__________________________________

We are either going to bounce hard here, or we are going to be cast into a pit of molten lava, where blood and bone will be cooked to a fine carbon gristle with extra smoke.

And I’m talking about both the SPY and the PM’s here. Both experienced a Bollinger Band crash (violation of the lower Bollinger) and both should rebound here in the next week, at least to the midpoint. In the case of the Gold Bugs Index ($HUI) that probably means the 200-day EMA.

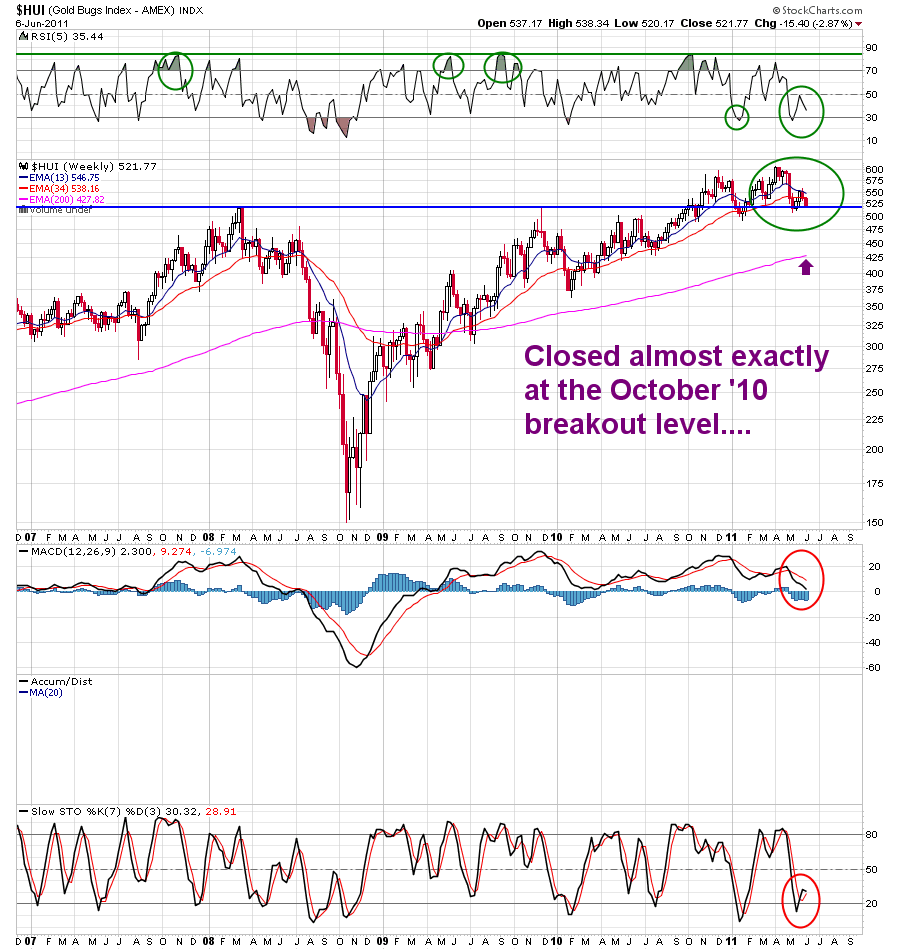

Here’s the $HUI weekly, which clearly illustrates the return to the October breakout. We break here, and we’ll be headed for that long term support line down in the 500 area first:

Now the daily, with the Bollinger Band illustrations:

Does that look like it’s done to you? Me neither, which tells me if we do get a bounce it’ll likely be later morning tomorrow.

Whatever the case, I believe that unless I see evidence of us getting back over that 200-day EMA (above), I will be bringing my core all the way down to 25%, which will be my bull market low point. You should already be at 50%, give or take, in your PM concentrations. This is simply the next step down in raising cash for the coming wave forward.

I don’t know what it means for the SPY, but I don’t expect there’s much left in that rope either, if the dollar continues to strengthen and the financials and commodities continue to get clipped.

On the brighter side, however, I will note that while things look bleak, copper prices have held up well. Our own miners were hurt by today’s rumor of a Marxist nationalization effort in Peru. Such rumors give me good reason to keep my mining holdings in NAFTA countries alone. We are not being paid to take nation-risk here people. Look to Canada, Nevada and Mexico for your long term core holdings.

Last, I say look to sentiment. The last time Fly and I were this conditionally apocaplyptic, the market took off in a blaze of glory. Hell, even Gary Savage is hiding in Switzerland right now. Be strong for me, my friends.

Comments »