Here are some possible shorts, based on Earl Fly’s screen in The PPT. Members can see the full thing here.

BCOV and SKY (Especially BCOV)

Did I mention I am absolutely wrecked? Having crushed myself, once again.

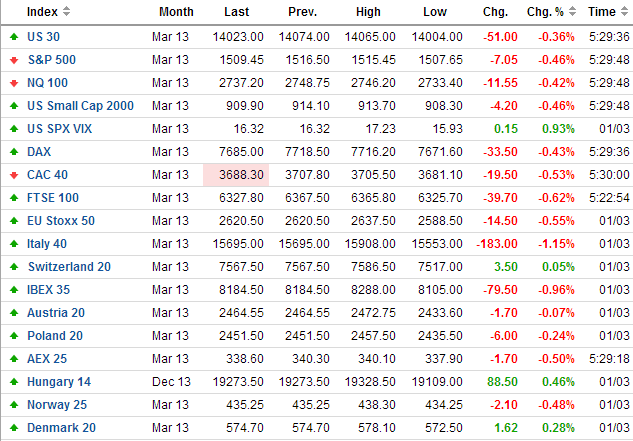

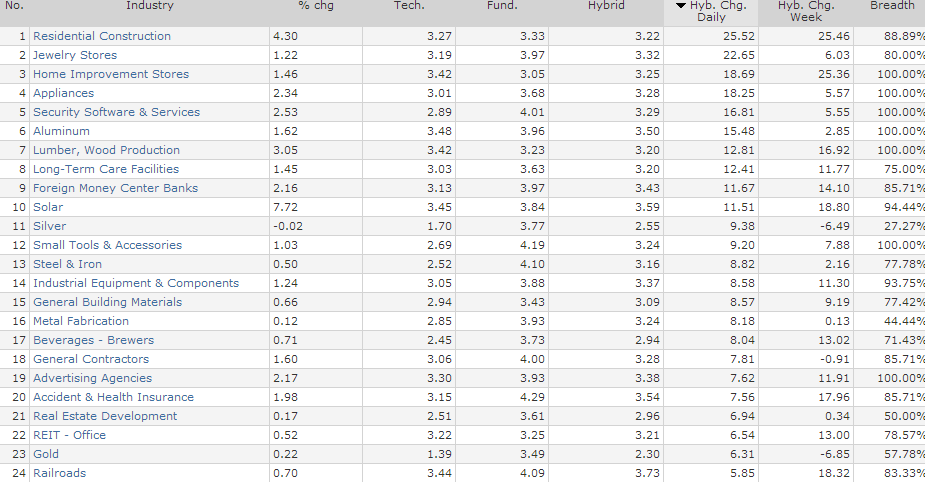

US index futures are barely up, but VIX futures are down almost 1.7%. I foresee a market that trades up, but basically flat tomorrow. (I could also be completely wrong). I am looking for stocks that have momentum behind them, with good hybrid scores, and volume. Volume is going to be key tomorrow, as all traders will have to “pick their shots.” I am raising cash and looking for my last winners into tax day, I’m looking for a few percent– here and there –because I want to keep my winship and limit risk. These are some names that I think may provide that, based on this screen, (sorry, friendo, members only).

WRES TW MOLX CDNS PII MDP PMT

Charts for all of the above can be found here.

I’m sorry but my Vikings Recap is going to have to wait, I am beat.