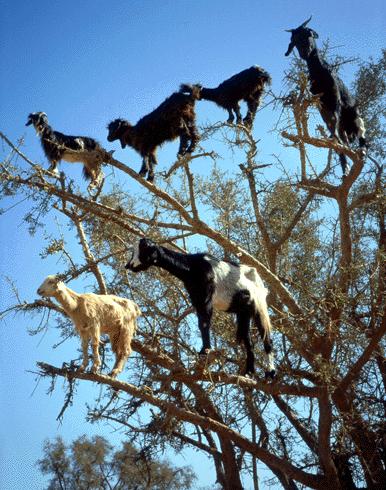

Not to be disparaging, but I’ve felt I’ve spent the week with a squadron of flying goats. There you are flitting from tree to tree looking for the best green shoots, ears up and horns out, “baaaaahhhing” it up to beat the band.

Chips stocks! Cancer stocks! Lenny Dykstra Car Wash franchise stocks! Get ’em while they’re hot from the chute!

But why must you make your lives so difficult? There’s no reason to search for rare buds in the top branches of the acacia tree when there’s plenty of bull grass right here on the ground. Come down from there and take a look at the freshly scythed alfalfa I have gathered for you, my yellow-eyed friends.

Remember our weekly $HUI chart from last week?

Well, look what’s happened this week…. Pop!

Can anything be more promising than that little green bud out of the consolidation zone? And yes, we’re a little overbought here, and should be coming into some more resistance around 400 or so, but we should welcome that opportunity.

After all my boy, it is a bull market — and maybe the only one you’ll see for years to come. So relax some, take a load off, and get your nets ready. It’s almost harvest time again.

This week’s Jackson Core Holdings Portfolio results were very pleasing, especially as measured against the indexes. So have some nice goat cheese this weekend, and maybe try to pause a second whilst hoisting that relaxing beverage to remember those who have served, and especially those who have fallen in order that you could enjoy this great country. Be well.

| Name | 5/8/2009 | 5/15/2009 | ∆ | 5/22/2009 | ∆ |

| ANDE | $ 21.50 | $ 21.31 | -0.88% | $ 23.34 | 9.53% |

| GDX | 37.46 | 37.65 | 0.51% | 42.05 | 11.69% |

| GLD | 89.98 | 91.55 | 1.74% | 94.45 | 3.17% |

| IAG | 9.92 | 9.83 | -0.91% | 10.86 | 10.48% |

| MON | 86.42 | 89.95 | 4.08% | 86.61 | -3.71% |

| NRP | 23.39 | 21.29 | -8.98% | 22.21 | 4.32% |

| PAAS | 19.35 | 18.66 | -3.57% | 21.42 | 14.79% |

| RGLD | 39.90 | 39.97 | 0.18% | 44.26 | 10.73% |

| SLV | 13.79 | 13.77 | -0.15% | 14.50 | 5.30% |

| SLW | 8.91 | 8.58 | -3.70% | 9.34 | 8.86% |

| SSRI | 20.06 | 19.06 | -4.99% | 21.73 | 14.01% |

| TBT | 52.24 | 49.13 | -5.95% | 53.57 | 9.04% |

| TC | 7.98 | 7.65 | -4.14% | 8.64 | 12.94% |

| TSO | 16.72 | 16.60 | -0.72% | 16.23 | -2.23% |

| AVG | -1.96% | 7.78% | |||

| Name | 5/8/2009 | 5/15/2009 | ∆ | 5/22/2009 | ∆ |

| SPY | $ 92.98 | $ 88.71 | -4.59% | $ 89.02 | 0.35% |

| QQQQ | 34.23 | 33.37 | -2.51% | 33.54 | 0.51% |

| DIA | 85.47 | 82.78 | -3.15% | 82.87 | 0.11% |

| NDX | 1,394.16 | 1,355.11 | -2.80% | 1,363.17 | 0.59% |

| RUT | 511.82 | 475.84 | -7.03% | 477.62 | 0.37% |

| AVG | -4.02% | 0.39% |

_____________________________________________________________________

Comments »