying and paying the price. Missing good exits ($BOFI at $24 most recently!) because I wasn’t where I needed to be.

Bad exits are really hurting. Entries I am ok with. Picking stocks I am getting better with. But exits… even seeing volume profiles its not working. I take profits on a pop only to watch the stock ramp. Then I leave a position on looking for a better exit and end up losing the profits. Need to focus on this.

Just a matter of gaining confidence and effective use of stops. Any given stock has a pattern.. maybe bouncing off a moving average or a support or trend line.. don’t panic if it falls but holds one of these. You can always use stops to preserve profits or sell just a part of your position on a pop.

The best thing CPST has going for it is that it can only fall $1.67. Plus only 4% short float. But in this market anything can pop so..

OA – I took +10 out of the /TF move. Thanks! You still holding?

What’s up with GOOGL?

The same thing that happened to AAPL, MSFT, NFLX, TWTR and others: earnings miss

We have FB tomorrow afternoon and AMZN on Thursday. If they miss, at least IWM is diverging, so the bull market can go on….

If anyone watches the show “VEEP”… the first episode of the season they wore the FIT step counter things and mentioned the company name at least 10 times. Not really actionable or tradeable stuff but interesting to see.

OA, any thoughts on putting a low bid out there on AAPL for extended pm session? Hoping for the knee jerk overdone down move. Say $88 …… thoughts?

Everyone is waaaaay to bearish on AAPL today. I’d be blown away if it traded under $100. Lowball bid for me would be $96.

Here’s ur chance then

Bought at 96

Oh that TWTR

Twtr never fails

TWTR always a POS. BWLD slaughtered. AAPL tanking.. CMG poleaxed.

Tomorrow should be interesting.

Bot TWTR @ 15.9

I like AAPL for a bounce here 98.2

“This business will get out of control. It will get out of control and we’ll be lucky to live through it. “

Here’s the washout below 108 QQQ I was referring to…buy the blood

Feb 11th was the low in the RUT, not Thurs.

No shit holmes, we’re measuring divergent price action in recent days.

Closed longs EOD except TVIX short/ FEYE long. Also held a small batch of AAPL calls unfortunately. Looking to buy into potential wkness tomorrow, hoping for a gap down.

Couldn’t resist and picked up AAPL at 96.05. Not looking to hold long though.

Was thinking NQ here at 4407

You nailed it again. Survey indicator remains 100%. Down we go

1) Looking at monthly timeframes:

Aug 2012 close: 95.03

Sep 2012 open: 95.11

Sep 2012 close: 95.30

Oct 2012 open: 95.88

July 2014 close 95.60

Aug 2014 open 94.90

Then really nothing more until 85 as monthly support/resistance

2) So if Apple closes out the week (and therefore the month) below ~95, then is it a safe bet it’s going down to ~85?

3) If Apple goes down to 85, then QQQ is pulled down over another full point as well – even if every other holding didn’t move. That puts it awful close to major 2016 support/resistance/retest at 105.7.

So waht do you think of a QQQ 106 straddle or even a 106 calendar option play?

Staying long $IWM calls cuz we finish the week higher.

watching NFLX here – could be a candidate to go down to 88 if this price action continues, but would look for a nice bounce at that level

Ongoing thesis: FANG stocks will be a source of funds throughout 2016. Methinks NFLX trades to $60 this year. Hot money rotating into Biotech – get some.

Totally agree, all those stocks hitting Jan-Feb panic levels already. Forget those stocks. Quickly.

yeah, good thesis – could be painful for retail investors looking to get them at a bargain only to provide selling opportunities to institutions looking for an exit

Bio????

From 3/21 had AMZN and NFLX as developing bearish setups.

http://ibankcoin.com/hattery/chartblast-3-21-16/

As long as we don’t surpass the trendline or recent high, these 1-2-3 reversals are still in play.

I pointed that same thing out in Late Jan/Early Feb

http://ibankcoin.com/option_addict/2016/02/05/a-technical-take-on-fang/

Bought a few TWTR weeklies. See if any buyers step in at 15

Bot AUY….great continued pin action in the PM’s

this is either a perfect spot to get heavily long or short. If you have a bias now is the time to bet. If you’re scared stay on the sidelines as there is a massive move coming.

In FCX we trust — higher we go!

Here’s the spot to buy IBB….278.60

CLF might be coming out of that flag sooner than later.

Loving IBB here more than my right hand….

Why are you so excited about IBB? I cant see it

All of the action in IBB this month has occurred within the confines of the big range day that propelled prices out of the low 270s. I see signs of consolidation / accumulation in the large cap names amidst a melting Nasdaq backdrop.

I prefer to buy into breaks of prior week lows which just occurred. Look for 280+ close.

Like IBB here as well, but certainly not receiving any love…

Technical selling / stop hunt…nothing more. Folks will regret not buying at these levels.

Bio been leading the pullback this week

I do like here for a bounce but don’t think it can get above 287

All large bios reporting tomorrow so it’s do or die day no matter what…either it break up or leg down…

My biggest concern is AMGN and GILD (top IBB holdings) way overextended into earnings.

Agree. Everyone been thinking bios turn to go up. We know what that means

If I had a spare 10K I would add to May QQQ 112’s here and bump position to 900 contracts.

900 contracts? that’s would be a lot of transaction cost there….

Win Big….Lose Big. Brokers do love my degenerate ways but if I’m winning big a couple pennies isn’t going to spoil the day. Might as well round off position here to 1000 contracts and bring my basis down to .21.

You must have some wild swings in your account. Priced out 900 contracts on my trading platform (USAA) and the trade charge would be $450… I am looking at the trade though, but for a number of contracts substantially less than 900

Added some to my QQQ position. I would not want to be short at this level.

Loving AGN here — last chance sale under $220

I know you have no problem taking a gamble but why not wait until the earnings are out to see what sets up ? Honestly curious.

It’s about risk:reward, not anticipating the outcome of event.

they beat the last 4 quarters so the risk of miss is not as great as AAPL, AMZN, NFLX.

Part of the thesis is shares are mispriced because of supply from arbs unwinding positions. They’re not trading down because of preannouncement.

Besides vanity is back — check out shares of CYNO

Understood. Thank you for the explanation

OA”s poll results = prelude to a fat pitch

IBB trading back above last week’s lows. Bears are getting nervous….hehehehe

You kidding around? It’s down more than the nasdaq index today. Lol

Not kidding….QQQ’s are meaningless. IWM & MDY are the proxies going forward.

Check with me after 4PM.

Ok then IBB is severely underperforming iwm

Anyone buying JDST down here?

XLE is really overbought here.

Unless its in a trend, then overbought becomes just a term.

Right. It can always run higher. Good point

“This Week in Petroleum” out in a few minutes should tell the tale

E-Sports names worth a look down here….EA, ATVI, SNE

honestly, doing anything right now sucks because it looks like the market could flip ether way – FANG+Fruit stocks all being down is really weighing on the market, but many of the stocks I am in are doing great today 2:00 is going to be nuts

LNG — new idea. What a beaut.

Started my “buy and tuck” $AMBA at $41.99 today. I could afford to tuck a little more if the opportunity presents itself over the summer.