“Buy low, sell high”

Crude Oil has been massacred, desecrated, shat upon and defiled. Despite the fact that the futures price of WTI is about the same as it was YoY, the current decline in oil sector equities, with some exceptions, has now entered record territory according to Exodus. So is this now a buy, or can we expect further pain?

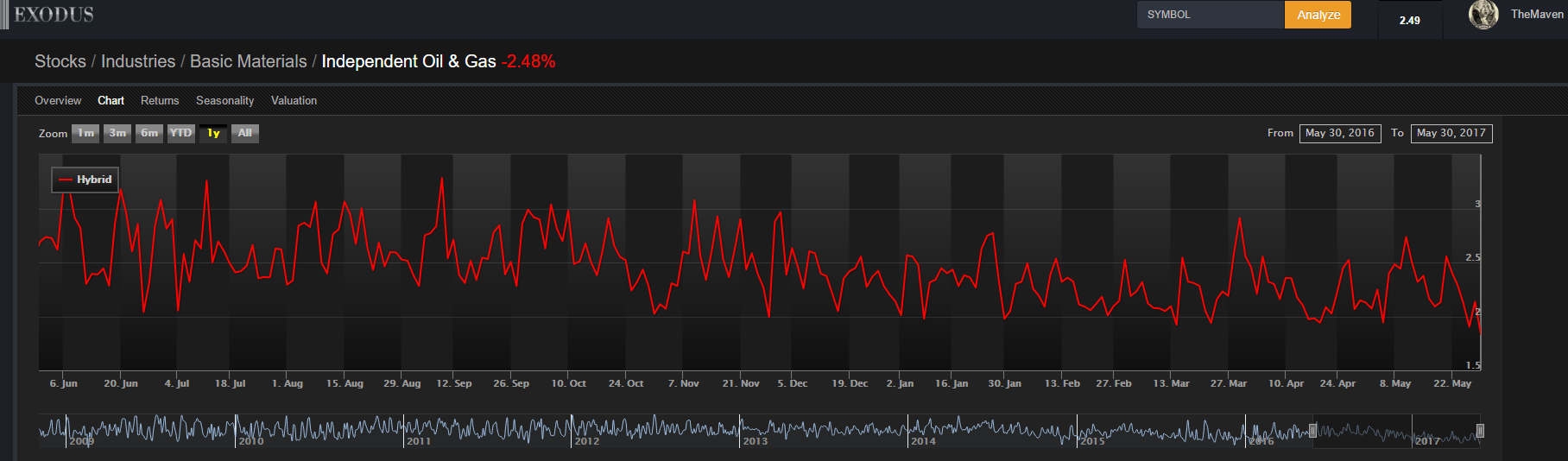

Charting the Average Hybrid Score within Exodus by industry sector brings things into focus, Today’s Independent Oil & Gas score is 1.837 as of this writing.That is quite low, folks.

