Indeuuuud!

___________________

Don’t get me wrong, silver will pull back almost immediately here. And gold should have a nice refrain as well. But all the Glenn Beck modalities aside, let’s not lose sight of the big picture here.

Don’t let the closet commie Keynesians who are currently plaguing the Fly ward you away from the nose in front of your face. It seems there are those who would hew to the belief that the sovrereignity of our currency will remain, unmolested by the tenets of common sense or basic economics. In the words of Lewis Carroll — “Callou Callay, oh frapjous day!’

Nothing to worry about here right?

But then, there’s that old bogey “empiricism,” creeping up to spoil their party once again. One example?

Does this indicate an overbought investment? Well, sure. For the last ten years now. In fact, that’s why perhaps the silver sister has finally begun catching up, and the ratio between the two has begun shrinking.

But there’s still quite a bit of room to go:

Even silver looks a bit overbought right now, doesn’t it? Yes, in fact, I may take some of my leverage off early this week as a result. That means I’ll likely sell some of the AGQ I re-purchased in the $93 and $96 ranges, and maybe even sell my SLW December $25 calls as well.

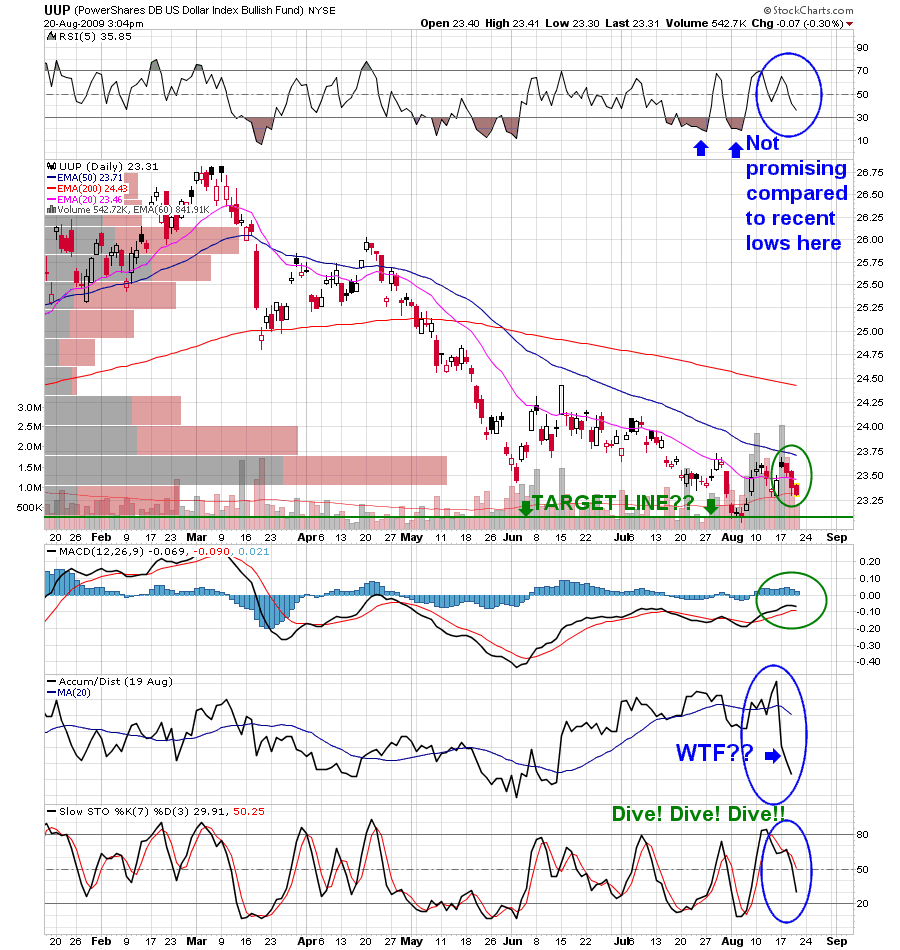

It’s not like I’m going to sell any of my core positions. That would be foolish, given the disposition of our currency. The DX-Y chart is what you should be watching, rather than the ephemeral explanations of the “cake and eat it” economics students who’ve recently appeared like noxious mushrooms on these internets.

Don’t let their quibbles with Glenn Beck or any other broadcast polemicist stay you from your review of the empirical data. The dollar will bounce, likely at $74 or so. But that gato will be expired before you can cash your small beer change.

Friends, the dollar is the Dallas Cowboys of the currency world. It may have another touchdown or two in its future, but those brief triumphs will be wreathed by tragedy.

Indubitably.

___________________________

I still like EGO, if you’re looking for a latter day saint. Also, IAG is probably a pullback look.

_________

Comments »