I am so very very happy…

_______________________________________

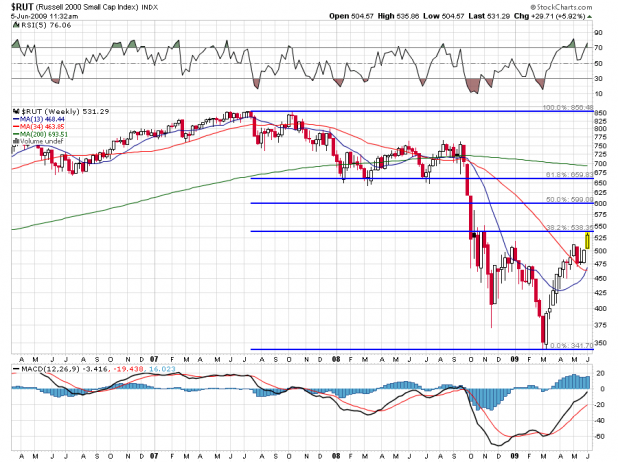

Despite the great sturm and drang of late day trading, the charts for the [[SPY]] still look relatively benign, and price is not even hitting the 20 day EMA yet. True there’s been some readily apparent divergences in the MACD and RSI, but nothing to get overly excited about if this is just a consolidation for further action upward.

Canaries do cough in the coal mine, however, and one of the yellow hackers is perennial bull-nuisance [[BKX]] , our Philadelphia Banking Index, which is currently humping over like poor Quasimodo at Esmeralda’s keyhole. With the 200-day EMA ($43.42) breached today with considerable vigour (sic), I think this index stands a chance of falling through the more recent support level illustrated below, at about $41.75:

I believe that if it does breach that level, the $BKX will likely bring the rest of the market down with it for at least a short term hiatus.

For my part, I did nothing trade-wise today save analyse (sic) highly intellectual rap orchestrations with Mssr. Le Fly, whilst eating peanut butter and banana samiches.

Tomorrow, I may or may not do the same, but I will surely let you know. Quicker still, if you’re residing inside The PPT, of course.

Best to you.

_________________________________________

Comments »