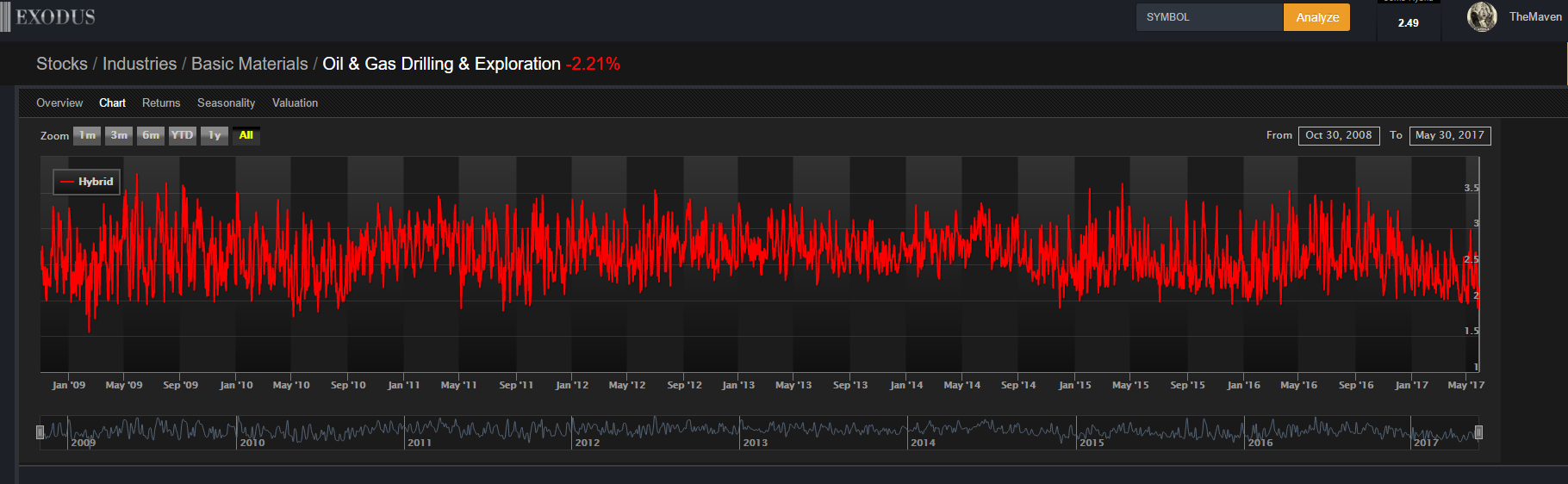

Things look no better in Exploration and Production sector, in fact they look worse. You have to go back to Feb ’09 to find lower Average Hybrid Scores within the Exodus algos.

I have been buying heavily over the past few trading days, opening or adding to positions in $APA, $CLR, $MDR, $MTDR, $MUR, $NE and $SN. A typical screen of just about anything in the sectors will yield an oversold condition on the 3,6 and 12-month signals. Some of them are literally screaming the OS news:

Risk aversion is high in the commodity space, oil is no exception. But what are the underlying fundamentals? I have been screaming GLUT for many months, whether referring to the feed-stock or the refined products. Oil, gasoline and most refined products are still at high levels. But a little digging unearths some interesting data. OPEC’s long-awaited meeting to determine an extension of voluntary production cuts caused a sharp drop in futures prices late last week, which has pushed me from cautious buyer to full-blown Bull. Here is why, courtesy of Phil Flynn’s Energy Report:

It is not nice to fool oil traders. OPEC and non-OPEC Russia paid the price for building up traders’ expectations of a longer extension of OPEC production cuts or even a deeper cut only to come back with a priced in 9-month extension of the current production cuts. As soon as the Saudi oil minister said that the safe bet was a ninth month extension of cuts, the market fell from a Bollinger Band high of $52.00 a barrel to a close of $48.90, down nearly 5% in a wild trading session.

Flynn goes on to explain why this could a massive buying opportunity:

OPEC’s sin was not an extension of cuts but their communication. The early announcement by Saudi Arabia that cuts would be extended by nine months was somewhat priced in and declarations by both the Saudis and the Russians that they would do whatever it takes to get the market in balance, made the decision just to extend a bit underwhelming.

Yet is the market’s reaction fair? Despite the market mantra that the current cuts are not working, the evidence is quite the opposite. U.S. inventories have fallen for eight weeks in a row and we should see that trend continue and the number of draws get larger. The Saudis now are saying they will reduce crude shipments to the U.S. which have fallen already by 1.0 million barrels a day from early March. U.S. refiners prefer heavy Saudi crude to shale oil as refiners are better equipped for heavy crude. (And Saudis now own a large refinery outright in the Gulf -Maven.). The trend of falling U.S. crude supplies should accelerate because the increase in shale output will be offset from falling Saudi oil imports.

Reuters agrees, writing that between, “April and May, U.S. crude draws averaged 3.4 million barrels every week, on track for the first decline for that period since 2008. U.S. refiners are churning crude at near-record levels. Refinery utilization was at the highest level seasonally in two years last week even ahead of the U.S. Memorial Day holiday, the de-facto start of peak gasoline demand. Saudi Arabia’s oil minister said on Thursday that the seven weeks of U.S. stock draws, along with a drop in floating storage, is “excellent news,” adding that exports to the United States were dropping measurably.” Reuters did warn that the primary offsetting factor is U.S. production, which sits now at 9.3 million barrels a day, 550,000 barrels higher than a year ago, according to EIA data.

Yet that may be not enough to offset OPEC cuts. We also are going to see peak shale oil production, or at least a plateau, in the U.S.. While U.S. shale has done a fantastic job in lowering costs, the trajectory of shale production will start to level off. The high decline rate of shale rigs and costs that are already start to rise, may slow shale oil’s meteoric rise. I am not saying that shale is dead. It will grow, but not at the current rate.

Buy low, sell high. I reckon I’ll be holding through 2019-2020. And remember, a spike in crude prices is often just a geopolitical event away. As always, this is not advice, this is an opinion. You lose your shirt betting on volatile crude oil, don’t come crying to me, rube.

If you enjoy the content at iBankCoin, please follow us on Twitter

Losing money is never fun.

See me Thursday afternoon. LOL.

Making money is Big Fun. Salaam, Sarge. 😉